Janison Education (JAN.ASX)

Authors: Ron Shamgar

Janison specialises in high-stakes, high-volume digital assessment platforms for which there are few competitors able to offer comparable levels of scale, reliability, and exam integrity with demonstrated success with governments and esteemed education institutions.

Janison provides services to some of the biggest examination bodies in Australia and worldwide. Some of their key customers include the National Assessment Program (Naplan), a series of exams I’m sure at least some of ours readers are familiar with, while they also deliver ICAS Assessments, a suite of school tests, and most recently Janison entered into an exclusive partnership with the Organisation for Economic Co-operation and Development (OECD) to deliver its Programme for International Student Assessment PISA for Schools test. We will return to this later.

EdTech

Spending on EdTech and digital expenditure is expected to grow by 2.5 x between 2019 and 2025, reaching a total market size of $550bn. As a result of covid-19, the estimated market size for EdTech has expanded by a further $85bn in the past year. The short-term increase in spending through COVID is expected to remain in the long term as education departments uplift infrastructure capability to provide the devices and networking standards required for digital adoption. Schools are more equipped than ever to adopt digital assessments now that teachers are more familiar with technology; schools are expanding the infrastructure necessary to deliver digital exams on a large scale. Janison’s digital assessment solutions address the changing needs of the educational sector, covid-19 has emphasised and validated the advantages of digitisation in education and Janison is well placed to execute its strategy in this market.

PISA for Schools

In May 2019 Janison announced that they had entered into an exclusive agreement with OECD to be the provider of PISA for Schools globally. PISA for Schools is providing educators with the best available evidence, drawn from the best available data sets to inform best practices in their schools. The PISA for Schools test will be powered by the Janison Insights platform which offers educators an enhanced dashboard and streamlined reporting structure alongside a suite of practical features enabling schools to explore their own data and compare their results to those of other schools and countries around the world. PISA is the gold standard in international assessments for global benchmarking. This deal will see Janison deliver the PISA for Schools to up to ninety countries (they currently are rolling out across fifteen) and gives them a huge addressable market to capitalise on.

PISA for Schools Revenue Model

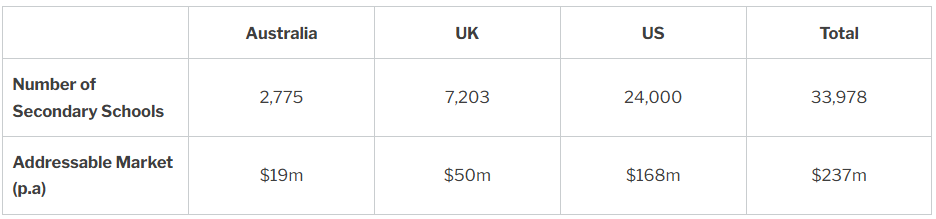

Janison’s revenue model for providing the PISA for Schools test will depend on whether they are the National Service Provider (NSP) or the International Service provider (ISP) for the country in which they are rolling the platform out. As the national service provider, Janison will sign up schools themselves through sales representatives and will receive $7000 p.a. from each school they sign up. As an international service provider they will give the platform to a distributor who will then sell the testing platform to the schools, bringing in around $500 p.a. from each school. By rolling out the platform themselves and being the national service provider, Janison can see a much bigger profit margin. This is what they have been doing in major countries like Australia, UK and the US

Valuation + Outlook

Jansion is currently trading at an enterprise value of $200m, in FY21 Janison did $23m in ARR. As we have said many times before, we love businesses with good earnings visibility that have a recurring revenue model. The majority of Janison’s revenue is from providing assessments to schools through their partnerships with ICAS, PISA for Schools and others. PISA for Schools has provided Janison with a significant runway to scale their ARR. Janison’s cost base from rolling out the exams won’t increase a whole lot and, as they sign up news schools in the UK and US, their EBITDA margin will skyrocket.

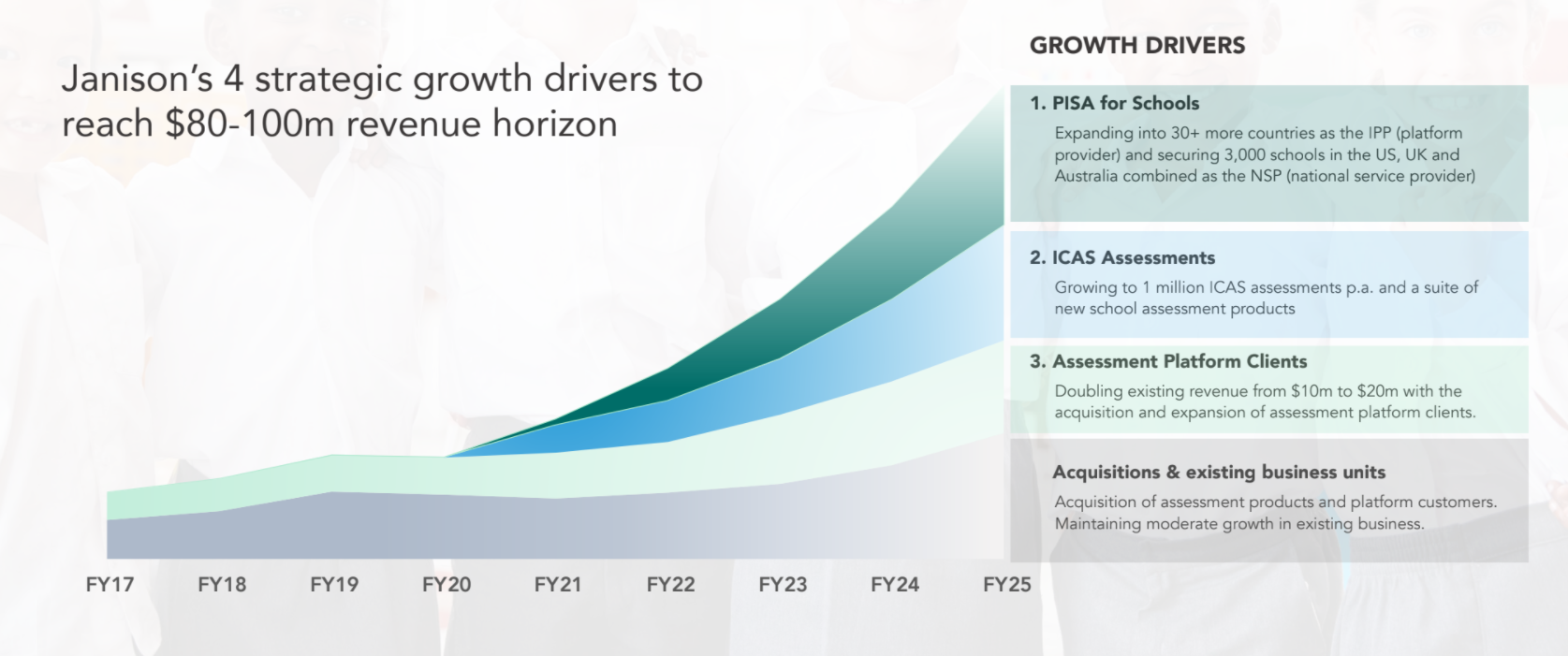

Looking forward, Janison are in the process of rolling out PISA for Schools across fifteen countries, they are the NSP in six of them. We can see Janison exceeding $100m ARR by 2025, considering the growth in the EdTech sector and the incoming ICAS/PISA for Schools rollout (both of which are international exams that will provide significant scale for Janison).

Janison have also been active on the acquisitions front. They look for businesses with an existing customer base that will provide cross selling opportunities. This week Janison announced the acquisition of Quality Assessment Tasks. The rationale behind this deal is that QAT comes with a bank of past assessments and exam questions which have monetary value within Janison’s school assessment offering. It also introduces a network of over 250 highly skilled test writers and reviewers, supporting Janison’s strategy of developing and refreshing its digital library of assessments and items to the highest quality standards. Janison is in a net cash position of about $20m and no debt, they are well funded to continue M&A activities.

For an enterprise value of ~$200m, Janison is looking like a great proposition. We believe the market isn’t ascribing enough value to the potential upside of the PISA for Schools rollout; Australia, UK and the US are a $237m p.a. opportunity alone and that doesn’t include the eleven other countries in which PISA is being rolled out.

We estimate that Janison’s EBITDA margin will go to around 30-40% when they achieve their ARR of $80-100m, at those levels we see the valuation as multiples of the current market cap. In the short term, we value JAN at $1.60 or around 10x FY22 ARR.