Author: Ron Shamgar

Webcentral (WCG.ASX)

WCG completed the acquisition of 5GN, a telecommunications carrier providing datacentre and cloud solutions across Australia. Webcentral and 5GN operate in complementary businesses and the merger will result in a market leading, full-service online/digital solution provider that delivers strong value and growth opportunities to shareholders. This will come with synergies. During the half, 5GN saw strong customer growth and completed $12m in contract renewals.

Results

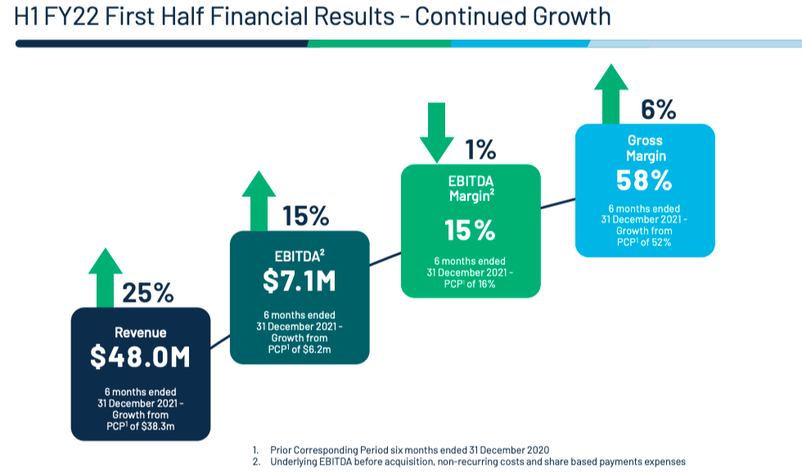

WCG saw their revenue climb to $48m, up +25% on the previous comparable period (pcp), with EBITDA of $7.1m, up +15%, for the half. They beat guidance on EBITDA while revenue came in at the top end of the range. WCG’s gross margin improved to 58% from a combination of organic growth and direct cost synergies. The company experienced a lack of hardware and software orders due to Covid-19 which disrupted installation. They also noted that this segment is skewed towards H2. It was stated on the earnings call that hardware sales are already recovering as we edge into H2. New data centre sales are currently tracking at $100,000 per month and they have seen improved customer retention. Looking to H2, WCG will be launching their domain business on March 24. They believe that it is a significant market and internal forecasts suggest that WCG will take approximately 30% of the market. WCG is also expecting 10-20% of their 330,000 strong SME customer base to take up their initial NBN launch in June.

Outlook

We were surprised to see WCG slide down after providing this result. Despite seeing weak hardware and software sales, they are still on track to meet their long terms goals. They are forecasting that they reach $29m in EBITDA in FY23 and are very confident on achieving a 20% EBITDA margin for FY22 There are also a lot of small M&A targets being looked at and they have seen an increased volume of inbound deals from brokers. In terms of their ~18% stake in Cirrus Networks (CNW.ASX), they are waiting to see their results and take action from there. They are also forecasting a gross cash position of $55m in FY23. Right now WCG are trading on an FY23 EV/EBITDA of 3x, a level that we believe is far too cheap given their growth initiatives.

SRG Global Limited (SRG.ASX)

Results

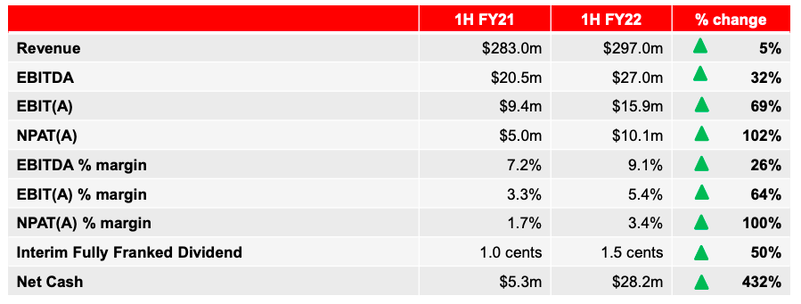

In what has been a tough operational environment for the sector due to Covid disruptions and labour shortages, SRG posted a strong result for the half year. SRG was able to weather the storm and grow revenue by +5% to $297m and EBITDA to $27m, +32%. SRG has seen a $40m swing from net debt to net cash since FY20; net cash now sitting at $28.2m. SRG’s strategic plan is to transition the business toward recurring revenues, providing better earnings visibility. Currently recurring revenue makes up 67% and they are hoping to boost this to 80%. SRG launched their Engineering Products segment which SRG are very excited about, believing it could grow to be their fourth operating arm. Alongside this, the revenue is recurring in nature. SRG have built a strong suite of clients, including the likes of Iluka (ILU.ASX), Fortescue (FMG.ASX), and Rio Tinto (RIO.ASX); 70% of these top tier clients weren’t there three years ago. SRG have also stressed the cross-selling opportunities of services as well as being able to get more work once they are on site with clients.

Outlook

SRG has a strong pipeline, Work in Hand coming in at $1bn with a broader pipeline of $6bn. Management noted that they believe the business will do significantly better in an easier operating environment; the WA border opening being a tailwind and increased access to labour on the horizon as Covid-19 restrictions ease. SRG have done well in their transition to more of a recurring revenue based strategy; we believe will earn them a higher multiple. We expect SRG to grow through a mixture of M&A and organic growth and they are well funded to do so, being in a strong net cash position. SRG upgraded guidance to $54-57m, putting them at an FY22 EV/EBITDA of around 4x and will be paying a fully franked dividend of around 6% at current prices.