So, what exactly is a recession?

There is no single definition of recession. The most common definition used in the media and textbooks is a ‘technical recession’, in which there have been two consecutive quarters of negative growth in real gross domestic product (GDP).

This is a somewhat arbitrary and abstract definition with the oxymoron of “negative growth” thrown in for fun. What tends to happen during a recession is the more important factor to consider.

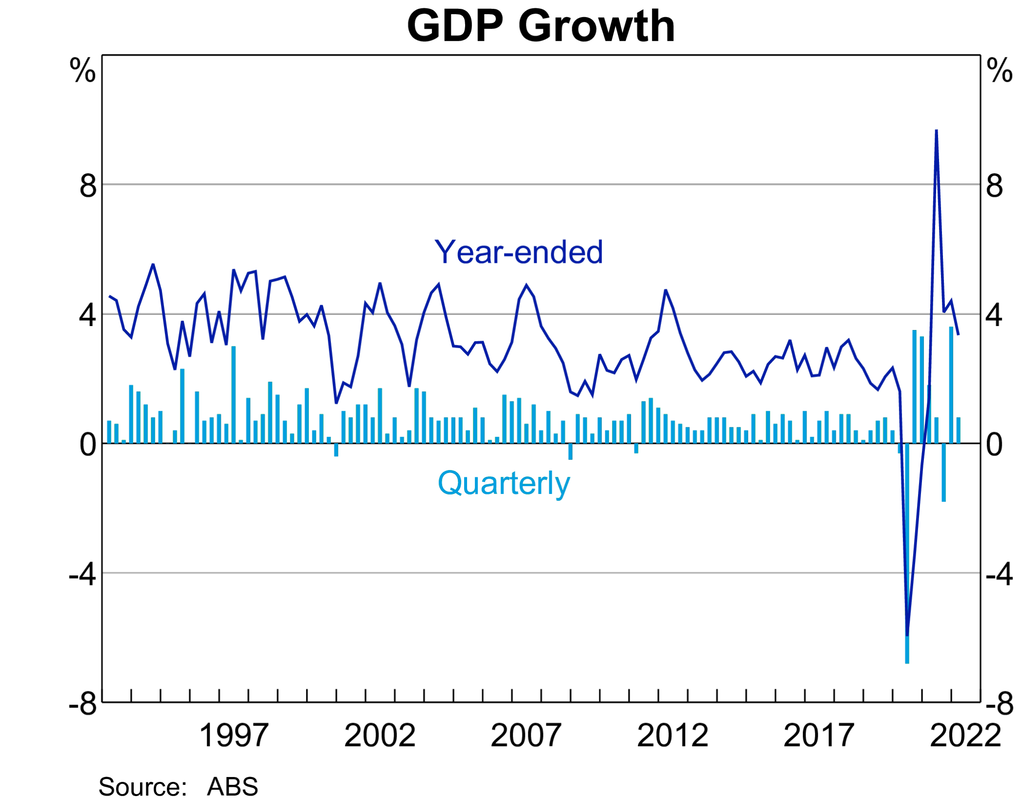

Let’s start with what “real GDP” is. Real GDP is an inflation-adjusted measure that reflects the value of all goods and services produced by an economy in a given period of time. Two consecutive quarters in which real GDP decreases reflects an economy going backwards by producing fewer goods and services than before. Following this through, if fewer goods and services are being produced then this generally implies there is reduced demand for them. If businesses are experiencing less demand and therefore producing/supplying less, they require less labour to do so. This manifests in workers receiving fewer hours or being laid off and therefore higher underemployment and unemployment. This is a key characteristic of recessions alongside depressed levels of household spending and business investment.

What causes recessions?

Finally, if we go by gross GDP, the most recent recession was caused by the arrival of Covid-19; gross GDP falling -0.3% and -7.0% respectively in the March and June 2020 quarters. Management of the public health crisis resulted in governments mandating suspension of large swathes of the economy for prolonged periods of time which prevented them from producing goods and services, leading to a reduction in output. In fact, the June 2020 quarter falling by -7% is the largest quarterly decline since records have been kept.

How long do they typically last?

|

|

|

How do they affect the share market?

There is no sugar coating it, recessions are negative for the share market. Reduced demand leads to reduced profits and profitability. In turn this results in a decrease in share prices. As this tends to be economy wide, recessions are usually associated with bear markets, a term used to describe a decline in a share market index of at least 20% or more from its most recent peak.

Of course, within the overall decline there can be opportunities which see individual companies experience increasing share prices. The most important takeaway from the below charts tracking the share market across various recessions since 1875 is that it has always recovered to a new high subsequently. EVERY. SINGLE. TIME. Recessions are temporary; the wealth creating effect of the market is enduring.

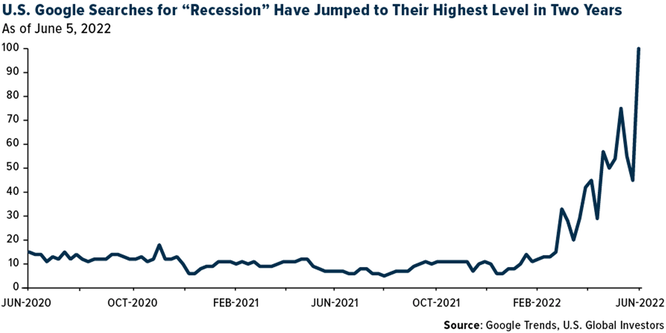

So, are we headed for recession in 2022/2023?

The short answer? We don’t know and neither does anyone else for that matter. The pandemic resulted in disruptions to supply chains as manufacturing and transportation around the world was affected by differing government policies and restrictions in addition to workforce issues resulting from illness and/or fear of the virus.

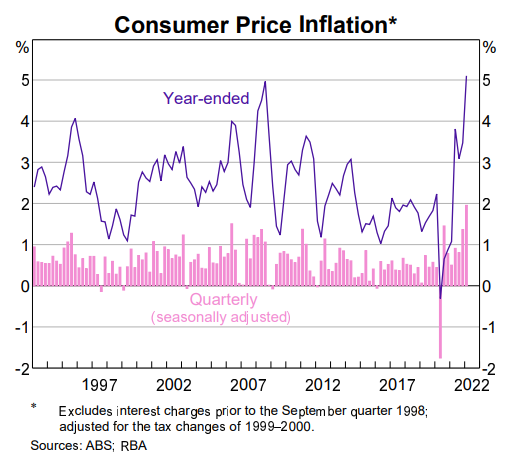

This had the expected effect of reducing the supply of goods and services. Simultaneously governments, particularly in the western world, unleashed a torrent of short-term direct stimulus which in many cases fully replaced (and them some) the income of workers affected by closure of parts of the economy. Longer term stimulus was also enacted, think the Home Builder Grant. The twin effects of reduced supply and increased demand have resulted in inflation not seen in decades (see below).

|

|

|

This has been exacerbated by the war in Ukraine which has led to higher energy prices. Central banks likely assumed that as the pandemic came under control, supply would normalise to meet demand and inflation would slow down. This has not proven to be the case and central banks around the world are now “behind the curve” in controlling inflation (USA 2% target vs 8% currently and Aust. 2-3% target vs 5% currently) resulting in them increasing interest rates aggressively. A war that affects global energy and food prices was the last thing needed. As mentioned above, high interest rates were partly the cause of the early 1990s recession and an oil price shock the cause of the 1970s recession. The fear is that history will repeat. Central banks are hopeful they can increase rates enough to dampen demand and reduce inflation without causing a recession (i.e. a soft landing).

Will they succeed? Only time will tell but history suggests they have their work cut out for them.