by Amy | Sep 1, 2016 | Reporting Season, Stock Insight

Darren Katz, TAMIM Asset Management’s Managing Director and Head of Investments, reviews a number of the Stock Picks we have presented over the course of the year to assess how they have fared through the recent reporting season. We review our original investment rationales and try to learn from the mistakes we have made through our investment journey.

Darren Katz, TAMIM Asset Management’s Managing Director and Head of Investments, reviews a number of the Stock Picks we have presented over the course of the year to assess how they have fared through the recent reporting season. We review our original investment rationales and try to learn from the mistakes we have made through our investment journey. Overall the year has been very good for our Australian Value and Small Cap strategies. With the Value underlying fund delivering a 13.9% return over the past 12 months and the Small Cap underlying fund delivering a 31.3% return for the same period.

Reporting Season Wrap-up – Part 2

Darren Katz – Head of Investments

With reporting season over, we bring you the second part of our reporting season wrap-up. Having spent the last 12 months providing you with a number of our best ideas and thoughts around a select group of Australian shares, I thought it was an opportune time to stop and look back at some of these stocks. It is always a good idea when investing to stop and look at your initial hypothesis with a view to learning from the good and bad decisions you have made. This is an extremely important lesson, and acts to make us all greater investors.

Duet (TAMIM Australian Equity Growth IMA):

Current Poistion

Investment Rationale: Strong Growth prospects, Strong Yield

Current Price: $2.63Read the original article here.

DUET Group (DUE.AX) is an owner of utility assets in Australia, the US and Europe. Since listing in 2004, DUE has evolved from being an externally managed asset owner/ investment fund to an internally managed asset owner/operator with an EV of over A$18bn. The catalysts for share price performance include contract wins in the DDG and EDL business units, better-than-expected outcomes from the DBP regulatory reset and United Energy regulatory reset (final decision due imminently). Activity in relation to SKI selling down its stake and potential corporate activity as underbidders in the NSW electricity privatisation process potentially looking to acquire other regulated asset holders were additional catalysts.DUE reported pleasing results on the 19th of August, the distribution for the year came in at 18c with the net year expected to be 18.5c. Proportionate earnings were 34.5% higher then the previous comparable period. The integration of EDL has been completed and it is apparent that that integration synergies are emerging. The company will continue to search for accretive acquisitions through the forthcoming year.

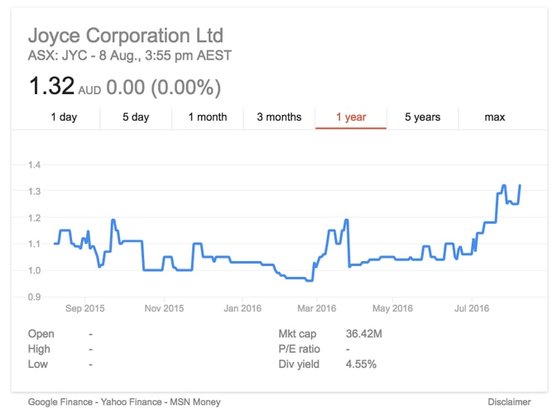

Joyce Corporation (TAMIM Australian Small Cap IMA):

Current Poistion

Investment Rationale: Underfollowed, unloved, turn-around story

Current Price: $1.49Read the original article here.

Joyce has a strong track record of partnering with businesses. The company acts as a business partner, providing capital and management expertise to good, profitable businesses that currently lack the capital and management to reach the next level. The key in this business partnership is to ensure that the risks and rewards are appropriately shared and incentives are aligned.Over the last several years, Joyce has been slowly building out a business of considerable scale, with the group’s total network revenue in the home improvement and furniture space now in excess of $125 million. The recent sale of a non-core property asset and the purchase of another property, together with the purchase of an interest in (and subsequent accounting consolidation of) a new business unit, has meant Joyce’s recent financial reporting is messy, and the Joyce story (and its potential) is perhaps poorly understood by the market. We expect the story to become clearer over the coming reporting periods.

Highlights for the financial year ending 30 June reflected a 62.8% increase of revenue to $56.5m. This was reflected in an NPAT from continuing operations of $3.46m. The full year dividend was 11 cents. Primary businesses (Bedshed and KWD) performed better than forecast and the company was also able to acquire Lloyds Online. JYC is forecasting sales of between $170m to $200m through the next financial year.

by Amy | Aug 25, 2016 | Reporting Season, Stock Insight

Darren Katz, TAMIM Asset Management’s Managing Director and Head of Investments, reviews a number of the Stock Picks we have presented over the course of the year to assess how they have fared through the recent reporting season. We review our original investment rationales and try to learn from the mistakes we have made through our investment journey.

Darren Katz, TAMIM Asset Management’s Managing Director and Head of Investments, reviews a number of the Stock Picks we have presented over the course of the year to assess how they have fared through the recent reporting season. We review our original investment rationales and try to learn from the mistakes we have made through our investment journey. Overall the year has been very good for our Australian Value and Small Cap strategies. With the Value underlying fund delivering a 13.9% return over the past 12 months and the Small Cap underlying fund delivering a 31.3% return for the same period.

Reporting Season Wrap-up – Part 1

Darren Katz – Head of Investments

We are currently well into the Australian reporting season. Having spent the last 12 months providing you with a number of our best ideas and thoughts around a select group of Australian shares, I thought it was an opportune time to stop and look back at some of these stocks. It is always a good idea when investing to stop and look at your initial hypothesis with a view to learning from the good and bad decisions you have made. This is an extremely important lesson, and acts to make us all greater investors.

Collins Food (TAMIM Australian Equity Value):

Exited Poistion

Investment Rationale: Underfollowed, unloved

Current Price: $4.70

We exited our position in Collins Food (CKF) in early January at close to $5.00 after a highly successful investment. At the time, net operating cash flow was up 43.4% at $23.8m. The group had also reported a lower net leverage ratio of 1.62 which seemed to be on a declining trajectory. After reaching a high of $5.34 the price of CKF declined to below $4 with significant price movements both up and down over the period.

The latest set of results showed net operating cash flows at $49.7m which allowed CKF to continue to reduce overall net debt. Net debt now stands at $112.5m with the net leverage ratio down to 1.52. CKF will continue to grow stores and increase existing same store growth which should continue to help with strong cash flow generation. While we continue to like the company, the company doesn’t offer a large enough margin of safety and we continue to allocate our clients’ capital into better alternatives that we see more upside in.

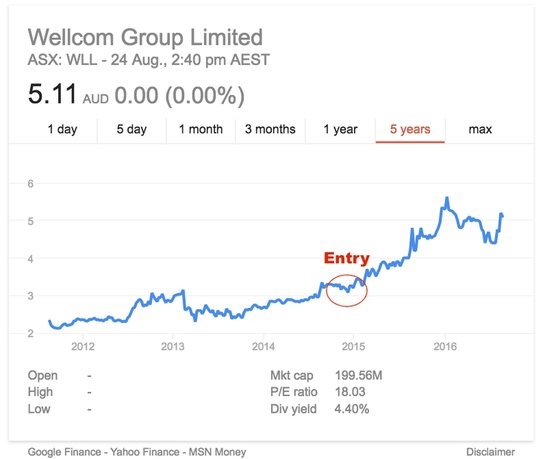

Wellcom Group (TAMIM Australian Equity Value):

Current Poistion

Investment Rationale: Family Business Alignment, Strong Cash Flow

Current Price: $5.11

As we reported in February 2016 we continue to own a position in the Wellcom Group (WLL), a small listed business that is a world leading global content production company. WLL is capable of offering around the clock services connecting industry leaders with customers. The Executive Chairman, Wayne Sidwell, has almost five decades of experience and remains as passionate about the industry as ever.

The TAMIM Australian Equity Value IMA enjoys finding and owning well-managed, risk averse (especially when it comes to debt) listed companies generating good cash flow with a strong family business alignment and pedigree. We continue to believe that whilst the international profit contribution to the WLL Group which is still small (especially in absolute terms); enormous potential exists for this company to grow in a large global profit pool from a low base.

The digital and social media revolution continues to force structural change across advertising and media industries which will favour production companies which are able to deliver large volumes of content frequently. The 2016 result for WLL highlighted net revenues up 20% to $103.4m with net profit up 14% to $11.1m. The dividend is up 10% underpinned by good cash flow to a fully franked 22.5 cents. Importantly, UK revenue increased by 51% and the US revenue base increased to 39.4%. With an increased global footprint, improved content production and with lower cost structures, WLL continues to be a holding in our Value portfolio.

SpeedCast (TAMIM Australian Equity Growth):

Current Poistion

Investment Rationale: Strong Growth prospects, Industry Consolidation

Current Price: $3.83

SpeedCast is fast becoming a major global player in the high growth attractive satellite services and VSAT segment. In our article in March we discussed how SpeedCast had delivered 38% revenue growth and 42% EDITDA growth. Management had also flagged its acquisition strategy to consolidate the fragmented industry which it has now actively been fulfilling with its recent acquisition of WINS for €60 million in cash.

The half-year 2016 results have revenues reported at USD 101.5m which reflects growth of 41% over the previous comparable period. EDITDA was USD 17m which reflected a 34% increase. SpeedCast has delivered strong growth in the maritime (31% of revenues) and the energy (17%) sectors. The business has purchased Newcom, ST Teleport and now in August, WIN. The WIN purchase will add a strong presence in Germany as well as diversify the maritime segment into the fast growing segment of passenger carrying vessels.

SpeedCast has presented some compelling opportunities to add to the position over the last 6 months. The latest results do indicate the company is executing well in its approach to consolidate the industry as well as continuing to grow diversified components of existing business segments.

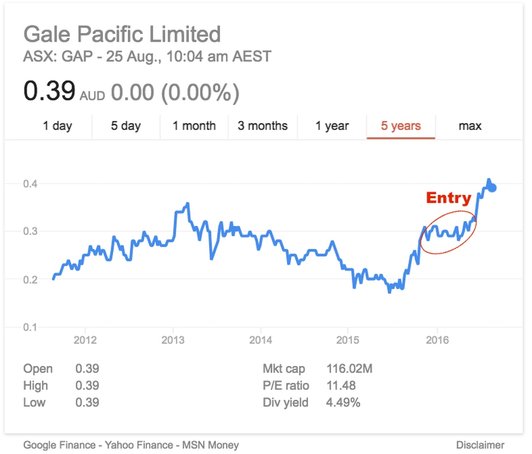

Gale Pacific (TAMIM Australian Small Cap):

Current Poistion

Investment Rationale: Underfollowed, unloved, turn-around story

Current Price: $0.39

As our Small Cap manager recently wrote in the article on Gale Pacific, GAP is a great example of a smaller company achieving global success in a chosen niche market. As the company grows its earnings and market cap we expect the market and the analysts that cover the sector to start recognising GAP and drive a multiple expansion. Over the past 12 months, GAP has returned close to 100% while the Australian share market has displayed an anaemic 2.6% return. It is still very cheap on future estimates, and looks set to yield in excess of 7% this coming year, leading us to believe there is still material upside despite the recent share price performance.

After GAP’s fall from grace from 2005 to 2010 the business has strategically refocused on its core products and improved its management of working capital. This has all occurred off the radar of most investors. Today GAP is a global leader in the production of technical shade material. The 2016 results showed revenue up 17% with NPAT up 47% at $10.2m. We continue to hold our position in Gale Pacific and remain impressed with this small Australian company making large strides in the lucrative US, Middle East and African markets.

by Amy | Aug 18, 2016 | Stock Insight

Investment Theme – US Infrastructure

Robert Swift – Head of Global Equity Strategies

by Amy | Aug 10, 2016 | Stock Insight

oyce has a strong track record of partnering with business the company acts as a business partner, providing capital and management expertise to good profitable businesses that currently lack the capital and management to reach the next level. The key in this business partnership is to ensure that the risks and rewards are appropriately shared and incentives are aligned.

Stock Picking – Joyce Corporation Ltd (JYC.AX)

Joyce Corporation Limited has been listed on the ASX since 1986, but its origins go back over 125 years. For much of this time, Joyce was involved in foam manufacturing (Joyce was the first company to make foam in Australia) but disposed of this business in 2005. This is not however the reason for investing in the business. Joyce has a strong track record of partnering with business the company acts as a business partner, providing capital and management expertise to good profitable businesses that currently lack the capital and management to reach the next level. The key in this business partnership is to ensure that the risks and rewards are appropriately shared and incentives are aligned.

Transformation

Over the last several years, Joyce has been slowly building out a business of considerable scale, with the group’s total network revenue in the home improvement and furniture space now in excess of $125 million. The recent sale of a non-core property asset and the purchase of another property, together with the purchase of an interest in (and subsequent accounting consolidation of) a new business unit, has meant Joyce’s recent financial reporting is messy, and the Joyce story (and its potential) is perhaps poorly understood by the market. We expect the story to become clearer over the coming reporting periods – below we provide our thoughts on where the business currently sits, and it’s potential.

Balance sheet and operations

Joyce currently has $13m cash and a property with a market value likely to be in excess of $5m on its balance sheet. Joyce’s strong balance sheet, in the words of its Chairman, puts “the company in a relatively impregnable position with little downside”.

With a market capitalisation of $30m, given the value of its cash and property assets, (simplistically) the market is applying a value of approximately $12m to the Joyce operating business that could generate close to $2m (normalised) NPAT for the full year. Joyce reported $900k NPAT after non-recurring items and minority interests (& paying full tax) for the first half of 2015. While traditional value investors would be attracted to the strong cash backing and low implied earnings multiple on offer, we are equally excited by the opportunities associated with the operating model Joyce has quietly been developing over the past few years.

Essentially, Joyce acts as a business partner, providing capital and management expertise to good profitable businesses that currently lack the capital and management to reach the next level. The key in this business partnership is to ensure that the risks and rewards are appropriately shared (between Joyce and the incoming owner/manager partner), and incentives are aligned. Joyce’s two businesses are discussed in detail below.

Bedshed www.bedshed.com.au

Joyce owns 100% of the Bedshed (franchise) business. The first Bedshed store was opened in Perth in 1980 (as a waterbed expert!). Today, it is one of Australia’s largest specialist mattress, bedding and bedroom furniture retailers with a network of 30 stores (the bulk of which are franchised). Bedshed has been able to consistently grow like for like sales through offering a compelling customer proposition – personalised service from highly trained bedding specialists, with the benefits (and value) of being part of a substantial buying and marketing group.

The benefits of the ‘partner’ model is evident through the success of the franchised stores which consistently record superior profit metrics to the small number of company (Joyce) owned Bedshed stores – reflecting the drive and commitment that a passionate business owner/manager can bring to a retail business. Joyce is committed to expanding the retail footprint of Bedshed through recruiting high calibre new franchisees. As well as the alignment of interests, this franchise model serves Joyce well as it means the store fitout, leasing costs and working capital investment required to roll out a new store is funded by the franchisee, not from the balance sheet of Joyce. In return, Joyce can offer franchisees support, specialised advice, training, a proven structure and 35 years of franchising experience that significantly reduces the risks relating to starting a new business, in many cases facilitating a positive change of lifestyle for a new franchisee The Bedshed operations currently contribute approximately $2m+ in annual EBIT to Joyce. As the footprint expands (together with ongoing same store growth) this has the potential to deliver Joyce solid ongoing returns with low capital requirements.

Kitchen Connection www.kitchenconnection.com.au

In 2013 Joyce acquired an interest in KWB Group Pty Limited, Australia’s largest specialist retailer and installer of kitchens, laundries and wardrobes, and currently owns 51% of the company, having made an investment of approximately $1m. KWB targets the lucrative renovation market, providing a unique (for a national provider) “do-it-for-me” (rather than DIY) one stop, premium, full service consultation-to-design-to-installation kitchen, laundry and wardrobe offering, with competitive pricing.

When Joyce acquired its interest in 2013, annual sales were approximately $22m. For the six months to 31 December 2015 sales were at $19m (+28% on the corresponding period) with EBIT of $2.3m (+90%). Joyce reported KWB’s normalised earnings grew in FY15 over 300% on the corresponding period, driven by the strategic investment in the retail kitchen showrooms, the additional depth in back end customer service management and the expansion of the core product range. Joyce noted they expect that further significant improvements can be obtained. The founding KWB management team remain as 49% shareholders and continue to lead KWB. Together with Joyce they are focused on driving further growth, and sharing in the rewards of the growth as meaningful shareholders in the business. On the numbers reported, Joyce is certainly succeeding in its initial aim to grow the KWB business to reach its potential. The business would appear to have good momentum, with significant opportunity to expand both its products, and geographically into other regions/states. KWB could potentially achieve EBIT of up to $5m for the full year – applying a 5x multiple generates an enterprise value close to $25m (versus the $1m JYC investment for 51%).

Future partnerships

Following the settlement of the non-core industrial property in late 2015, Joyce now has the balance sheet strength to deploy capital into new opportunities. Such an opportunity may be a high performing business centered in a particular region, which has the potential for expansion into other regions, but the current owners/managers lack the capital and know-how to go about this. Joyce can bring its capital, its contacts, its experience, its back office systems and its leadership to do just that. It is not difficult to see Joyce in the not too distant future with say four or five solid, profitable, scalable and growing national businesses that they have partnered with, and with a national network of sales far in excess of the current $125m. In the meantime, for the current $30m market cap, one gets:

- a substantial cash balance

- a substantial unencumbered property asset with significant development potential

- around $2m of after tax, after minorities, earnings for FY16

- 9%+ fully franked dividend

- potential upside from earnings growth of 2 national businesses – one of which is very fast growing

- potential upside from new acquisitions

- an experienced management team, with a proven ability to execute.

The TAMIM Australian Equity Small Cap Portfolio is an investor in Joyce. This is a strong example of the types of investment we look for in our portfolio. Strong cash balances, earnings, real assets and strong growth potential – not to mention a dividend yield that would make the bank envious. If you would like more information on this portfolio and the services we offer to clients please contact us for a conversation with one of our Directors.

Happy Investing,

The team at TAMIM

by Amy | Aug 3, 2016 | Stock Insight

Stock Picking – JP Morgan

Robert Swift – Head of Global Equity Strategies