Darren Katz – Head of Investments

Collins Food (TAMIM Australian Equity Value):

Exited Poistion

Investment Rationale: Underfollowed, unloved

Current Price: $4.70

We exited our position in Collins Food (CKF) in early January at close to $5.00 after a highly successful investment. At the time, net operating cash flow was up 43.4% at $23.8m. The group had also reported a lower net leverage ratio of 1.62 which seemed to be on a declining trajectory. After reaching a high of $5.34 the price of CKF declined to below $4 with significant price movements both up and down over the period.

The latest set of results showed net operating cash flows at $49.7m which allowed CKF to continue to reduce overall net debt. Net debt now stands at $112.5m with the net leverage ratio down to 1.52. CKF will continue to grow stores and increase existing same store growth which should continue to help with strong cash flow generation. While we continue to like the company, the company doesn’t offer a large enough margin of safety and we continue to allocate our clients’ capital into better alternatives that we see more upside in.

Current Poistion

Investment Rationale: Family Business Alignment, Strong Cash Flow

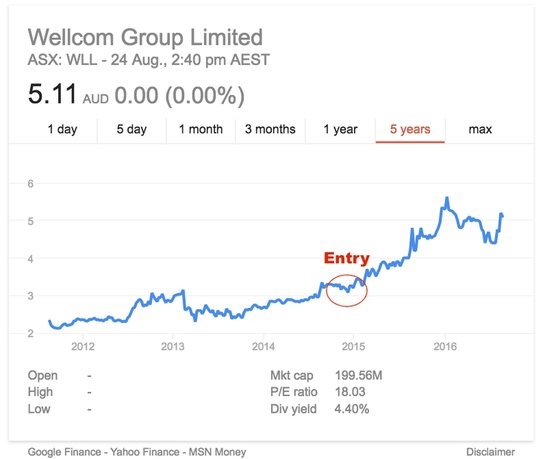

Current Price: $5.11

As we reported in February 2016 we continue to own a position in the Wellcom Group (WLL), a small listed business that is a world leading global content production company. WLL is capable of offering around the clock services connecting industry leaders with customers. The Executive Chairman, Wayne Sidwell, has almost five decades of experience and remains as passionate about the industry as ever.

The TAMIM Australian Equity Value IMA enjoys finding and owning well-managed, risk averse (especially when it comes to debt) listed companies generating good cash flow with a strong family business alignment and pedigree. We continue to believe that whilst the international profit contribution to the WLL Group which is still small (especially in absolute terms); enormous potential exists for this company to grow in a large global profit pool from a low base.

The digital and social media revolution continues to force structural change across advertising and media industries which will favour production companies which are able to deliver large volumes of content frequently. The 2016 result for WLL highlighted net revenues up 20% to $103.4m with net profit up 14% to $11.1m. The dividend is up 10% underpinned by good cash flow to a fully franked 22.5 cents. Importantly, UK revenue increased by 51% and the US revenue base increased to 39.4%. With an increased global footprint, improved content production and with lower cost structures, WLL continues to be a holding in our Value portfolio.

Current Poistion

Investment Rationale: Strong Growth prospects, Industry Consolidation

Current Price: $3.83

SpeedCast is fast becoming a major global player in the high growth attractive satellite services and VSAT segment. In our article in March we discussed how SpeedCast had delivered 38% revenue growth and 42% EDITDA growth. Management had also flagged its acquisition strategy to consolidate the fragmented industry which it has now actively been fulfilling with its recent acquisition of WINS for €60 million in cash.

The half-year 2016 results have revenues reported at USD 101.5m which reflects growth of 41% over the previous comparable period. EDITDA was USD 17m which reflected a 34% increase. SpeedCast has delivered strong growth in the maritime (31% of revenues) and the energy (17%) sectors. The business has purchased Newcom, ST Teleport and now in August, WIN. The WIN purchase will add a strong presence in Germany as well as diversify the maritime segment into the fast growing segment of passenger carrying vessels.

SpeedCast has presented some compelling opportunities to add to the position over the last 6 months. The latest results do indicate the company is executing well in its approach to consolidate the industry as well as continuing to grow diversified components of existing business segments.

Current Poistion

Investment Rationale: Underfollowed, unloved, turn-around story

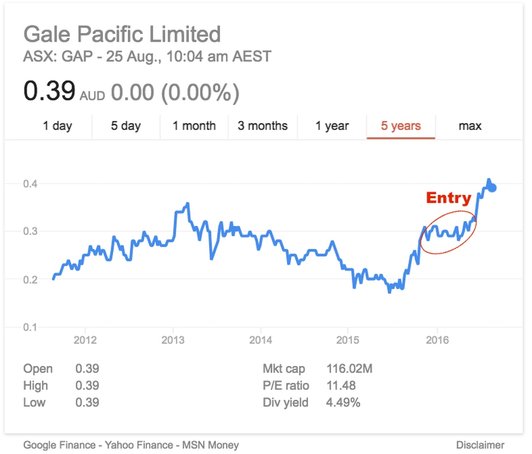

Current Price: $0.39

As our Small Cap manager recently wrote in the article on Gale Pacific, GAP is a great example of a smaller company achieving global success in a chosen niche market. As the company grows its earnings and market cap we expect the market and the analysts that cover the sector to start recognising GAP and drive a multiple expansion. Over the past 12 months, GAP has returned close to 100% while the Australian share market has displayed an anaemic 2.6% return. It is still very cheap on future estimates, and looks set to yield in excess of 7% this coming year, leading us to believe there is still material upside despite the recent share price performance.

After GAP’s fall from grace from 2005 to 2010 the business has strategically refocused on its core products and improved its management of working capital. This has all occurred off the radar of most investors. Today GAP is a global leader in the production of technical shade material. The 2016 results showed revenue up 17% with NPAT up 47% at $10.2m. We continue to hold our position in Gale Pacific and remain impressed with this small Australian company making large strides in the lucrative US, Middle East and African markets.