Investing in Retail Stocks

Retail stocks provide a unique insight into consumer preferences, economic conditions, and technological advancements, making them a dynamic and ever-evolving investment opportunity. From e-commerce powerhouses to traditional brick-and-mortar retailers, the sector reflects the trends shaping consumer behavior. Our curated articles on retail stocks explore the impact of consumer sentiment, seasonal trends, and digital transformation on the sector’s performance. Discover actionable insights to identify promising retail investments and navigate the shifting landscape of consumer spending.

Investing in ASX Retail Shares

The retail sector plays a vital role in the economy, meeting consumer needs and driving growth through innovation and adaptability. ASX retail shares represent a diverse array of companies, from grocery and department stores to online marketplaces and specialty retailers. This diversity offers investors exposure to both defensive staples and high-growth opportunities, making it a compelling choice for portfolio diversification.

Why Consider ASX Retail Shares?

Investing in ASX retail shares offers several benefits:

-

- Consumer-Focused Growth: Retail stocks are directly influenced by consumer spending patterns, providing opportunities for growth during periods of economic expansion.

- Diverse Opportunities: The sector spans various sub-industries, including supermarkets, apparel, electronics, and online retail.

- Steady Income: Many established retail companies offer consistent dividend payouts, appealing to income-seeking investors.

However, the retail sector is sensitive to economic conditions, inflation, and evolving consumer preferences. Investors with a clear understanding of market trends and long-term goals are better positioned to navigate these challenges.

Top ASX Retail Shares to Watch

Here are some notable retail stocks listed on the ASX, known for their resilience and alignment with consumer trends:

1. Wesfarmers Ltd (ASX: WES)

A retail giant with holdings in Bunnings, Kmart, and Officeworks, Wesfarmers benefits from its diversified portfolio and strong market presence across Australia and New Zealand.

2. Woolworths Group (ASX: WOW)

A leader in the supermarket industry, Woolworths focuses on innovation in grocery retail and online delivery services, ensuring a robust market position.

3. Coles Group Ltd (ASX: COL)

Known for its extensive supermarket network, Coles emphasises sustainability and customer-centric strategies to maintain its competitive edge.

4. Temple & Webster Group Ltd (ASX: TPW)

An e-commerce specialist in furniture and homewares, Temple & Webster has seen significant growth, leveraging the online shopping boom.

5. JB Hi-Fi Ltd (ASX: JBH)

A trusted name in electronics and entertainment retail, JB Hi-Fi combines strong brand recognition with competitive pricing to drive consistent growth.

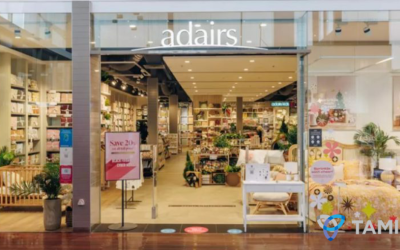

6. Adairs Ltd (ASX: ADH)

Specialising in home furnishings, Adairs captures market share with its stylish, affordable offerings and strong omnichannel presence.

Notable Global Retail Stocks

1. Amazon.com Inc. (NASDAQ: AMZN)

A global e-commerce giant, Amazon has revolutionised retail with its vast product offerings, efficient delivery network, and innovations in cloud computing and AI, making it a dominant force in the global retail sector.

2. Walmart Inc. (NYSE: WMT)

The world’s largest retailer, Walmart excels in both physical stores and e-commerce, offering a wide range of products at competitive prices, driven by its strong logistics and customer-centric strategies.

Are ASX Retail Shares a Good Investment?

ASX retail shares offer a compelling blend of growth potential and income opportunities for investors who understand the sector’s nuances. While the retail landscape is highly competitive and influenced by economic cycles, companies with strong brands and innovative strategies often outperform.

For long-term investors with an eye on consumer trends and a willingness to adapt to market changes, retail stocks can be a rewarding addition to a diversified portfolio. As always, aligning your investment strategy with your financial goals and risk tolerance is essential.

Retail Sector Stock and Market Insights

Shining a Spotlight On Two Resilient ASX Retailers

Whether it be sport, business, investing or entertainment - we love a story of...

Second-Level Thinking: Benefiting from the Rebound of ASX Retail Stocks

The Australian consumer has navigated a complex landscape over the past 12-18...

Three ASX Resilient Retailers Posting Impressive Results

As company earnings reports roll in, investors will see multiple examples of...

Should We Go Shopping for ASX Retail Stocks?

Should We Go Shopping for ASX Retail Stocks? 10/10/2023 Buying bargains...

Retirees are Staying with Stocks

The Wall Street Journal recently published a personal finance column entitled...

A Rough Ride for Retailers

Australia’s unemployment rate has defied the doom and gloom predictions,...