Written by Ron Shamgar

The Inflection Point

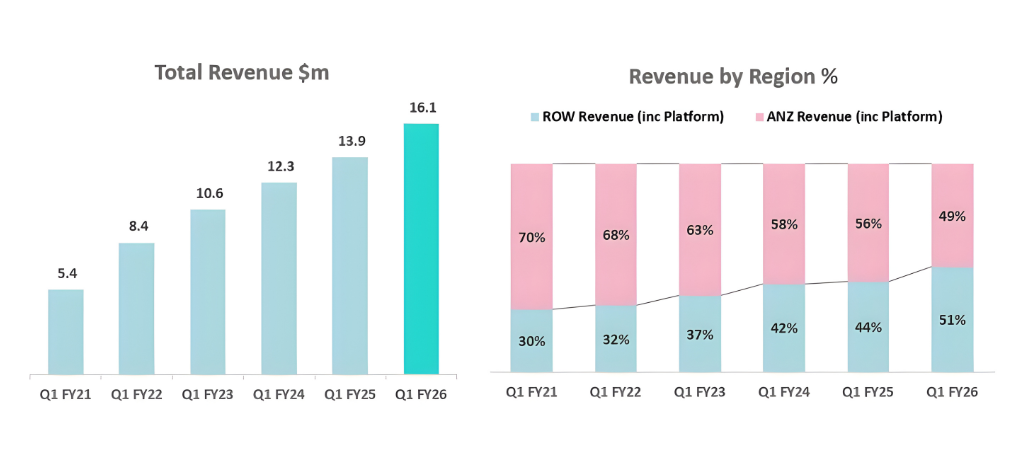

In the small-cap universe, few transformations are as profound as when a domestic success story becomes a true global operator. For Pureprofile (ASX: PPL), that turning point has arrived. In the September quarter, the company achieved a milestone years in the making: international revenue surpassed domestic sales for the first time in its history. It may sound like a statistic, but it represents something far more important, a validation of strategy, patience, and disciplined execution in a notoriously volatile industry.

From Research Boutique to Data-Driven Platform

Five years ago, Pureprofile was an Australian market-research firm struggling for relevance in a crowded local market. Fast-forward to FY26, and it has evolved into a global insights and data platform spanning 13 markets, with more than half its revenue generated offshore. The shift was neither sudden nor accidental. It was the product of a methodical internationalisation strategy, one that favoured building durable capabilities over chasing short-term growth headlines.

Pureprofile’s core proposition has expanded well beyond surveys and panels. It now delivers technology-enabled insight generation, allowing brands, agencies, and researchers to access high-quality, first-party data through a combination of human panels and automated platforms. In an era where data privacy and authenticity are paramount, that positioning has become immensely valuable.

The Mathematics of Global Scale

Numbers tell the story best. In FY21, offshore operations represented roughly 30 per cent of total revenue. Today that figure exceeds 50 per cent. This doubling of international exposure has fundamentally altered the company’s risk and opportunity profile. The UK and US markets, where Pureprofile has been deliberately investing, now contribute the lion’s share of global insights spending, together representing nearly 78 per cent of the total addressable market.

From an investor’s perspective, this diversification has three key implications:

- Reduced geographic cyclicality; Australian advertising and research budgets are seasonal. Global diversification smooths those peaks and troughs.

- Improved pricing power; International clients operate in more complex, higher-value research environments. That complexity commands premium pricing.

- Higher margin potential; Platform-based revenue carries structurally higher EBITDA margins, and Pureprofile’s mix is tilting decisively in that direction.

Margins Built on Technology

Pureprofile’s management has long understood that profitability in this industry doesn’t come from human headcount, it comes from platforms. Roughly 20 per cent of group revenue now flows through technology-enabled channels, such as Data Rubico, the company’s self-serve insights platform. These products automate data collection, survey design, and analysis, cutting service delivery costs while simultaneously increasing client stickiness.

This evolution mirrors the shift seen in other SaaS-like models across the insights industry. Companies that successfully transition from project-based consulting to recurring platform usage often see EBITDA margins expand by several hundred basis points. For Pureprofile, the groundwork has been laid: scalable infrastructure, a growing base of recurring clients, and the operational leverage to monetise it.

Innovation as a Culture, Not a Slogan

Where many small-caps falter is execution fatigue, innovation gives way to maintenance. Pureprofile’s differentiator has been a relentless pursuit of product innovation. The company’s AI-driven research tools represent a structural leap forward. These tools use machine learning to segment audiences, predict survey outcomes, and reduce sampling bias, enhancements that elevate both data quality and speed to insight.

The result: higher customer satisfaction, lower churn, and stronger pricing power.

It’s the difference between selling a service and selling a solution.

The US Opportunity: Playing on the Biggest Stage

If the UK was Pureprofile’s training ground, the United States will be its proving ground. The US accounts for over half of global market-research spending. Yet, despite the dominance of large incumbents such as NielsenIQ, Ipsos, and Dynata, there remains a substantial mid-market opportunity. Clients increasingly demand agile, transparent, and tech-forward partners, a gap tailor-made for Pureprofile’s model.

The company’s acquisition of iLink in Australia provided a template for how it might approach US expansion: disciplined valuation, cultural alignment, and integration that adds real capability rather than just scale. Management has hinted that strategic acquisitions could be on the horizon to deepen its American presence.

With a net-cash balance sheet and growing EBITDA, the company is well-placed to act when the right opportunity arises.

Financial Outlook: Growth With Discipline

Guidance for FY26, $63–64 million in revenue and 10–11 per cent EBITDA margins, signals a management team confident in both its trajectory and cost discipline. For context, this implies a near-doubling of EBITDA in just three years, alongside consistent top-line growth. Importantly, that expansion is self-funded. Pureprofile’s balance sheet remains unlevered, giving it optionality in capital allocation, whether toward acquisitions, technology investment, or potential capital returns in future years.

Valuation remains undemanding: 7-8× FY26 EBITDA for a business now structurally global, technology-enabled, and operating in one of the fastest-growing adjacencies to AI.

The Strategic Context – Data as the Fuel of AI

To fully appreciate Pureprofile’s long-term optionality, investors must step back and view it through the lens of the broader data economy. Every AI model, whether developed by OpenAI, Anthropic, or Google, depends on high-quality, permissioned data. The battle for differentiated datasets is intensifying, and companies that already possess longitudinal, verified consumer insights are becoming strategic assets.

It’s not inconceivable that in the coming years, AI developers or marketing-tech giants could look to acquire insights platforms like Pureprofile to enhance training data quality and consumer understanding. In this sense, Pureprofile’s growing global dataset, covering diverse geographies, demographics, and behavioural segments, may represent its most valuable hidden asset.

The TAMIM Lens – Quality Growth With a Margin of Safety

At TAMIM, we tend to look for businesses that combine three ingredients:

- Earnings visibility: recurring or repeatable revenue models.

- Operational leverage: where incremental sales translate into disproportionate profit growth.

- Management alignment: leadership that thinks in years, not quarters.

Pureprofile now ticks each of those boxes. Its internationalisation strategy has created a natural hedge against domestic cyclicality. Its technology stack provides embedded leverage. And its management team has shown an ability to deliver on guidance consistently, an underrated signal of competence in the small-cap space.

The Competitive Moat – Not Just Panels, but Relationships

The market-research and insights industry is highly fragmented. The barriers to entry are low, but the barriers to trust are high. Pureprofile’s moat lies not just in its technology, but in its relationships with clients and panel members, built over years of transparent data practices and reliable delivery.

Moreover, its platform model means that every new client increases network value: more respondents, richer datasets, smarter algorithms. This flywheel effect strengthens over time and makes replication increasingly difficult for new entrants.

Challenges on the Road Ahead

No investment story is without risk. For Pureprofile, the key challenges are:

- Execution risk in the US, competing with larger, better-resourced incumbents will require precise strategy and disciplined capital use.

- Technology pace, keeping up with AI-enabled analytics and automation requires sustained R&D investment.

- Currency exposure, as international revenue rises, foreign-exchange volatility becomes a more material factor.

Yet, these risks are the natural companions of opportunity. The fact that Pureprofile is now exposed to such dynamics is itself evidence of how far the company has come.

The Broader Investment Thesis

The global insights market is forecast to grow 6–8 per cent annually through 2030, driven by digitisation, privacy regulation, and the rise of predictive analytics. Within that context, Pureprofile occupies a sweet spot: small enough to be agile, established enough to be credible, and positioned at the intersection of data, technology, and marketing intelligence.

If management continues to execute, there’s a realistic pathway to doubling revenue again within five years, with EBITDA margins converging toward 15 per cent. At current multiples, that could imply significant re-rating potential as the market recognises its transformation from service provider to platform business.

Case Study: A Measured Globalisation Playbook

Pureprofile’s journey offers a blueprint for how smaller Australian tech firms can succeed globally:

- Start with core capability, own a defensible niche domestically.

- Export expertise, not ego, build relationships in select offshore markets before scaling.

- Invest in process automation, technology is the bridge between small-cap resources and global reach.

- Maintain financial discipline, fund growth through operations, not dilution.

In short, it’s about winning slowly but surely.

Valuation and Peer Context

When compared with peers in the global insights ecosystem, Pureprofile screens as deeply undervalued:

| Company | FY26 EV/EBITDA | Revenue Mix | EBITDA Margin |

| Pureprofile | 8× | 51% International | 10 – 11% |

| YouGov (UK) | 14× | 90% International | 20% |

| Dynata (US, private) | ~12× | 80% International | 18% |

Even allowing for scale differences, the gap suggests room for multiple expansion as Pureprofile’s international revenues and platform margins grow.

Why Now Matters

Crossing the 50 per cent international threshold isn’t just a headline, it marks a structural re-rating opportunity. The market tends to treat companies as “local” until a clear majority of their revenue is global. Once that shift occurs, comparables change, investor coverage widens, and valuation frameworks evolve.

Pureprofile is at precisely that juncture. For long-term investors, such inflection points often represent the most asymmetric entry opportunities.

Looking Forward – The Next Chapter

Management’s focus now is twofold:

- Deepening penetration in core international markets (UK, US, Europe).

- Scaling platform revenue through Data Rubico and AI-enabled solutions.

These initiatives are mutually reinforcing, the larger the client base, the richer the data; the richer the data, the more valuable the platform. That flywheel, once fully spinning, could turn Pureprofile into one of the most attractive acquisition candidates in the Asia-Pacific insights sector.

TAMIM Takeaway

Pureprofile’s evolution from an Australian market-research boutique into a global data and insights platform is a story of quiet persistence and strategic patience. While the market has yet to fully recognise the scale of the transformation, the ingredients are now in place: a diversified revenue base, margin expansion potential, proprietary technology, and exposure to a structural growth industry.

At around 7× FY26 EBITDA and with a net-cash balance sheet, Pureprofile offers both value and optionality, a rare combination in the current market. For investors seeking exposure to the data economy without paying Silicon-Valley multiples, Pureprofile represents an inflection point in both growth and profitability. Its steady execution, expanding international footprint, and strategic alignment with the AI revolution make it an overlooked gem in the ASX small-cap landscape.

In a world where information is currency, Pureprofile isn’t just selling data, it’s building the infrastructure of insight.

_________________________________________________________________________________

Disclaimer: Pureprofile (ASX: PPL) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.