There is a reason why Warren Buffett’s Berkshire Hathaway has such a large stake in the insurance industry; insurance companies provide a service people need and is an almost recession-proof business model. Property and Casualty (P&C) insurance protects against property damage and provides liability coverage for claims against insurers for injuries or damage to others’ property. Two of the most common forms of P&C insurance are auto and homeowners. Insurance companies will not only benefit from rising interest rates as they earn more money from the premiums they invest but the policies they write will grow as a result of inflation which leads to higher prices for the things that people need to insure.

Chubb Limited (CB.NYSE)

Chubb is the world’s largest publicly traded P&C insurer, based on a market cap of $90.6bn. Chubb is a global company, with local operations in 54 countries and territories. Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. As an underwriting company, they assess, assume and manage risk with insight and discipline.

Chubb has a clear advantage in its underwriting capabilities stemming from experience and scale. Their combined ratio is well ahead of their peers, the ratio measures the profitability of an insurance company by adding the expense ratio and its underwriting loss ratio. Any ratio above 100% indicates that the company is paying out more money in claims than it is receiving from premiums.

Interest Rates

During 2020, the pandemic resulted in widespread panic and plenty of questions about whether economies could survive lockdowns. Economists from every corner of the globe all had a different take on the issue but consensus was that global markets would require stimulus from central banks to mitigate the impacts of slower economic growth. People were worried about deflation rather than inflation in those ancient times. The Federal Reserve took interest rates from 1.75% to just 25bps and rapidly expanded their balance sheet through quantitative easing programs to provide much-needed liquidity to falling markets.

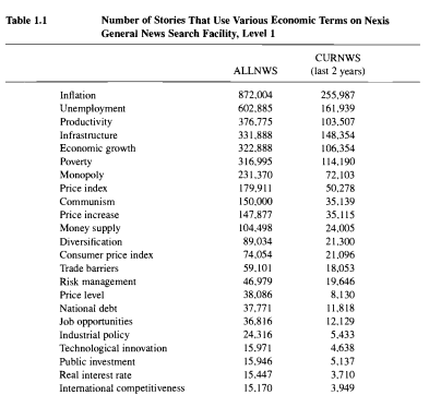

Fast forward to today and the headlines are dominated by inflation with the word being the most used out of any economic terms in finance related articles. The tables have turned and we aren’t worried about lockdowns, rather we are worried about our eroding purchasing power thanks to higher energy prices and ongoing supply chain issues. While rising rates and inflation is a curveball for most industries, especially those with poor pricing power, there are some companies that stand to benefit.

Unlike most industries, insurance companies have a positive correlation to interest rates. As part of an insurance company’s business model, they invest the premiums they receive from customers into bond-like instruments. There are stringent regulations on what insurance companies can and cannot invest their money in and they are typically restricted to investing in treasury bonds and asset-backed securities. During the GFC AIG (AIG.NYSE) famously found themselves investing in credit default swaps, which were underpinned by securitised mortgages the devil of 2008. Due to the restrictions on what insurance companies could invest in, AIG was attracted to the higher yields they could obtain from exposure to securitised mortgages that were still rated AAA. As long as the insured bonds were performing, AIG would receive their regular interest payments. If the assets underpinning the bonds were to collapse however… As we know, they did when the housing market collapsed and AIG found themselves in a far from enviable situation. AIG ended up owing Goldman Sachs traders $20bn. Most of which was paid out when the US government was forced to bail AIG out.

The recent 50bps rate hike by the Fed will have an impact over time on insurance companies’ bottom line. The more rate hikes there are, the more insurance companies will continue to benefit from the increased yields. The chart below highlights the recent increase in Municipal bond yields, 9% of Chubb’s investment portfolio is invested in Municipals.

The insurance industry has endured an extended period of tough operating conditions due to tighter regulations post-GFC as well as a lengthy period of low rates. However, with rates rising insurance companies are one of the few clear winners in the current environment and pose an interesting proposition for investors in terms of sector allocation.