Being early is the same as being wrong… or is it?

Robert Swift

Anyone can see that a stock is cheap by using publicly available information on P/E, Price to Sales, or Price to Book. This is not really forward looking analysis at all but a simple exercise in sifting stocks based on historical data. What is harder is to identify the reason for the earnings, the price earnings multiples, and the share price to rise. Cheapness alone is not enough for us. There has to be some change to attract other buyers and for the company’s management to convince us and other investors that they can deploy capital into more profitable projects and return the company to even modest growth. It’s the combination of cheapness and change that works well in a value approach.

We categorise the catalysts in 3 dimensions:

- Management change,

- Strategic change often with balance sheet change, (disposals and/or acquisitions) &

- External/Regulatory change.

Most often one or more of these is the catalyst that drives a share back to favour and the share price higher. It is a well-known ‘problem’ to be too early when you buy cheap stocks. It is a ‘problem’ because the investment can take time to come to fruition since other investors have to change their mind and start to buy the stock. Having seen it underperform for so long it is often hard for them to do so rapidly. This time delay is an opportunity cost (there may be much more fun going on in other stocks elsewhere where the crowd is gathered) and it is important to be paid to wait in the form of an above average dividend yield. Timing the entry point perfectly is hard, but even if we invest a little ahead of the catalyst being evident, we don’t mind waiting a while partly because the dividend yield pays us to be patient. Never forget that a significant part of the total return from equity investing is the dividend yield and not just the share price appreciation!

A stock which possessed cheapness and, we thought, catalysts for change was (and still is) Macy’s (M.NYSE). This is a department store which trades under the brand Macy’s and Saks 5th Avenue. It has not been easy for the company but we see both internal and external catalysts.

Unfortunately, we invested both at a higher price and sometime ago at the beginning of 2017. Six months later the price is lower and while we have collected some dividends, we are ‘underwater’.

So what has gone ‘wrong’ and why are we holding on?

This retail industry is certainly a tricky place to invest right now. You’re either forced to pay sky-high valuations for the stocks like Amazon (>1860 earnings) or Ulta Beauty (35x earnings) that are working on momentum alone or to take chances with potential value traps like Macy’s, Target, or Kroger, all of which have near single-digit valuations, but also don’t seem to have many growth prospects in the near term. Some former glamour retail stocks are at the brink – such as Sears, Abercrombie & Fitch,

What do we see in Macy’s?

The retail ecosystem (landlords and retailers) is now, finally, responding to the Amazon and Alibaba category killers. The weaker players such as Sears have been driven to the precipice but survivors will have more market share available, less competition, and the benefits of having managed against a tough backdrop which means a tight cost structure.

Macy’s will survive and should prosper – at these stock prices we are now getting paid 7% in the form of a dividend yield to wait for the changes made by new management to have an effect on profitability, business strategy and the share price. We also anticipate mall owners to respond to the internet by driving more foot traffic through their doors. This morning we saw this story about a Shanghai mall from the local press.

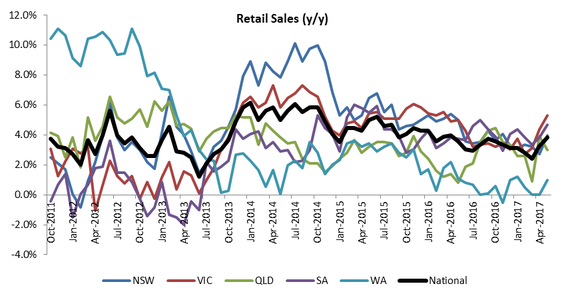

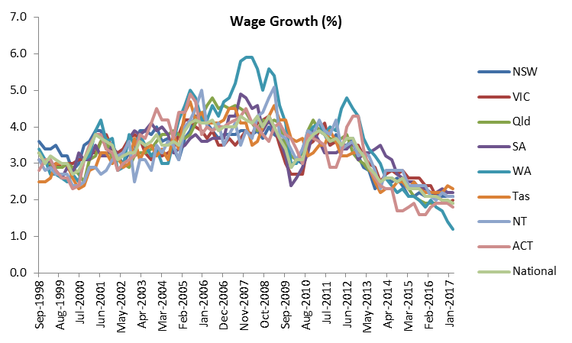

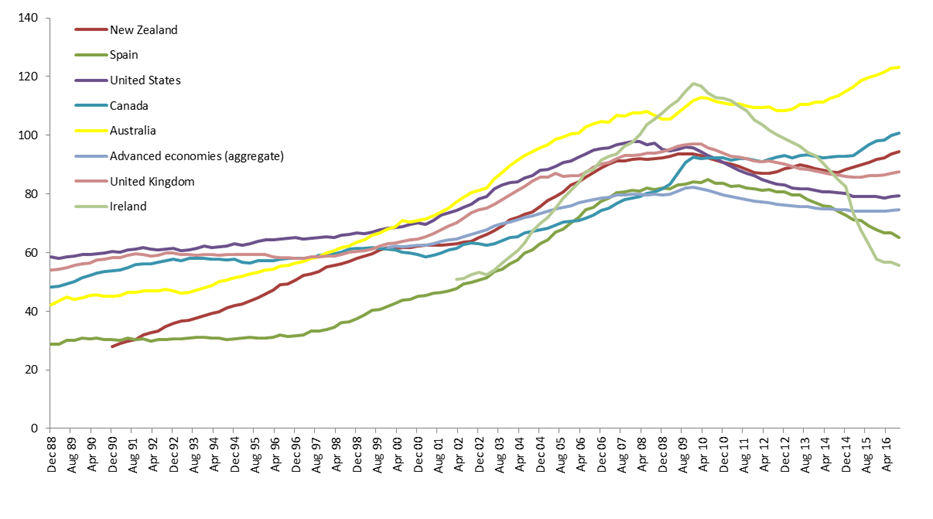

We are generally underweight consumer cyclicals and believe that the consumer is over-leveraged in the UK, the USA and Australia and doesn’t have much spare income at all. We also watched Amazon and Alibaba roll out their business on the internet; saw the demise of Barnes and Noble the USA bookseller which was the first to be hit by Amazon’s internet book sales, and so waited for the retail carnage to continue driving down stock prices everywhere.

Then early this year we decided to enter the retail industry and purchased Macy’s for the model gobal high conviction portfolio.

Why will Macy’s survive and prosper? What on earth were we thinking?!

Asset value – about half of retail space is freehold and worth considerably more than stated in the report and accounts. The credit card business alone is possibly worth several billion $ since it generates about $700m pa. The value of the company in the stock market is currently about $7bn. It is very likely that the net asset value of the real estate is 3x that.

We think the market is effectively ascribing negative value to the retail and credit card operations and has a jaundiced view of the real estate value. It is a classic contrarian value opportunity and we anticipate that even a stabilisation in store sales will see a rapid reappraisal of the company.

Sales and cash generation – sales per quarter are equivalent to almost the market capitalisation of the business. Put another way the company is valued at about 25% of its annual sales. Cost reductions will flow through to the net income line as long as management can stabilise the revenue numbers once the store disposals are completed. We think they can.

Change is evident in Management action:

Cost cutting and refocusing – New management is cutting unprofitable or marginally profitable stores. Real estate disposals generated over $650m last year which is equivalent to 10% of the market capitalisation. A venture with Brookfield (albeit on a small portion of the asset base) has been signed to optimise the real estate portfolio. Meanwhile total sales fell only about 3%. It’s not the sales at any price margin that are important but making profitable sales that matter. We think it obvious that total sales will fall as the company rolls out a closure programme and news flow on this does not concern us.

New management has a positive attitude to shareholders and has continued with share purchases from the considerable free cash flow.

Reinvesting to grow again – The company is driving foot traffic to stores with new formats such as Spas (Blue Mercury) and discount offerings (Backstage) and digitising (belatedly) their retail offering (check out www.macys.com).

Macy’s online sales are growing in double digits so it’s not like Amazon is the only successful online destination! We believe that general retailers have forgotten that impulse buying is important as is the consequent need to bring foot traffic through the door. The food retailers are currently better at this. Tastings and samplings, price discounts on a seasonal basis, and recipe ideas, all help to create excitement. Why for example do Myers in Australia not hold lunchtime “fashion shows” in their stores to showcase this seasons’ looks and to create additional visits? If you travel and want to see how a UK department store is adapting its space to meet a changing market then go to Fortnum and Masons in Piccadilly in London. The 3rd floor has been transformed from menswear (which is offered in overabundance in other local outlets) to a cocktail bar.

A destination for a quiet drink perhaps while some shopping is done? We did a bit of digging and it transpires it is quite profitable AND popular as a starting point for an evening out.

Macy’s is trying to generate more visitors with its Backstage format and value shoppers are able to shop for discounted clothes and help Macy’s improve stock turn. We anticipate more concepts being rolled out.

External change is occurring – All USA malls are adapting to the online impact (finally) so the 50% of leased space that Macy’s have is likely to piggy back that. Macy’s has stores in over 70% of malls categorised as A grade so since these will survive and fight back…Macy’s should do alright. We would be concerned if they were predominantly in B and C grade malls.

The metrics to measure management success are no longer total sales growth or like for like sales growth, but sales per employee and free cash flow to pay dividends and invest in digital platform.

Lacklustre sales growth on a like for like basis is spooking some investors but it shouldn’t be the metric to define success. We continue to judge the transition as being successful if we see the following continue:

- Continued asset disposals producing net gains to the profit and loss statement, thereby maintaining the strength of the balance sheet and proving the conservative carrying value of the real estate in the books.

- Free cash generation net of continued investment in the digital platform

- Sales per employee continuing to rise