Moderna (MRNA.NASDAQ)

This is one security that we’re quite sure most of you will have at the very least come across recently (i.e. their Covid-19 vaccine, Spikevax). Before delving further into the company however, it is probably good to start off by at least gaining a very basic understanding of the niche in which they operate; that is, in the development of RNA therapeutics.

So, lets ask the question, what is RNA? RiboNucleic Acid is a molecule that is essential in the coding and regulation of essential genes. DNA (DexyriboNeuclic Acid), which most will be more familiar with, forms the basis for the storage of genetic information. RNA is the transmission mechanism that transfers the code from the nucleus to the ribosomes to make protein. To simplify it into computer terms, “DNA is a storage device, a biological flash drive that allows the blueprint of life to be passed between generations. RNA functions as the reader that decodes this flash drive.”

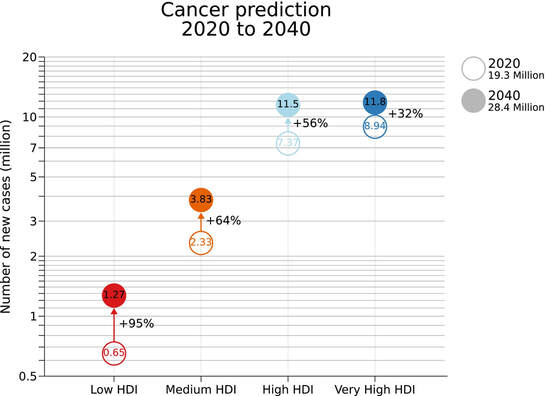

As of today, the company’s only commercial product remains its Spikevax Covid-19 vaccine and the company has faced some governance issues, most recently in the form of board member Moncef Slaoui taking up a position as the head of Operation Warp Speed during the Trump administration and holding onto around US $10m in stock options at a time when the company received around US $483m in Federal Funding. Despite this, Moderna’s pipeline remains particularly interesting. I personally, became interested in the company in mid-2019 (so pre-Covid!) not due to its ability to tackle Covid but rather its pipeline of vaccines and treatments in relation to influenza, HIV and, more importantly, cancer (returning to one of our thematics). In particular, the company retains two potential vaccine candidates for cancer and is working in conjunction with AstraZeneca (AZN.NASDAQ) in cancer immunotherapy.

Author: Sid Ruttala

With that, lets get to the numbers (which are rather straightforward given that for now Moderna’s only commercial product remains Spikevax). Third quarter revenue of US $5bn, Net Income of US $3.3bn giving a fully diluted EPS of around US $7.70 per share. We expect the company to come up with full year vaccine sales of approximately US $21.5bn and $21bn in 2022 before tapering off. What will be interesting to watch here will be sequential revenues as the vaccinated population moves toward booster shots. On a related note, the CEO has recently suggested that existing vaccines may not be effective against the new Omicron variant of Covid-19, with the implication being that a new vaccine would have to be developed over the next six months (at the very earliest). This will certainly be the space to watch. However, what we would like to emphasize is that Covid-19 vaccines, while instrumental in propelling the company from an early stage biotech to a US $150bn company, are not the entirety of this company. The biggest change has first and foremost been the validation of its underlying mRNA technology platform and the ability to now use the cashflow generated to further speed up its work across other products and markets.

Covid-19 and associated vaccines will, we feel, be up for competition, not least from emerging markets and players. In other words, the initial windfall will not be sustainable. The more likely scenario is that revenues from this segment taper off into the low-single-digit billions annually, contingent on whether people continue to receive vaccinations over the long run (i.e. booster shots, new strains). We are also very likely to see increased competition and declines in pricing power as the sector and governments continue to adapt. So, why then do we feel that this may be a buy?

For one thing, the record-breaking speed of eleven months in which time the firm created and developed the two-dose vaccine, not only placing the company firmly in the limelight but also accelerating the development of clinical know-how and manufacturing capabilities that will pave the way for faster timelines in other products. Of these, the most significant progress to date has been concerning Human Metapneumovirus (Phase 1), Respiratory Syncytial Virus (successful Phase 1, moving to Phase 2 and 3), and HIV Vaccine (Phase 1). On the oncology front, the company continues to work with Merck (MRK.NYSE) and AstraZeneca in immunotherapy and groundbreaking personalised cancer vaccines (Phase 2, results pending in 2022).

From an investor perspective, the ability to have that number of potentially addressable markets while at the same time having exposure to growth via an existing product line is what makes Moderna a potentially lucrative investment. Typically, companies working on early stage and novel therapies do not have the ability to generate cashflows to fund R&D expenditures for consistent periods of time, especially should always inevitable unforeseen outcomes eventuate. That said, the investment is not for the feint of heart, the Covid-19 landscape continues to evolve and the company does face some uncertainty around its only commercial product line. But, with a PE of 21.61x, one wouldn’t be paying up egregiously for a potentially lucrative multi-decade investment.

Fate Therapeutics (FATE.NASDAQ)

Think then about the potential for a company that could take a renewable pluripotent cell and then derive clonal populations? Currently the process for immunotherapy involves taking cells from specific donors with desired attributes, ex vivo modulation and then the creation of cell products for therapeutic functions. Fate seeks to circumvent then entire process and create 1) a renewable master cell line; 2) Cryopreservation which implies longer shelf-life and, most importantly for the profit motivated investor, 3) deliver it off the shelf. The potential for commercialisation and economies of scale could be substantial.

The global market size of lymphoma in Non-Hodgkin lymphoma alone could be around US $27bn. Which brings us to our first point for the not so patient investor. Although the initial results for their off-the-shelf treatment for lymphoma were below expectations, the fact that of eleven patients treated, six achieved remission seems to have been altogether missed by the market. In terms of what is in the pipeline for the future: unmet medical needs and potential off-the-shelf treatments for AML, myeloma and solid tumors. Of these, the solid tumors component seems to be the most promising with a Investigational New Drug (IND) application, for FT536, to be submitted before EOY in order to target multi-antigen targeting.

Looking at the numbers, though not particularly relevant given the early stage, revenue stands at US $11.1m. Importantly, the company has US $888m in cash and equivalents on the balance sheet (important as it indicates that a capital raise wont be necessary in the near term). Assuming operating expenses stay at current levels, $57.3m per quarter, this would imply that company has about four years worth of cash left. On the negative side, with a current market capitalisation of US $5.25bn, the market is certainly expecting a blockbuster in the near term. We would argue, rightly so.