The margin of safety is one of the most important principles in value investing. Popularised by Benjamin Graham, the father of value investing and mentor to Warren Buffett, it refers to the buffer or cushion between the intrinsic value of an asset and its market...

Investment Philosophy

Sentiment-Driven Investing: Are You Riding the Vibe or Valuing the Future?

Market sentiment is a powerful force that often drives fluctuations in stock prices and market volatility, sometimes overshadowing the actual business fundamentals. While sentiment can be a useful gauge of market mood, relying on it to make investment decisions...

The Power of Second-Level Thinking: Beyond the Obvious in Investing

In the world of investing, the difference between success and mediocrity often boils down to how deeply one thinks about opportunities and risks. Howard Marks, co-founder of Oaktree Capital Management, is renowned for his deep insights into market behavior, and one of...

Tax Loss Selling: Uncovering Hidden Gems for Patient Investors

While selling at a loss to offset other gains is the obvious benefit, tax loss selling may provide additional opportunities for patient investors. Tax-loss selling is a strategy where investors sell underperforming stocks at a loss to offset capital gains from...

Should investors play Defence in FY2025?

While markets and investors are often captivated by sectors promising rapid growth and technological advancements, there are times when strategic investments in more stable sectors can offer "defence" against economic downturns. One such sector is Defence, where...

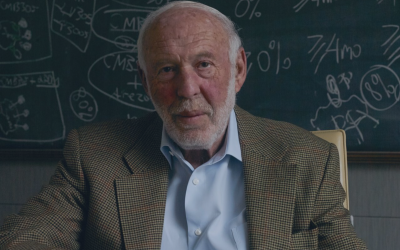

Jim Simons: A Legacy of Mathematical Brilliance and Investment Pioneering

The investment world mourns the loss of another titan: Jim Simons, a prizewinning mathematician who transitioned from a stellar academic career to finance — a field he initially knew little about — to become one of Wall Street's most successful investors. Simons,...

When Boring Is Beautiful on the ASX

While flashy industries and businesses often capture the imagination of investors, it's the understated, "boring" businesses that often form the backbone of solid portfolios. These companies may not make headlines, but their stable, predictable revenue streams and...

Navigating the Tug of War Between Interest Rates and Inflation

Sometimes the macroeconomic outlook changes like the weather, and investors find themselves sailing in a crosswind of uncertainty. The Reserve Bank of Australia (RBA) is ensnared in a catch-22 dilemma: whether to raise rates to tame inflation and risk plunging the...

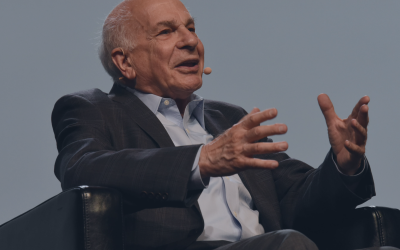

Fast Thoughts, Slow Wisdom: The Legacy of Daniel Kahneman

Daniel Kahneman, an Israeli-born American Nobel prize-winning author, passed away on March 27 at age 90. For those yet to become familiar with his work, he was a psychologist at heart but to many he will be remembered as a pioneer in what has become known as...

Second-Level Thinking: Benefiting from the Rebound of ASX Retail Stocks

The Australian consumer has navigated a complex landscape over the past 12-18 months. Grappling with the repercussions of a post-pandemic surge in inflation, the Reserve Bank of Australia has raised interest rates 13 times since May 2022 with the current cash rate...

Biden vs Trump: Shaping Your Portfolio for the U.S. Presidential Outcome

As Super Tuesday's results and Nikki Haley’s exit from the Republican primary race, the stage looks set for a 2024 U.S. Presidential election rematch between the incumbent Joe Biden and former President Donald Trump. With rumblings from various European leaders about...

Investment Wisdom: Buying Well

On a Behind The Memo podcast last year, renowned value investor Howard Marks stated that: “What I learned from my first 10 years of experience is that good investing doesn’t come from buying good things but from buying things well. The difference is more than...