Building Portfolios Around What the World Needs Most In an era marked by energy volatility, digital transformation, and geopolitical uncertainty, the world is investing in one thing above all else: infrastructure. While airports, grids, ports, and data centres might...

Investment Philosophy

Infrastructure Investing in 2025: A Quiet, Steady Cornerstone for the Long-Term Portfolio

Introduction: The Case for Real Assets in a Repricing World In the current investment environment, where rates remain elevated, growth forecasts are patchy, and risk sentiment oscillates week-to-week, there’s a growing argument for looking past the noise. At Tamim,...

Nobody Knows: Why Embracing Uncertainty is the Smartest Move Investors Can Make

The Investor's Dilemma in an Unknowable World In investing, there are few enduring truths, but one towers above the rest: nobody knows the future. Whether facing the 2008 Global Financial Crisis, the COVID-19 pandemic, or today's geopolitical upheavals and trade...

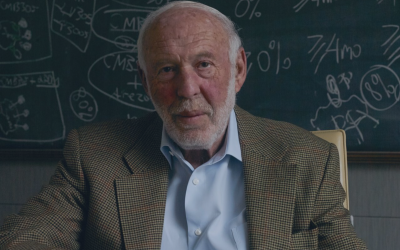

Jim Simons: A Legacy of Mathematical Brilliance and Investment Pioneering

The investment world mourns the loss of another titan: Jim Simons, a prizewinning mathematician who transitioned from a stellar academic career to finance — a field he initially knew little about — to become one of Wall Street's most successful investors. Simons,...

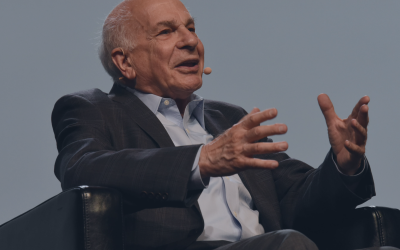

Fast Thoughts, Slow Wisdom: The Legacy of Daniel Kahneman

Daniel Kahneman, an Israeli-born American Nobel prize-winning author, passed away on March 27 at age 90. For those yet to become familiar with his work, he was a psychologist at heart but to many he will be remembered as a pioneer in what has become known as...

Second-Level Thinking: Benefiting from the Rebound of ASX Retail Stocks

The Australian consumer has navigated a complex landscape over the past 12-18 months. Grappling with the repercussions of a post-pandemic surge in inflation, the Reserve Bank of Australia has raised interest rates 13 times since May 2022 with the current cash rate...

Investment Wisdom: Buying Well

On a Behind The Memo podcast last year, renowned value investor Howard Marks stated that: “What I learned from my first 10 years of experience is that good investing doesn’t come from buying good things but from buying things well. The difference is more than...

The Power of Positive Thinking

The Power of Positive Thinking 16/11/2023 Economist Paul Samuelson is famously quoted as saying that the stock market has predicted nine out of the last five recessions. While somewhat satirical, this quip demonstrates how poor investors and economists are at...

What Really Matters in Investing

What Really Matters in Investing 22/6/2023 The world of investing can be a complex and ever-changing landscape, and the financial media can make it even more confusing, having you believe that the macroeconomic news of the day is the most important factor in any of...

Common Investing Mistakes Are More Common Than You Think

Common Investing Mistakes Are More Common Than You Think 15/6/2023 There is an old saying on Wall Street that “financial markets are driven by just two powerful emotions: Greed and Fear.” Investors often let their emotions dictate their decisions on when to buy, hold...

Optimising Returns and Minimising Risks: The Importance of Asset Allocation in an Investor’s Journey

Successful investing goes beyond making smart decisions; it requires avoiding mistakes and adopting a mindset of longevity and endurance. While taking risks and investing optimistically are important for building wealth, keeping your wealth also demands a mix of...

Special Situation Investing

In this week's article, we will explore a distinctive investment approach that has the potential to serve as a viable pathway for maintaining overall portfolio returns, regardless of the broader market conditions... This approach is known as special situation...