Author: Adam Wolf

US Sports Betting Market

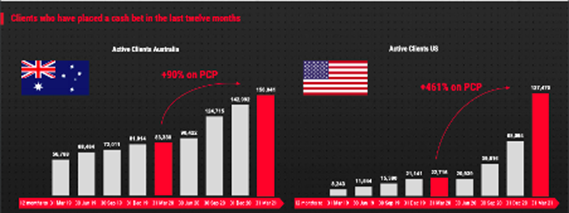

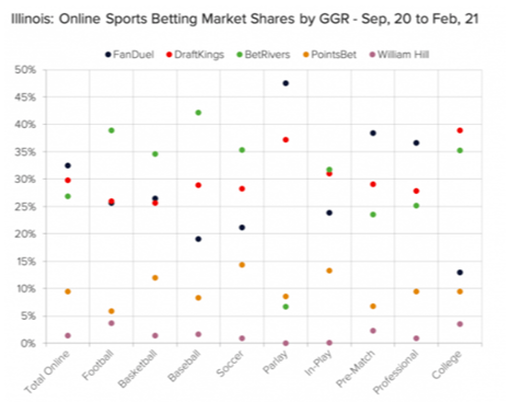

In 2018 the US Supreme Court passed a judgement that effectively ended the federal ban on sports betting. Since then, twenty states have legalised online sports wagering and 80% of states have either legalised sports betting or introduced legislation to do so. The legal sports betting market presents a rather compelling opportunity for participants, with the total addressable market at maturity predicted to be in the vicinity of $53bn USD. By legalising sports betting state governments can benefit from the enormous taxation revenue gambling brings. Given the large budget deficits governments have amassed as a result of the Covid-19 response and relief, this is something that may be rather appealing. Legal sports betting will also deter people from illegal gambling which cannot be taxed or regulated, a major benefit for state governments and we expect to see most states legalise some form of sports betting in the next few years. The main players in the industry include DraftKings, FanDuel and BetMGM, PointsBet are looking to capture a small piece of a very big pie by achieving a 10% market share in the states they operate in.

Key Financial Metrics

Market Cap: ~$2.2bn AUD

Cash and cash equivalents as of March 31: $328m

Q3FY Revenue: $65m (up 246% QoQ)

NBC Partnership

In 2020, PointsBet announced a 5-year deal with NBC worth over $500m AUD. NBC are one of the biggest broadcasters in America and have over 180m viewers, they also hold the largest sports audience in the US. This deal provides PointsBet with a spectacular runway to execute their strategy and scale their platform in the US. NBC were also issued a 5% stake in PointsBet and hold options for a further 66m shares; they are well incentivised to ensure PointsBet becomes a dominant player in the market.

iGaming Opportunity

PointsBet have developed their own igaming platform inhouse. They recently launched their inaugural igaming product in Michigan, which will offer customers access to online casino games. They expect to launch igaming in New Jersey later this year. JP Morgan sees the igaming industry eclipsing $4.6bn USD by 2025.

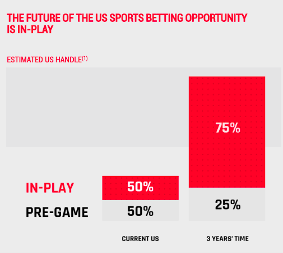

Banach Acquisition

In April, PointsBet announced the acquisition of Banach Technology, funded through cash and script consideration worth $43m USD. Banach is a leading provider of ingame betting products across multiple sports, allowing customers to place ingame wagers. The acquisition will increase PointsBet’s product offerings and contribute to a higher gross margin. The real strategic value in this acquisition is that Banach currently provides services to some of PointsBet’s biggest competitors. PointsBet will honour the contracts and then cease to provide these services, keeping the IP for their own platform. This will put PointsBet’s ingame offerings ahead of their competitors and will force competitors to build their own models. Within three years PointsBet sees in-play betting representing 75% of all wagers, up from the current 50%. Banach is also part of PointsBet’s focus on building a strong inhouse tech stack. This is proving to be important as PointsBet management highlighted that they were one of the few operators not to have technical issues during the Super Bowl.

Upcoming Legislation:

Canada

On April 22nd the Canadian House of Commons passed bill C-218, the ‘Safe and Regulated Sports Betting Act’. Now sitting with the Senate, there are still some final hurdles to get through before the parliamentary session ends on June 25th but it is looking like Canada has seen the revenue potential like their southern neighbours and are heading in the same direction in terms of legalisation. This would provide PointsBet with another huge addressable market to enter and it would appear that they have every intention of doing so. PBH hinted at the Canadian sport betting opportunity in their half year results presentation. PointsBet are well positioned to enter the Canadian gaming market after announcing a multiyear deal with the NHL as their official sports betting partner. Canadians love their hockey and PointsBet will have its name all over the upcoming hockey season.

(26 May 2021 Note: Bill C-218 made further progress in Tuesday’s Senate meeting, it was adopted at the second reading and was sent to the Committee of Banking, Trade and Commerce which will convene in the coming days.)

New York

Source: PBH Advertising | PointsBet have taken to partnering with legendary sports names like Allen Iverson (pictured) and, more recently, Shaquille O’Neal

Source: PBH Advertising | PointsBet have taken to partnering with legendary sports names like Allen Iverson (pictured) and, more recently, Shaquille O’Neal

We recently saw New York legalise sports betting. As one of the largest population centres in the country, this is obviously a stupendous opportunity for operators. Unfortunately, New York will only award licenses to a few operators and will tax them at 51% of their revenues. PointsBet will most likely not receive a license even though they do have a second skin agreement with a tribal casino in NY. Given the expenses involved and the heavy taxation, it’s not the end of the world if PointsBet doesn’t get immediate access to the New York market. We see New York issuing more licenses in the near future as they will face functionality issues with a lack of competition in their market.

Arizona

Arizona legalised sports betting in April and will issue up to twenty licenses through tribal casinos and sports teams. PointsBet should announce a partnership with one of the casinos for market access and they may even look to partner up with one of Arizona’s sports teams, as they have done with the Detroit Tigers. Arizona will be a big opportunity for PointsBet if they get market access as all participants will be starting from scratch. Arizona is one of the few states that hasn’t legalised daily fantasy sports. That is to say that Draft Kings and FanDuel will have no existing databases to work off, giving PointsBet a good opportunity to achieve more than their targeted 10% market share.

Florida

Florida have made huge progress towards legalising sports betting after reaching a deal with the Seminole tribe that would earn the state government annual payments of $500m USD. The Seminole tribe will continue to control the state’s gambling activities and details about how many operators will be participating are still unknown. There are some final hurdles to get through. Florida will be the largest state (by population) to legalise sports betting and a license to operate would be a huge addition to any bookmaker looking to capture a share of the overall US market.

Louisiana

Louisiana lawmakers moved forward on a bill to legalise both in-person and online sports betting, the session ends on May 31st but it is beginning to look likely that they will pass the bill before then. PointsBet have already secured market access in Louisiana and the hope is that first bets will be taken before the end of the upcoming football season.

Thesis

The past few weeks have been rough for all gaming stocks, including PointsBet, with PBH down 36% over the past three months. We believe PBH is starting to look like a compelling proposition at its current market cap of ~$2.2bn. PointsBet are establishing a position in a huge market that will only increase in size as more states pass legislation to legalise sports betting. It is also pleasing to see that they are building a strong suite of their own in-house technology, bolstered by their Banach acquisition mentioned above.

On the back of their partnership with NBC they have access to 180m viewers and we would back them to achieve at least a 10% position in the states they operate. In their latest quarterly, management said they are aiming to be operational in eighteen states by the end of next year which, three times the amount of the states they currently operate in.

PointsBet’s biggest competitor, DraftKings, are currently sitting on a $22bn market cap, ~10x that of PBH. This valuation makes PointsBet look very cheap given their market access and partnership with NBC. You would think that PBH would look to list in America at some stage alongside their competitors – DraftKings (DKNG.NASDAQ), Penn National Gaming (PENN.NASDAQ), Caesers Entertainment (CZR.NASDAQ) – who are all worth many multiples more than PBH, a US listing could see a much more generous valuation.A theme we saw in the Australian sports betting market was the consolidation of sports betting providers as the market started to mature. M&A activity in the industry could also lead to a significant re-rate of PBH or potentially a takeover offer from a bigger player. The management team, lead by CEO Sam Swannell, have shown that they are more than competent at executing their US strategy and have provided early shareholders with enormous value since listing in 2019. They are the only Australian based sportsbook to be operating in the US market and have made plenty of key partnerships with sporting teams and organisations along the way. If PointsBet are able to execute their strategy in the US and Canada whilst remaining competitive in Australia, we can see them becoming one of the top tier sports betting companies with a market cap closer to the likes of DraftKings and Flutter Entertainment (FLTR.LON).