Financial markets rarely move in straight lines, but the past six years have been turbulent enough to make even seasoned investors question their intuition. We have lived through political upheaval, a global health crisis, dramatic swings in inflation, the sharpest...

Investment Philosophy

Lessons From Omaha: Why Character Outperforms Strategy in Long Term Investing

There are moments in markets when noise becomes deafening and investors search for a signal that cuts through it. Warren Buffett’s final shareholder letter does exactly that. It is part memoir, part reflection, and part masterclass in how to think about investing over...

Finding the Leaders Who Compound For You

If you strip investing down to its bare, unfriendly bones, you end up with a simple reality: over long periods, your returns converge toward the quality of the people running your money and the businesses you own. Balance sheets matter, valuations matter, industry...

Books Build Better Investors: the Best Business Reads of 2025

At Tamim, we believe that enduring outperformance stems not just from sharp spreadsheets or sector calls, but from the consistent cultivation of curiosity. That’s why we read, widely, deeply, and with purpose. Reading builds mental models. It stretches time horizons....

Margin of Safety: The Enduring Discipline of Capital Preservation

At TAMIM, we believe investing is as much about managing risk as it is about pursuing returns. In fact, one of the most critical frameworks in our investment process is a concept introduced nearly a century ago by Benjamin Graham and deeply embedded in the work of...

Ruminating on Asset Allocation: Combining Australian Equities and Private Debt for Balanced Growth and Income

When constructing an investment portfolio, one of the most important decisions is asset allocation - the process of determining how much of each asset class to include. This decision significantly influences the portfolio’s performance and how it responds to both...

How the Margin of Safety Can Protect Your Portfolio and Boost Returns

The margin of safety is one of the most important principles in value investing. Popularised by Benjamin Graham, the father of value investing and mentor to Warren Buffett, it refers to the buffer or cushion between the intrinsic value of an asset and its market...

Sentiment-Driven Investing: Are You Riding the Vibe or Valuing the Future?

Market sentiment is a powerful force that often drives fluctuations in stock prices and market volatility, sometimes overshadowing the actual business fundamentals. While sentiment can be a useful gauge of market mood, relying on it to make investment decisions...

The Power of Second-Level Thinking: Beyond the Obvious in Investing

In the world of investing, the difference between success and mediocrity often boils down to how deeply one thinks about opportunities and risks. Howard Marks, co-founder of Oaktree Capital Management, is renowned for his deep insights into market behavior, and one of...

Tax Loss Selling: Uncovering Hidden Gems for Patient Investors

While selling at a loss to offset other gains is the obvious benefit, tax loss selling may provide additional opportunities for patient investors. Tax-loss selling is a strategy where investors sell underperforming stocks at a loss to offset capital gains from...

Should investors play Defence in FY2025?

While markets and investors are often captivated by sectors promising rapid growth and technological advancements, there are times when strategic investments in more stable sectors can offer "defence" against economic downturns. One such sector is Defence, where...

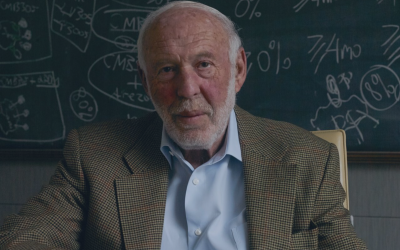

Jim Simons: A Legacy of Mathematical Brilliance and Investment Pioneering

The investment world mourns the loss of another titan: Jim Simons, a prizewinning mathematician who transitioned from a stellar academic career to finance — a field he initially knew little about — to become one of Wall Street's most successful investors. Simons,...