Authors: Ron Shamgar

Cardno (CDD.ASX) is an environmental, government and community consultancy firm which operates with over 4,400 staff globally. The company has been overlooked by the market recently as it has been in turnaround mode for the last few years and also demerged its lab testing division, Intega (ITG.ASX), more recently, making it too small for some index funds to hold. We took advantage of this to build a position around 23 cents ($100m market cap) recently.

CDD released a strong trading update in July with the business not being impacted by Covid, benefitting in fact, as governments and corporates require help with community planning due to Covid restrictions. CDD is guiding to EBITDA of $41-$43m in FY20 and a positive net cash position. Operating cash flows were also strong and we believe there’s a good chance of dividends being reinstated. We estimate that FY21 will see further earnings growth as management has indicated a strong backlog of work. CDD is trading on a 6x PE multiple and we value it at 55 cents.

iSelect (ISU.ASX) is a price comparison site that helps consumers compare and save on Health insurance, energy and telco bills. The company has a strong and recognisable brand along with a valuable commission trail book worth 53 cents a share. We have been quietly building a position in the company at the 20-cent mark as we like the new management team and their strategy to simplify the business and cut costs.

ISU announced in July that its largest shareholder and competitor, Compare the Market, has lobbed a cash takeover offer of 40 cents. Unfortunately, the companies could not agree on some clauses related to Covid, and so the bid was cancelled for the time being (even though the price was not the issue). We think the bidder will eventually come back and may end up paying more.

In the meantime, ISU divested its loss making iMoney Asian business which will remove $4-5m of annual losses. During July, ISU grew profit substantially to $1.5m EBITDA or 65% growth on July FY19. This bodes well for profitability next year which we think can be about $15m in EBITDA. At the very least, we think ISU is worth 40 cents with potential for much more.

In addition, TNT announced FY20 milestones of a $40m of annualised revenue run rate and reaching cash flow positivity in June. The company is now well funded with a newly established debt facility to acquire more cyber security firms in the short term. We expect at least one “bolt on” during August and a larger one thereafter. The shares reacted favourably since the deal was announced and TNT has now officially made us 5x our money since we bought the stock at 5 cents last year. We have taken some profits but still retain a sensible position.

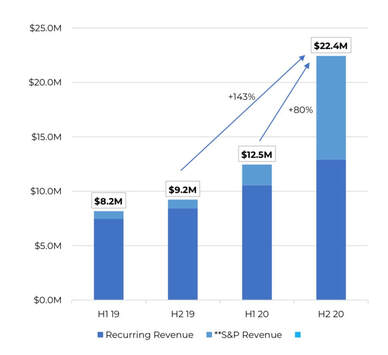

Spirit Telecom (ST1.ASX) is a modern national telco provider to businesses. The company has been transformed by their new CEO, Sol Lukatsky, who joined last year. They have blossomed from a sleepy fixed wireless infrastructure provider to an aggressive, high growth and modern national telco. ST1 has made several successive acquisitions over the last twelve months in order to offer not just a fast internet service, but also other IT services such as cloud and cyber security services, virtual hosting and IT hardware and support.

The company’s strategy revolves around their SpiritX platform which allows both business customers and telco dealers to use the online platform and see which is the best data connection for their location. ST1 offers not just its own fixed wireless network but also NBN and other provider’s fibre services. Overall, this increases the market size opportunity for ST1 and has resulted in strong growth.

FY20 2H revenues grew 80% to $22.4m, with 14% revenue growth from Q3 to Q4. The recurring revenue base of B2B customers grew 82% in 2H. EBITDA for FY20 is approximately $3.8m. The company also recently made an acquisition of VPD which will add further growth in FY21. We see SpiritX as a strong lead generation tool with 12,000 addresses qualified through the platform in 2H. This provides visibility on customer demand and is valuable IP that the company is building.

City Chic (CCX.ASX) is a leading online plus size women’s retailer. During July CCX announced the acquisition of the e-commerce assets of US based plus size retailer Catherines from bankruptcy proceedings. The deal, when successful, should add up to $90m in online sales in the US. To support the acquisition, which we estimate will cost $30m, CCX raised $90m in new equity. We have participated in this at $3.05 a share.

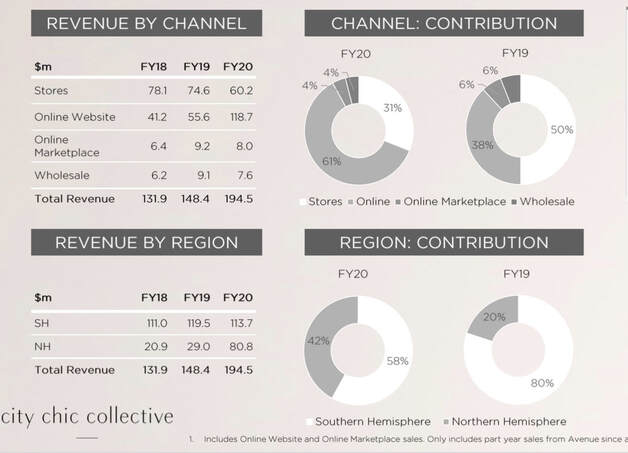

Management also provided FY20 financial results of 30% growth in revenues, to $195m, and about $29m in underlying EBITDA. The company finished the year with a net cash position and, together with the proceeds of the raise, should have over $60m to deploy on future deals. We expect 80% of group sales next year to come from online. The global opportunity in North America and Europe provides CCX a long runway for growth and management are astute in their opportunistic buying of other businesses. We value CCX at over $4.00.

CML group (CGR.ASX), which provides invoice financing to small and medium businesses, provided both a business update and a technology acquisition during the month. Pleasingly, CGR financed over $1.7bn in invoices during FY20 and achieved EBITDA of $20m and $8m NPAT. The company will also pay a 1.75-2 cents dividend which is an attractive yield. FY21 outlook is positive with demand increasing in June and July.

During tough economic times, invoice payments get delayed, and we are already seeing this with industry data showing invoice payment delays in June now at 49 days (compared to 15 days last year), with some industries seeing delays of over 60 days. This bodes well for CGR. The acquisition of Skippr in July provides an automated technology platform for the company to acquire smaller customers at a lower cost and thus increase their market size opportunity. We think investors will gradually begin pricing CGR as more of a fintech rather than a traditional finance company. CGR currently trades on 7.5x PE and a 6% ff yield. We value the company at more than 50 cents.

National Tyre & Wheel (NTD.ASX) is a leading national distributor of branded tyres and wheels. NTD announced the acquisition of Tyres4U for $50m in July. The acquired business is not profitable but presents an attractive opportunity for NTD to extract synergies and bring it to similar profit margins. The combined group will have over $450m of revenues and significant scale.

The deal will be financed partly through cash and a new debt facility structure with CBA bank. Following the deal we estimate net debt of about $30m. This deal presents good upside, as the group can double earnings through cost outs, but also adds further risk as the debt levels are now high. Overall we think management have shown themselves to be conservative and we think the risk reward proposition is still attractive. We value NTD at 70 cents.