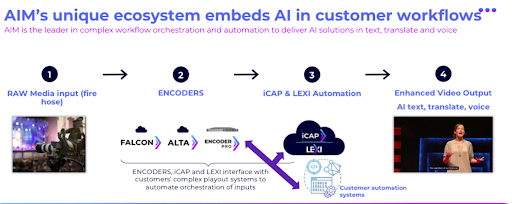

We attended the AIM AGM and Demo day last month and came away encouraged by the company’s prospects. The meeting provided a comprehensive update on AIM’s strategic transformation into a global technology leader focused on AI-powered language services. At the core of AIM’s business model is the Lexi platform, which leverages the company’s network of 5,000 encoders installed in customer workflows to orchestrate diverse data inputs into AI engines. This automated workflow management is seen as AIM’s key competitive advantage, allowing it to deliver superior AI language tools to high-value customers in broadcast, government, enterprise, and education.

Source: Ai Media Technology Investor Presentation

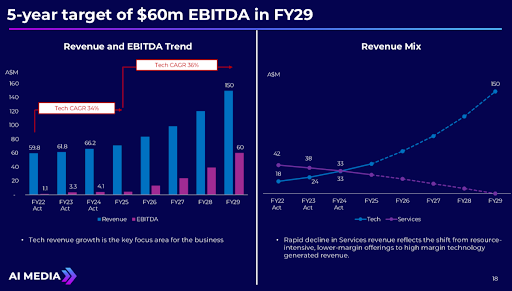

Financially, AIM is targeting 35% annual growth in tech revenue over the next 5 years, aiming to reach $150 million of revenues and $60 million in cash EBITDA by FY2029. This aggressive growth plan was articulated well by the Founder/MD and largest shareholder, Tony Abrahams, and is underpinned by several factors:

1. Mainstream adoption of Lexi in the US live broadcast market, which has grown from 16% to 50% market share in just 3 years. The installed encoder base has been critical to driving Lexi adoption, as the encoders provide a point of presence in customer workflows and enable the seamless integration of Lexi into existing infrastructure.

2. Geographic expansion, particularly in Europe, where AIM has already made significant progress selling encoders and expanding the iCap network. Key partnerships with broadcasters like ITV have helped drive adoption in the region, with AIM successfully deploying Lexi in countries like France, the Netherlands, Denmark, and Finland (FY25 YTD sales already doubled FY24).

3. New product innovations like Lexi Voice, which is expected to be a major revenue driver for the company. Lexi Voice is AIM’s first non-captioning AI product, aimed at providing AI-driven voice-to-voice translation and audio description services. The total addressable market for voice and translation services is estimated at $69 billion, significantly larger than the $2 billion market for captioning and transcription.

To execute on this growth strategy, AIM plans to increase investments in product development and sales/marketing by $4 million in FY2025. The company will also focus on transitioning legacy services revenue to the higher-margin tech business, with a goal of 35% annual tech revenue growth and reaching 80%+ of group revenue from tech sales by December 2025. This transition will involve shutting down the legacy services infrastructure over time.

Operationally, AIM faces risks around automating complex workflows, maintaining quality and accuracy of AI-generated captions, and potential bottlenecks in encoder production and distribution. However, the company is addressing these challenges through initiatives like resilient architecture design, capacity building, and exploring alternative encoder integration models, such as leveraging existing encoder networks in adjacent markets like government and enterprise.

Source: Ai Media Technology Investor Presentation

One key area of focus is the expansion of the iCap network in Europe and Asia, where AIM sees significant growth opportunities. The company is exploring ways to use existing commercial equipment/encoders and install it with their software to accelerate adoption, rather than relying solely on its own encoder manufacturing capabilities.

In terms of competition, AIM has reframed the industry structure, positioning itself further up the value chain and making its traditional competitors into customers. The company is now earning revenue from third-party service providers who use the iCap network, which has allowed it to invest in improving the network’s performance and reliability.

The TAMIM Takeaway

AI Media (ASX: AIM) is a standout in AI-powered language services, driven by its Lexi platform and rapid market adoption. With bold targets of $150 million revenue and $60 million cash EBITDA by FY2029, AIM is capitalizing on U.S. and European growth, non-captioning innovations like Lexi Voice, and the $69 billion voice and translation market.

The transition to high-margin tech revenue, geographic expansion, and strategic investments position AIM for significant upside. Even achieving half its targets offers strong potential returns, making AIM a top pick in Shamgar’s ASX Small Cap Watchlist for 2025.

______________________________________________________________________________

Disclaimer: AI Media (ASX: AIM) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.