In the rapidly evolving world of medical cannabis, one Australian company is quietly positioning itself as a potential industry leader. Bioxyne (BXN.ASX), a relatively young public company, is rewriting the playbook for medical cannabis manufacturing through a combination of strategic vision by its Founder and CEO, Sam Watson, regulatory expertise, and operational efficiency.

Founded through a reverse takeover in May 2023, Bioxyne represents a transformation from a dormant shell company to a sophisticated medical cannabis and psychedelics manufacturing powerhouse. The company’s journey began when its current CEO identified an opportunity to consolidate a struggling public entity with his existing medical cannabis business, Breathe Life Sciences. From our discussions with Sam, he came across as a young but highly motivated founder with ambitious growth aspirations – exactly what we are looking for in our portfolio companies.

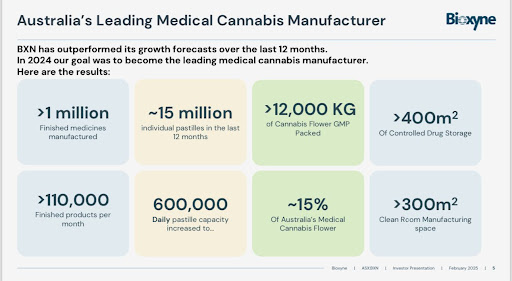

The company’s breakthrough came in February 2024 when it secured a comprehensive GMP (Good Manufacturing Practice) manufacturing license in Australia – a critical milestone that set it apart from competitors. Unlike most cannabis manufacturers who focused on limited product lines, Bioxyne obtained certification to produce an unprecedented range of products, including flower, oils, gummies, MDMA, and psilocybin.

Manufacturing Excellence as a Competitive Advantage

Bioxyne’s core strength lies in its manufacturing capabilities. We like to think of the company as the “Foxconn” to the industry. With fully automated production lines capable of processing up to 6,000 kilos of product monthly, the company offers something rare in the medical cannabis industry: scale, efficiency, and versatility. Their current market share stands at approximately 10-15% of the Australian flower packing market (estimated TAM $250 million in a $1 billion sales market), with revenues approaching $30 million annually in FY25. They currently service over 100+ customers with each one generating in excess of $250k p.a.

The company’s business model is elegantly simple. They primarily operate as a contract manufacturer for medical cannabis companies, charging per-unit fees for their sophisticated manufacturing services. This approach allows them to generate consistent revenue while minimizing the risks associated with brand development and direct patient sales. We think of BXN as a “Picks and Shovels” play to the sector, akin to Foxconn in China being the manufacturer for Apple products.

Strategic Global Expansion

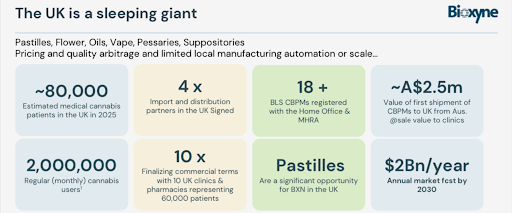

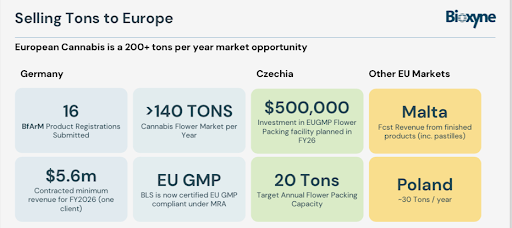

Bioxyne isn’t content with dominating the Australian market. The company has set its sights on international expansion, with particularly promising developments in Germany and the United Kingdom. In Germany, they’ve already secured a $5.6 million initial agreement to export cannabis flower products, tapping into a market that has recently seen significant deregulation and growth.

The UK presents another exciting frontier. Bioxyne is currently onboarding with nine of the top ten clinics and pharmacy businesses, positioning itself as a preferred manufacturing partner. Their ability to provide 12-18 months of product stability – compared to the typical 90-day limit for locally manufactured products – gives them a significant competitive edge. A recent $2.5 million contract win signals the start of an expanding opportunity.

Source: Bioxyne Shareholder Presentation

Financial Potential and Growth Trajectory

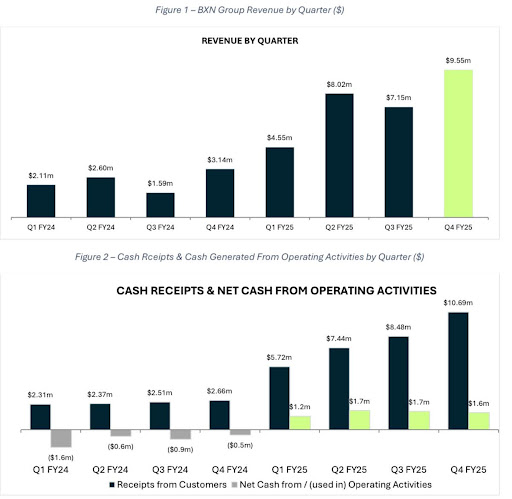

The company’s financial projections are compelling. FY25 sales of $29.3 million were achieved following 3 upgrades during the year. With a current run rate of around $45 million as a base case for FY26 and gross margins near 50%, we estimate FY25 Ebitda of $8.5 million growing to over $14 million in FY26. We also estimate free cashflow generation of $8-$10 million next 12 months. Bioxyne is aspiring to potential revenue of $100 million within two to three years if their current execution in Europe bears fruit. Their cost structure remains lean, with a monthly operational expense of just $500-600k, suggesting robust profitability and margin expansion ahead. Blue sky potential in FY27 is $30 million Ebitda if all the “Weeds” align (pardon the Dad jokes).

Source: Bioxyne Shareholder Presentation

Source: Bioxyne ASX Release

The leadership team, led by a CEO who owns 29% of the company, appears committed to strategic, measured growth. Rather than pursuing rapid, potentially dilutive expansion, they’re focused on strategic acquisitions and market consolidation. The company ticks what we look for from a founder led business. We do expect M&A in Europe to consolidate BXN market position and enable pricing power in future as they grow.

Beyond Cannabis: Exploring Psychedelics

Perhaps most intriguingly, Bioxyne is positioning itself at the forefront of the emerging psychedelics market. They’ve already signed their first commercial contract for MDMA capsules used in PTSD treatment, seeing significant potential in this nascent therapeutic space.

Challenges and Opportunities

The medical cannabis sector remains volatile, with historical investor skepticism due to previous market failures. Bioxyne must continue to differentiate itself by emphasising its unique regulatory advantages, manufacturing expertise, and clear strategic vision. Apart from regulatory risks, the market is growing fast, with Germany legalising in 2024 and already running over $1B in sales and eclipsing Australia.

A Unique Investment Proposition

What sets Bioxyne apart is its approach to medical cannabis manufacturing. Like Foxconn in electronics, they’re building a business model centered on becoming the go-to manufacturing partner in a complex, regulated industry.

Their competitive advantages are multifaceted:

– Comprehensive regulatory licenses

– Advanced manufacturing infrastructure

– Highly skilled operational team

– Ability to manufacture multiple product types

– Efficient, scalable production processes

Looking Ahead

As the medical cannabis and psychedelics markets continue to mature, Bioxyne appears well-positioned to capitalise on growing demand. Their strategy of focusing on manufacturing excellence, rather than direct consumer sales, provides a more stable and potentially more profitable approach to this emerging industry unlike many peers who are yet to turn profitable.

With projected revenues approaching $100 million in 2-3 years, a lean cost structure, and expanding international footprint, Bioxyne represents an intriguing opportunity for investors seeking exposure to the specialty pharmaceutical and medical cannabis sector.

The TAMIM Takeaway

BXN ticks all the boxes we look for in a company:

⁃ Industry leader

⁃ Founder led and alignment with shareholders

⁃ High growth and profitable

⁃ Strong cashed up balance sheet and Free cashflow generation.

⁃ Track record of under promising and over delivering.

⁃ Significant room for growth in a large TAM

⁃ Under the radar with no institutional ownership or broker research – yet!

⁃ Large discount to our 8 cents valuation next year and potentially 15 cents if they can achieve $100 million of sales.

___________________________________________________________________________________________________

Disclaimer: Bioxyne (ASX: BXN) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.