1. eBay Inc (NASDAQ.EBAY)

eBay’s growth strategy centres on “enthusiastic buyers”. This cohort of customers shops frequently, has high order value, and spends 30 days a year on the site. The website has become a destination for high-quality second-hand goods, including refurbished electronics, trading cards, sneakers and motor vehicle parts. eBay has also enhanced its platform through authenticity guarantees and certifications of purchase. Other positive moves include digital wallets and a focus on advertising revenue.

eBay’s share price gained 19 per cent over January. Still, the company is priced for demand to fall significantly, trading on a price-to-earnings multiple of 12 based on non-GAAP earnings. The business also trades on a dividend yield of 1.8 per cent, with a 20 per cent payout ratio implying plenty of headroom to increase this over time.

2. General Dynamics Corporation (NYSE.GD))

General Dynamics is a global aerospace and defence company based in the United States. The business offers a range of products and services for marine systems, land combat vehicles, weapon systems and munitions, technology and business aviation.

During the month, General Dynamics reported fourth-quarter and full-year earnings. Earnings in 2022 were USD $3.4 billion, up 4.1% from the prior year, on a healthy operating margin of 10.7%. What impressed us was the cash performance of the business. Cash from operations represented 135% of earnings, indicating that accounting profits turn into real cash for shareholders. This allowed the business to reduce debt by USD $1 billion, invest USD $1.1 billion in capital expenditure, and return USD $2.6 billion to investors via dividends and share repurchases.

Management noted a strong order book, with a backlog of USD $91.1 billion. This is the largest in company history and represents more than two years of revenue. At the midpoint of guidance, it expects earnings per share to increase by 3.6% in 2023.

We expect demand for General Dynamics products to be robust going forward, with nations prioritising defence capabilities in light of Russia’s invasion of Ukraine. NATO’s intention for 2% of GDP to represent the floor of defence spending, with some countries pushing for higher, is a clear example of this. The recent AUKUS deal between Australia, the United Kingdom and the United States is another positive tailwind. Trading on a price-to-earnings multiple of 19 and a dividend yield of 2.2%, we believe this is an attractive valuation for a company with strong cash and shareholder returns.

3. Covestro AG (ETR.1COV)

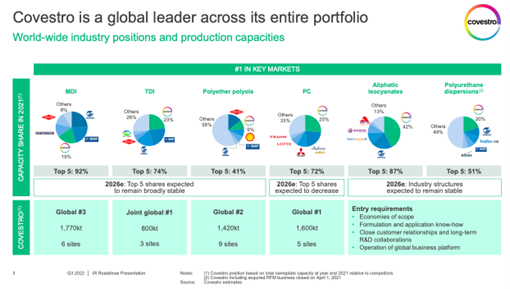

Covestro commands leading market share positions in several material markets, including MDI, TDI, polyether polyols and polycarbonate. It achieves this by spending upwards of EUR 900 million on research and development each year. Barriers to entry are high, with new competition deterred by the significant upfront capital cost and required operational know-how.

Covestro is forward-facing, creating new products which are lighter, more durable and better for the environment than incumbent offerings. For example, it has developed new insulation materials to improve the shelf life of food. It’s also exposed to future industries such as electric cars, which require 2-5x more polycarbonates than conventional vehicles. The company is committed to becoming climate neutral by 2035 regarding its scope 1 and 2 emissions. With a share buyback program currently underway and an aim to double sales by 2025, we believe the future is bright for this essential materials company.