Robert Swift – Head of Global Equity Strategies

After a few years of poor performance across emerging market equities, perhaps it is time for us to revisit the sector? Valuations look cheap relative to developed markets and with the exception of Brazil and South Africa, most economies have actually held up well. On a debt to GDP basis many emerging markets are actually in a healthier position than the developed ones. The continued higher population growth and the tendency for economic ‘catch up’ from a lower base, remain favourable trends for emerging markets, and all it may need for a rebound in asset prices is a catalyst?

To be sure, debt, currency fluctuations, and political risk are still present but most investment returns are seldom attractive without some degree of highly visible risk. It tends to “go with the territory” in looking for Value. However, rather than invest directly in stocks quoted on emerging market exchanges it has often been better to invest in companies listed on major developed exchanges but only where they derive meaningful revenues and profits, from emerging economies.

We have invested globally for many years and can identify companies which are capable of adapting products and business practices to local cultures and regulations. Such companies will tend to be long term successful in these markets. It has often been possible to capture emerging market growth, and participate in periods when emerging market stocks outperform, by investing in mature market stocks.

The benefits of investing in emerging economies this way are numerous.

- Easier access – Some emerging markets prevent foreigners from investing without permission or a licence. This permission is typically reserved for institutional size investors. Smaller investors can access emerging markets through developed market stocks. This is especially true for technology stocks where Taiwan and Korea are hard to access directly.

- Western governance is often more transparent – although not always perfect, standards tend to be fairer toward minority shareholders in developed stock markets

- Liquidity – the bid offer price spread, commission rates and overall levels of price volatility tend to be lower in developed markets making it easier for investors to remain calm and objective, and invest more of their money in the company rather than pay to agents in transaction costs

- When emerging markets perform better these companies tend to outperform developed market companies.

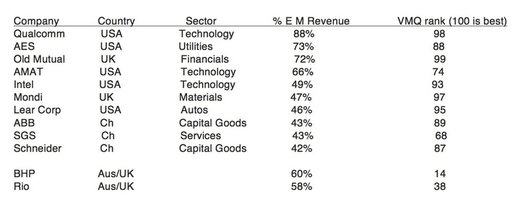

We have an extensive fundamental and accounting database which we use to assess the world’s major listed companies. We have recently done some work on ranking and identifying developed market companies with at least 40% of their revenue derived from emerging economies. The list of 10 of our favourites is below. By favourites we mean both >40% revenues from emerging economies AND attractively ranked on our quantitative stock VMQ model. We include both revenue % from emerging economies and our score in the table below. They are ranked in order of revenue from emerging economies.

We include BHP and Rio for information purposes. If you own these already note how much emerging market exposure you are getting. Why not look to diversify away from only mining and Australia?