Artificial Intelligence (AI) is no longer just a futuristic concept; it is reshaping industries across the globe, creating massive opportunities for businesses that can harness its potential. From automating complex processes to driving new innovations in data analysis and decision-making, AI’s rapid adoption is set to drive significant growth in the global economy. According to research by PwC, AI is expected to contribute up to $15.7 trillion to the global economy by 2030, with Australia standing to gain $315 billion in additional economic value over the next decade.

In Australia, AI is becoming increasingly integral across sectors such as healthcare, financial services, legal services, and logistics. Companies that leverage AI to enhance efficiency and deliver intelligent solutions are positioning themselves to benefit from this explosive growth. The ASX is home to several businesses that are at the forefront of AI-driven innovation, providing investors with a compelling opportunity to tap into this trend.

In this two-part series, we explore two Australian companies that offer the best exposure to the rapidly growing applications of Artificial Intelligence (AI). These companies not only operate in high-growth sectors but also showcase strong profitability, scale, and have strong net cash balance sheets. With management teams heavily aligned with shareholder interests, these businesses are positioned to deliver long-term value. We believe their current share prices represent an attractive entry point for investors.

Part 1 – Nuix (ASX: NXL)

Company Overview and Business Model:

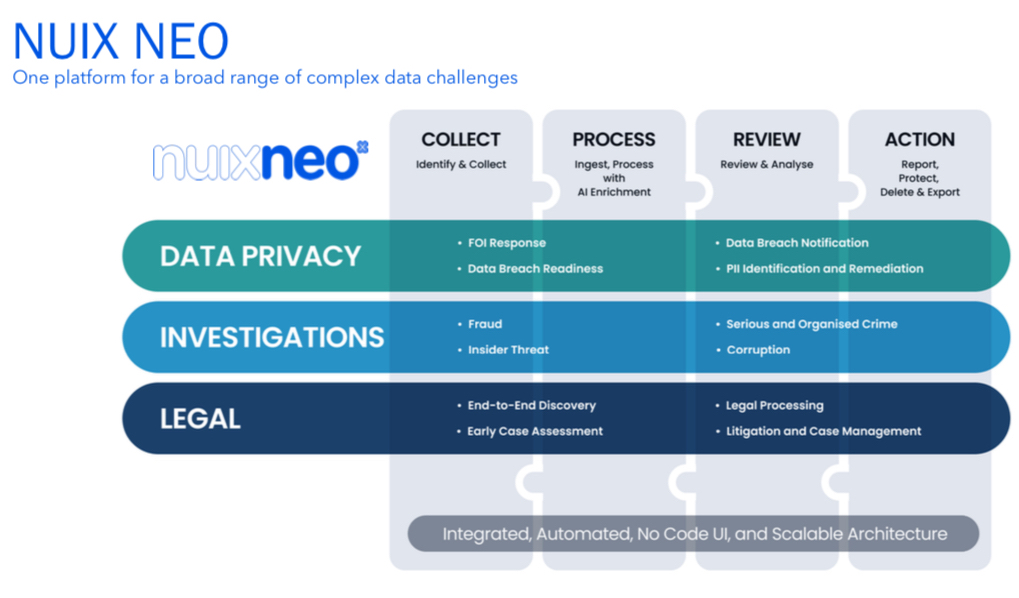

The company’s acquisition of Rampiva last year significantly enhanced its automation capabilities, enabling clients to achieve higher operational efficiency. While Nuix’s products can be intricate, they address real-world problems for a wide range of industries, particularly in legal and investigative fields. Nuix products can be complex and difficult to understand but the following graphic does a good job of highlighting the 3 key products:

Operating in a global market, Nuix generates 85% of its annual contract value (ACV) from clients outside Australia. With a portfolio of 1,000 high-quality customers, including those in law enforcement, government agencies, and large enterprises, Nuix has a strong market presence. Over 75% of its clients have been with the company for more than five years, illustrating the strength of its offerings and long-term relationships.

FY2024 Financial Results:

Nuix’s financial results for FY2024 exceeded expectations across the board. The company achieved a 14% increase in ACV, reaching $211.5 million, with 95% of this revenue coming from recurring subscriptions—a key metric in evaluating software companies. This success was largely driven by the Nuix Neo platform, which contributed to nearly half of the ACV growth.

Nuix also outpaced its revenue growth target, delivering a 20.9% increase to $220.6 million, well above the 10% constant currency growth goal. Its net dollar retention rate—a crucial measure of customer retention and upselling—rose to an impressive 112.9%.

Profitability was another highlight, with underlying EBITDA growing 38.7% to $64.4 million, and statutory EBITDA climbing 60.2% to $55.9 million. Strong operational leverage resulted in positive cash flow generation, a notable turnaround from the previous year, with $24.7 million in underlying cash flow and $11.9 million in total cash flow.

Outlook for FY2025:

Nuix has set ambitious targets for the upcoming financial year, aiming for 15% ACV growth while continuing to grow revenues faster than operating costs. A portion of this growth will be driven by increased R&D investments, with a focus on further enhancing the Nuix Neo platform and expanding its core solutions to appeal to a broader customer base.

The company also has a $30 million debt facility in place to explore M&A or partnership opportunities, which could further accelerate its growth strategy. With a strong cash position and improving profitability, Nuix is well-equipped to pursue these initiatives.

TAMIM Takeaway:

Nuix’s transformation, exemplified by its FY2024 performance, highlights the potential of its AI-driven solutions and the strength of its global customer base. The company’s focus on operational efficiency and continued innovation positions it to capitalise on the massive opportunities in the AI space.

Looking ahead, Nuix Neo AI capabilities have the potential to drive revenue growth by 2 to 3 times over the next 5 to 10 years, coupled with expanding profit margins. With double-digit revenue growth and high EBITDA margins, Nuix is on track to become a Rule of 40+ software company—a key indicator of both growth and profitability. Global peers in this category typically trade at 7-10x sales, and we believe Nuix’s valuation could reach $10.00+ per share in the next 2-3 years.

_____________________________________________________________________

Disclaimer: Nuix (ASX: NXL) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.