IVE Group (IGL.ASX)

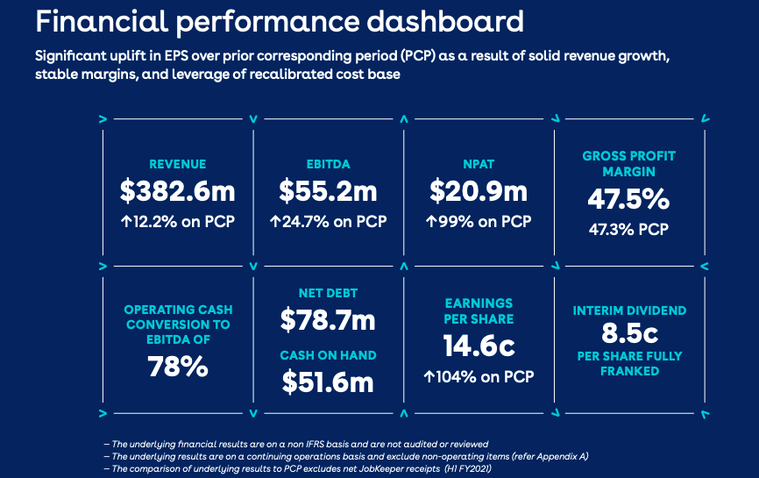

IVE reported great H1 results, arguably one of the best of the half year. Revenue climbed +12.2% to $382.6m while EBITDA rose +24.7% to $55.2m. IVE showed how stable their client base was and mitigated Covid issues extremely well. In some instances they even benefited; they saw a few clients come onboard as a result of looking to onshore manufacturing due to global supply chain issues for example. IVE also completed a few acquisitions in the half to expand their retail segment. We are expecting more to come.

IVE also announced an 8.5c dividend which puts them in the top quartile for dividend yields on the ASX. When asked whether they could maintain this, management were confident from an EPS perspective and we see no reason why they can’t.

IVE has a strong balance sheet with $50m of cash and is sitting on a low leverage ratio, currently sitting at 1x but their target is 1.5x. This gives them a lot of room to execute on their M&A strategy. IVE is looking for an acquisition in the fibre packaging space and will be looking for bolt on acquisitions. They also will be investing in their Lasoo acquisition which will improve customer experience.

IVE will still need to mitigate supply chain issues and potential inflation but they have done a great job so far and, given how strong their relationships are with suppliers, purse rises will be harder to pass on to IVE. Their full year guidance is for $34m NPAT and $95.5m EBITDA, this puts IVE at an EV/EBITDA of approximately 4x, far too cheap for a company performing this well.

Capitol Health (CAJ.ASX)

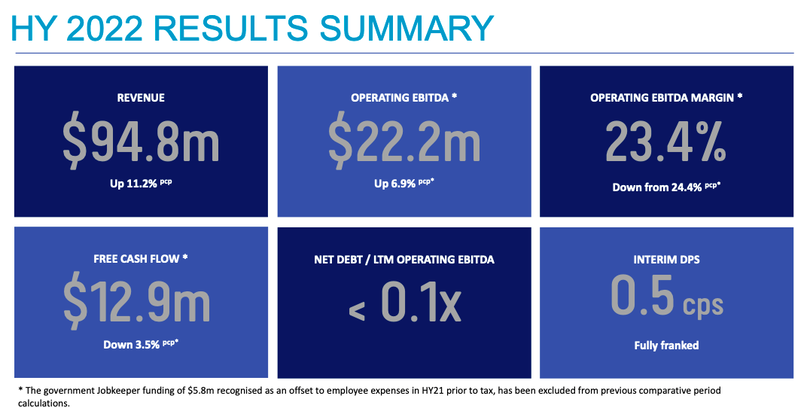

The half would have been an extremely tough one for CAJ and they were impacted heavily from the lockdowns, especially given their huge presence in Victoria. The biggest issue was staff shortages which hurt margins and volume. Even with the impacts, CAJ saw their revenue grow +11.2% to $94.8m with EBITDA up +6.9% to $22.2m. CAJ also declared a 0.5c fully franked dividend which put them at a dividend yield of 2.85%. These results look great when compared to listed peer IDX, who saw their EBITDA decline by -7.1% and their revenue up only +5.7%.

CAJ has already seen a bounce back post lockdowns and there is plenty of pent up demand. People still need diagnostic services; the revenue was just being delayed. CAJ has 2 new greenfield clinics opening this half but it takes a few years for them to be EBITDA positive. They will continue with their M&A strategy but their pipeline has slowed down. The 2H will be a much easier one for CAJ and they will realise the pent up demand and should see their staffing problems disappear.

The sector has been consolidating with several deals coming through recently. This includes the likes of Sonic Healthcare (SHL.ASX) buying Canberra Imaging Group at approximately 9x EBITDA, Quadrant selling Qscan to Infratil (IFT.ASX & .NZ) and a few other deals. We believe CAJ is a strong candidate as a takeover target and is trading at an EV/EBITDA of around 10x, an opportune time for acquirers.