There are decades when nothing happens, and then there are weeks when decades happen. For many readers, this rather neatly encapsulates recent market antics. With tariff policies still stuck in a revolving door and markets convulsing like a toddler denied ice cream,...

Investing in Shares

Ruminating on Asset Allocation: Combining Australian Equities and Private Debt for Balanced Growth and Income

When constructing an investment portfolio, one of the most important decisions is asset allocation - the process of determining how much of each asset class to include. This decision significantly influences the portfolio’s performance and how it responds to both...

Building Wealth with Investment Fundamentals: Key Lessons for Every Investor

Taking time to revisit the basics periodically is a practice we’ve always advocated for. When you’re living and breathing the markets day in and day out, it’s easy to lose sight of fundamental principles—sometimes you can’t see the forest for the trees. The beauty of...

Earnings Highlights: Bravura’s Turnaround, Viva Leisure’s Strategic Appeal, GQG continues to grow

Earnings season is well and truly underway with a number of companies in the TAMIM portfolio reporting last week. Two stand out and high conviction holdings that reported were Bravura Solutions Limited (ASX: BVS) and Viva Leisure (ASX: VVA). Coincidently we recently...

Seizing the Moment: Why Now is the Time to Invest in Japan

Finding unique opportunities in Japan is a thematic we have been enthusiastic about consistently over the years. Japanese balance sheets have historically been less than optimal, with many companies holding excessive cash reserves instead of returning capital to...

Tax Loss Selling: Uncovering Hidden Gems for Patient Investors

While selling at a loss to offset other gains is the obvious benefit, tax loss selling may provide additional opportunities for patient investors. Tax-loss selling is a strategy where investors sell underperforming stocks at a loss to offset capital gains from...

Should investors play Defence in FY2025?

While markets and investors are often captivated by sectors promising rapid growth and technological advancements, there are times when strategic investments in more stable sectors can offer "defence" against economic downturns. One such sector is Defence, where...

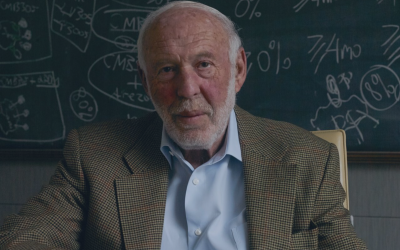

Jim Simons: A Legacy of Mathematical Brilliance and Investment Pioneering

The investment world mourns the loss of another titan: Jim Simons, a prizewinning mathematician who transitioned from a stellar academic career to finance — a field he initially knew little about — to become one of Wall Street's most successful investors. Simons,...

When Boring Is Beautiful on the ASX

While flashy industries and businesses often capture the imagination of investors, it's the understated, "boring" businesses that often form the backbone of solid portfolios. These companies may not make headlines, but their stable, predictable revenue streams and...

Navigating the Tug of War Between Interest Rates and Inflation

Sometimes the macroeconomic outlook changes like the weather, and investors find themselves sailing in a crosswind of uncertainty. The Reserve Bank of Australia (RBA) is ensnared in a catch-22 dilemma: whether to raise rates to tame inflation and risk plunging the...

Power Play: Investing In Energy For Innovation

As technology strides forward, the world's energy demands have skyrocketed, with artificial intelligence (AI) at the forefront of this surge. This escalation poses significant challenges and opportunities—an area we have recently begun to delve into. The rise in...

AI’s Power Surge: Overlooked Opportunities of a Tech-Driven Future

The surge in enthusiasm for anything related to artificial intelligence (AI) has continued apace in 2024, a theme we have discussed on several occasions, including here and here (to provide readers with useful topical information but less than the overload and...