This week we take a quick look at three companies that should benefit from borders reopening and the resumption of travel around the world. Typically, investors consider the Flight Centres (FLT.ASX) and Webjets (WEB.ASX) of this world when thinking of travel beneficiaries, but in this case we are examining a few tech-based businesses that, perhaps more indirectly, we believe will benefit.

Authors: Ron Shamgar

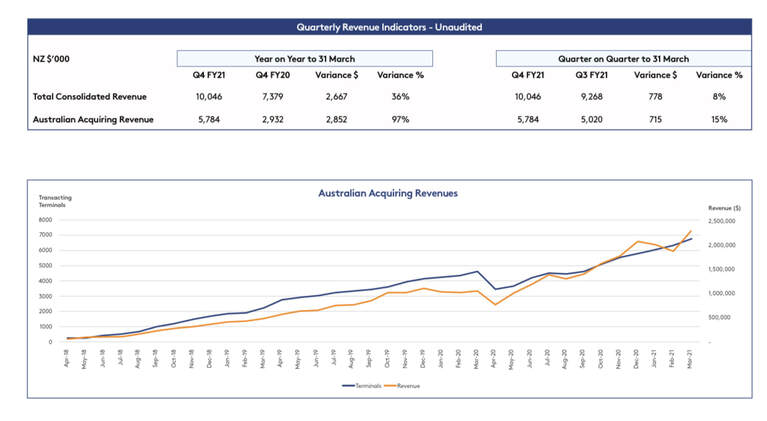

Smartpay (SMP.ASX) provides merchant terminals to small businesses in Australia and New Zealand. Their recent quarterly update in April showed growth continuing with 1,000+ new terminals added to their Australian base for the quarter. SMP is currently annualising $28m of revenues in Australia alone. In NZ, SMP generates $18m from terminal rentals and has about 25% share of the terminal market.

As travel resumes between NZ and Australia (and eventually other countries), we see retail spending for smaller merchants like convenience stores, cafes etc. increasing. A development which should benefit SMP. Prior to Covid, the NZ business received a $70m offer from Verifone and we believe another offer may emerge this year. Regardless, there are 1m terminals in Australia which provides a long runway for growth. We value SMP at $1.30.

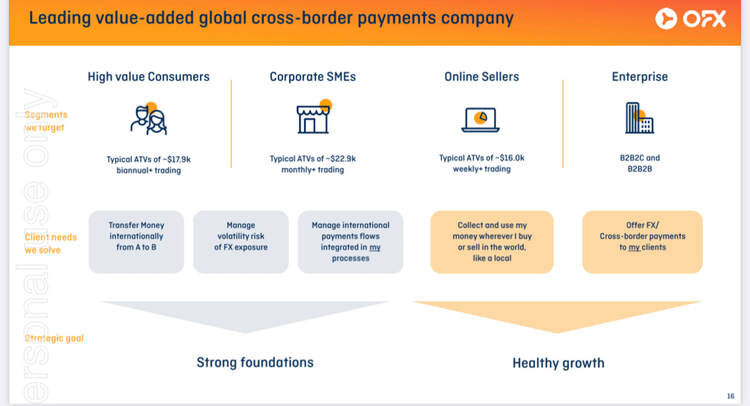

OFX Group (OFX.ASX) is an international payments platform that allows consumers and businesses to make payments and exchange currency around the world. Half of the business is in Australia, which competes against the major banks, while the rest of the business is focused on the US and European markets. OFX processes $25bn in transactions per year and will generate $130m of revenue and $35m EBITDA this year (March 2021 year-end).

Apart from trading at an attractive valuation of 9x EV/Ebitda, OFX will benefit from consumer demand to exchange money for travel and the emergence of online sellers on global marketplaces, like Amazon and eBay, that require currency exchange when they buy and sell their products. As 2H earnings accelerate, we think the market will react positively to OFX’s year-end result at the end of May. Our valuation is currently $1.60+.

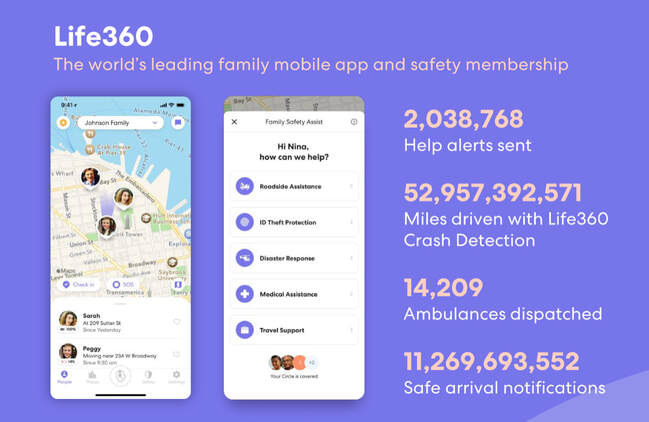

Life360 (360.ASX) is a US based technology business that provides an app, primarily for families, that allows them to locate each other, drive safely and call for help in case of an emergency. They currently have over 28m users globally and are on track for USD $110-$120m of revenues in CY2021. The company is trying to bolster its ability to monetise their member base with premium plans and we think the reopening of borders and easing of restrictions around the world, whenever that may be, will accelerate user growth.

Life360 is also targeting further acquisitions and a US listing, possibly through a SPAC vehicle, later this year. We view this development, if and when it eventuates, as a significant catalyst for their share price on the upside.

Disclaimer: All three stocks are held in TAMIM portfolios.