Stock News & Insights

Sign up for our newsletter

Stay Informed with TAMIM Market and Stock Insights

At TAMIM, we’re dedicated to empowering investors with knowledge to effectively manage their retirement futures. Our Market and Stock Insights cover various segments to keep you updated on the latest trends, strategies, and news affecting your investments. Explore our wealth of insights across different categories to stay ahead in the evolving landscape of investments.

Subscribe to our Weekly Stock Insights

Inflation. It’s a term thrown around by newsreaders and politicians, often with a tone of fear. But what does it really mean for Australians? More importantly, what’s happening right now in the United States, and how will that impact us here? As Australians, we need... The February reporting season presented one of the most dynamic market environments in recent memory. Earnings results triggered sharp movements, with investors swiftly adjusting their positions based on performance. This created significant shifts in valuations, with... Navigating the Market’s Shifting Landscape The world is shifting under our feet. Global markets are being reshaped by technological advancements, economic realignments, and geopolitical shifts that demand a new approach to investing. As investors, it is no longer... The ASX continues to be a hub for fintech innovation, with digital payments playing a crucial role in reshaping financial transactions and business operations. As businesses transition toward cashless transactions, demand for seamless, efficient payment solutions... Australia’s Big Four Banks Under the Microscope Over the past fortnight, we’ve seen continued market skepticism toward the banking sector. With global recession fears, some dubbing it a potential "Trumpcession", we’ve witnessed a correction in bank share prices.... The February 2025 earnings season has placed Coles (ASX: COL) and Woolworths (ASX: WOW) under the microscope, with both supermarket giants facing an evolving retail landscape. While Coles demonstrated strong execution and market share gains, Woolworths encountered... ClearView (ASX: CVW) has long been a business with strong fundamentals, yet its stock has remained undervalued in recent times. Now, with the worst of its claims experience behind it, earnings stabilising, and a bold share buyback program in place, the company is... Warren Buffett’s annual letter to Berkshire Hathaway shareholders is one of the most anticipated events in the investment world. Every year, investors both seasoned professionals and beginners, pour over his words to extract wisdom from one of the greatest investors... In the ever-evolving world of technology, few voices carry as much weight as Marc Andreessen. As one of Silicon Valley’s most influential venture capitalists and co-founder of Andreessen Horowitz, he has been at the forefront of technological innovation for decades....

Understanding Inflation and the Economy: A View from Australia

Capitalising on Market Cycles: Lessons from February’s Volatility

The Global Investment Shake-Up: Where to Find Opportunities in 2025

ASX Fintech Sector: Capitalising on the Digital Payments Shift

ANZ vs. NAB: Which Bank Offers the Best Opportunity in 2025?

Coles vs. Woolworths: The Risks, Rewards, and Investment Outlook

ClearView (ASX: CVW) 1H FY25 Update: A Turning Point in Valuation & Growth

Two Timeless Investing Lessons from Warren Buffett’s Latest Annual Report

Tech & AI Power Plays: Key Insights from Marc Andreessen

Inflation. It’s a term thrown around by newsreaders and politicians, often with a tone of fear. But what does it really mean for Australians? More importantly, what’s happening right now in the United States, and how will that impact us here? As Australians, we need... The February reporting season presented one of the most dynamic market environments in recent memory. Earnings results triggered sharp movements, with investors swiftly adjusting their positions based on performance. This created significant shifts in valuations, with... Navigating the Market’s Shifting Landscape The world is shifting under our feet. Global markets are being reshaped by technological advancements, economic realignments, and geopolitical shifts that demand a new approach to investing. As investors, it is no longer... The ASX continues to be a hub for fintech innovation, with digital payments playing a crucial role in reshaping financial transactions and business operations. As businesses transition toward cashless transactions, demand for seamless, efficient payment solutions... Australia’s Big Four Banks Under the Microscope Over the past fortnight, we’ve seen continued market skepticism toward the banking sector. With global recession fears, some dubbing it a potential "Trumpcession", we’ve witnessed a correction in bank share prices.... The February 2025 earnings season has placed Coles (ASX: COL) and Woolworths (ASX: WOW) under the microscope, with both supermarket giants facing an evolving retail landscape. While Coles demonstrated strong execution and market share gains, Woolworths encountered... ClearView (ASX: CVW) has long been a business with strong fundamentals, yet its stock has remained undervalued in recent times. Now, with the worst of its claims experience behind it, earnings stabilising, and a bold share buyback program in place, the company is... Warren Buffett’s annual letter to Berkshire Hathaway shareholders is one of the most anticipated events in the investment world. Every year, investors both seasoned professionals and beginners, pour over his words to extract wisdom from one of the greatest investors... In the ever-evolving world of technology, few voices carry as much weight as Marc Andreessen. As one of Silicon Valley’s most influential venture capitalists and co-founder of Andreessen Horowitz, he has been at the forefront of technological innovation for decades....

Understanding Inflation and the Economy: A View from Australia

Capitalising on Market Cycles: Lessons from February’s Volatility

The Global Investment Shake-Up: Where to Find Opportunities in 2025

ASX Fintech Sector: Capitalising on the Digital Payments Shift

ANZ vs. NAB: Which Bank Offers the Best Opportunity in 2025?

Coles vs. Woolworths: The Risks, Rewards, and Investment Outlook

ClearView (ASX: CVW) 1H FY25 Update: A Turning Point in Valuation & Growth

Two Timeless Investing Lessons from Warren Buffett’s Latest Annual Report

Tech & AI Power Plays: Key Insights from Marc Andreessen

While markets and investors are often captivated by sectors promising rapid growth and technological advancements, there are times when strategic investments in more stable sectors can offer "defence" against economic downturns. One such sector is Defence, where... Sometimes the macroeconomic outlook changes like the weather, and investors find themselves sailing in a crosswind of uncertainty. The Reserve Bank of Australia (RBA) is ensnared in a catch-22 dilemma: whether to raise rates to tame inflation and risk plunging the... In the early days of the internet, scepticism swirled around the notion of a global network connecting computers. People questioned its reliability, its security, and even its purpose. Yet, as history unfolded, the internet proved to be a transformative force beyond... As technology strides forward, the world's energy demands have skyrocketed, with artificial intelligence (AI) at the forefront of this surge. This escalation poses significant challenges and opportunities—an area we have recently begun to delve into. The rise in... In the wake of a significant market sell off following a stimulus induced boom there were plenty of company’s that saw the baby thrown out with the bath water. Over the past year, TAMIM has identified significant opportunities within the merger and acquisition... We first highlighted the importance of semiconductors back in April 2023 when we introduced the concept of megatrends. Back then, we used the example of the automotive industry and the increasing adoption of electric vehicles (EVs), and highlighted how investing in... The surge in enthusiasm for anything related to artificial intelligence (AI) has continued apace in 2024, a theme we have discussed on several occasions, including here and here (to provide readers with useful topical information but less than the overload and... Daniel Kahneman, an Israeli-born American Nobel prize-winning author, passed away on March 27 at age 90. For those yet to become familiar with his work, he was a psychologist at heart but to many he will be remembered as a pioneer in what has become known as... In a noteworthy decision on Tuesday, March 19, the Bank of Japan (BOJ) announced an increase to its benchmark interest rate for the first time since 2007. Japan has endured a prolonged period of “ultra loose” monetary policy since the Global Financial Crisis (GFC), as...

Should investors play Defence in FY2025?

Navigating the Tug of War Between Interest Rates and Inflation

AI Real Estate and the Importance of Data Centres

Power Play: Investing In Energy For Innovation

Will New Merger & Acquisition Laws Impact the Takeover Market?

CHIPS: Megatrends and Mega Funding

AI’s Power Surge: Overlooked Opportunities of a Tech-Driven Future

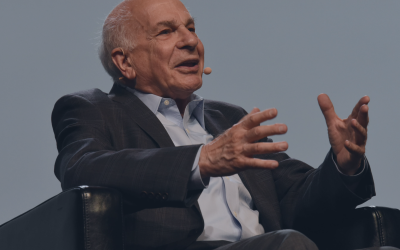

Fast Thoughts, Slow Wisdom: The Legacy of Daniel Kahneman

Japan’s Post-COVID Normal & Decoding Central Bank Speak

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.No Results Found

Investing in ASX Sectors

About TAMIM Asset Management

TAMIM Asset Management is a boutique investment firm that provides a variety of investment solutions tailored to our clients’ needs, with a commitment to safeguarding their wealth. At TAMIM we delivering expert solutions across equities, property & credit

Stay Informed with TAMIM Stock Insights

TAMIM Asset Management provides market and stock insights for general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal situation, and may not be suitable for you.