While markets and investors are often captivated by sectors promising rapid growth and technological advancements, there are times when strategic investments in more stable sectors can offer "defence" against economic downturns. One such sector is Defence, where...

Market Insight

Navigating the Tug of War Between Interest Rates and Inflation

Sometimes the macroeconomic outlook changes like the weather, and investors find themselves sailing in a crosswind of uncertainty. The Reserve Bank of Australia (RBA) is ensnared in a catch-22 dilemma: whether to raise rates to tame inflation and risk plunging the...

AI Real Estate and the Importance of Data Centres

In the early days of the internet, scepticism swirled around the notion of a global network connecting computers. People questioned its reliability, its security, and even its purpose. Yet, as history unfolded, the internet proved to be a transformative force beyond...

Power Play: Investing In Energy For Innovation

As technology strides forward, the world's energy demands have skyrocketed, with artificial intelligence (AI) at the forefront of this surge. This escalation poses significant challenges and opportunities—an area we have recently begun to delve into. The rise in...

Will New Merger & Acquisition Laws Impact the Takeover Market?

In the wake of a significant market sell off following a stimulus induced boom there were plenty of company’s that saw the baby thrown out with the bath water. Over the past year, TAMIM has identified significant opportunities within the merger and acquisition...

CHIPS: Megatrends and Mega Funding

We first highlighted the importance of semiconductors back in April 2023 when we introduced the concept of megatrends. Back then, we used the example of the automotive industry and the increasing adoption of electric vehicles (EVs), and highlighted how investing in...

AI’s Power Surge: Overlooked Opportunities of a Tech-Driven Future

The surge in enthusiasm for anything related to artificial intelligence (AI) has continued apace in 2024, a theme we have discussed on several occasions, including here and here (to provide readers with useful topical information but less than the overload and...

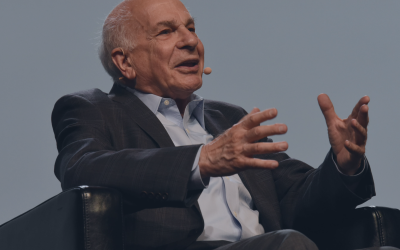

Fast Thoughts, Slow Wisdom: The Legacy of Daniel Kahneman

Daniel Kahneman, an Israeli-born American Nobel prize-winning author, passed away on March 27 at age 90. For those yet to become familiar with his work, he was a psychologist at heart but to many he will be remembered as a pioneer in what has become known as...

Japan’s Post-COVID Normal & Decoding Central Bank Speak

In a noteworthy decision on Tuesday, March 19, the Bank of Japan (BOJ) announced an increase to its benchmark interest rate for the first time since 2007. Japan has endured a prolonged period of “ultra loose” monetary policy since the Global Financial Crisis (GFC), as...

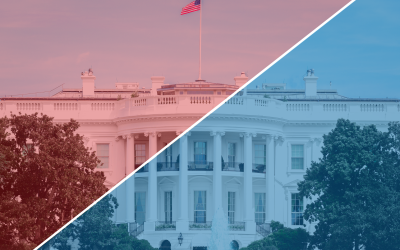

Biden vs Trump: Shaping Your Portfolio for the U.S. Presidential Outcome

As Super Tuesday's results and Nikki Haley’s exit from the Republican primary race, the stage looks set for a 2024 U.S. Presidential election rematch between the incumbent Joe Biden and former President Donald Trump. With rumblings from various European leaders about...

Insurance: A Rare Winner from Higher Interest Rates?

It’s a common investing belief that higher interest rates are a negative for stocks. As the world’s most famous investor Warren Buffett creatively described at the Berkshire Hathaway (NYSE: BRK.B) 2013 annual general meeting, “Interest rates are to asset prices, you...

Is Healthcare a Safe Haven for ASX Investors?

Healthcare accounts for approximately 10% of the S&P/ASX 200 index and is widely regarded as a reliable and defensive sector that provides returns that are relatively uncorrelated with the rest of an investor’s portfolio and the economy at large–often with less...