Over the past fortnight global equity markets have experienced a sharp and synchronised pullback. This week has added an important nuance. After the initial aggressive selloff, markets have not collapsed further, instead they have begun to oscillate. Large intra-day...

Global Equities

Investing Without a Map: What Global Equity Markets Are Teaching Us About 2026

There are moments in markets when the noise gets so loud that it becomes meaningless. Every data release is framed as decisive, every central bank utterance is dissected like scripture, and every price move is treated as either confirmation or catastrophe. Then there...

Trust in Rust: Why Industrial Stocks Are Gearing Up for a Renaissance

There are moments in markets where the noise becomes so loud, it drowns out common sense. Tariffs, geopolitics, inflation, central banks, and a US Congress with a taste for budgetary excess. And yet, despite all the reasons to panic, a certain type of company is...

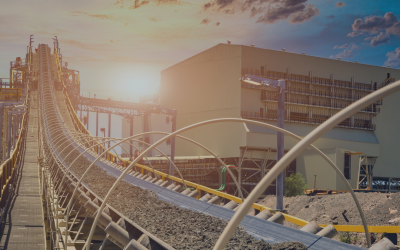

Global Energy Infrastructure – Investing Wisely into an Uncertain Transition

Embracing Uncertainty with Smart Allocations Global energy markets today sit at the intersection of volatility, policy shifts, and long-term transformation. From the unpredictability of fossil fuel supply to the growing (but not unchallenged) role of renewables,...

Global Listed Infrastructure: Investing at the Heart of the 21st Century Economy

Building Portfolios Around What the World Needs Most In an era marked by energy volatility, digital transformation, and geopolitical uncertainty, the world is investing in one thing above all else: infrastructure. While airports, grids, ports, and data centres might...

When Markets Move Fast: Defensive Investing for a Volatile World

There are decades when nothing happens, and then there are weeks when decades happen. For many readers, this rather neatly encapsulates recent market antics. With tariff policies still stuck in a revolving door and markets convulsing like a toddler denied ice cream,...

Tariffs and the ASX: What the U.S. Backflip Means for Investors

The past week has seen global markets whipsaw amid the latest U.S. tariff announcements, with Australian equities caught in the crosscurrents. Initially, global equities shed over $5.4 trillion in value following sweeping U.S. tariffs on imports, sending the S&P...

Three Global Stocks to Watch in 2025: Value, Innovation, and Resilience

In a market increasingly driven by headlines and hype, true investment opportunities often lie beneath the surface hidden in quality businesses trading below their intrinsic value. TAMIM Asset Management’s Global High Conviction portfolio is built on that very...

TAMIM Global Equities – Global Opportunities with TAMIM Diversified Investments Beyond Dividends

Robert Swift highlights TAMIM's investment approach, focusing on a diversified portfolio of 95-120 global companies that capitalise on emerging trends. He discusses the need for Australian companies to shift focus from high dividend payouts to reinvesting in growth....

Tech & AI Power Plays: Key Insights from Marc Andreessen

In the ever-evolving world of technology, few voices carry as much weight as Marc Andreessen. As one of Silicon Valley’s most influential venture capitalists and co-founder of Andreessen Horowitz, he has been at the forefront of technological innovation for decades....

TAMIM Global Equities – Investing in the Transition Balancing Green Energy and Traditional Resources

How can the U.S. reinvigorate private investment and stabilise the green transition? Robert Swift stresses the need to boost domestic investment while balancing renewables with fossil fuels to ensure economic stability. With rising demand for commodities like copper...

TAMIM Global Equities – The U.S. Grid and Nuclear Power: Opportunities in the Energy Transition

Is U.S. grid modernisation the next big investment opportunity? Robert Swift highlights the rising demand from data centers and renewables, pointing to companies like Emcor, Quanta, and Hitachi as key beneficiaries. He also underscores nuclear energy’s growing role,...