Monash IVF Group (MVF.ASX)

MVF is a leader in the field of human fertility services and is one of the leading providers of Assisted Reproductive Services (ARS) which is the most significant component of fertility care in Australia and Malaysia. ARS encompasses a range of techniques used to assist patients experiencing fertility issues to achieve a clinical pregnancy. In addition, MVF is a significant provider of specialist women’s imaging services

MVF is a leader in the field of human fertility services and is one of the leading providers of Assisted Reproductive Services (ARS) which is the most significant component of fertility care in Australia and Malaysia. ARS encompasses a range of techniques used to assist patients experiencing fertility issues to achieve a clinical pregnancy. In addition, MVF is a significant provider of specialist women’s imaging servicesThey have a great brand, are increasing pregnancies in a mature market, building their scientific capability and will continue to attract specialists. In the half, MVF attracted four new experienced domestic fertility specialists. It is important that MVF continue to invest in their scientific capabilities to continue attracting talent for expansion which will grow volumes in turn.

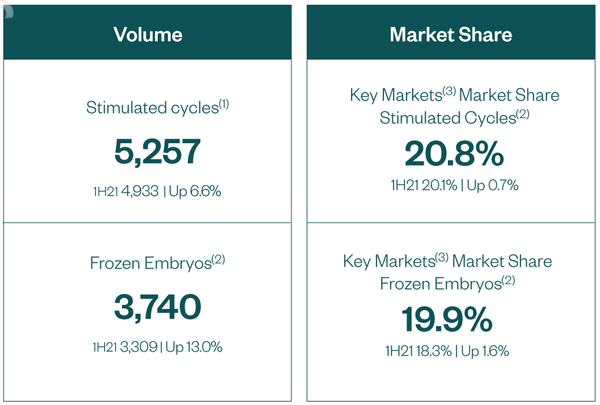

MVF will be opening clinics in Penrith and Darwin this half while also launching clinics in Singapore and Bali, which should add 300 cycles p.a over the next few years. Their Kuala Lumpur clinic was doing 1,000 cycles pre-Covid so Southeast Asia should be doing over 1,400 cycles p.a. in FY23. Given that MVF did 5,257 cycles in the first half, their Asia operations will form a material piece of the business. MVF will continue to look for partnerships in Southeast Asia as well as explore M&A if the right opportunity presents itself.

MVF are launching testing kits which will help people assess their fertility. They expect to be distributing 100 kits a month. The biggest benefit of this will be that the obvious choice for people that come up as at risk using the test kit will be to use MVF. They think that this could account for 10% of their volume in the next five years.

Fellow listed peer Virtus Health (VRT.ASX) received its first takeover bid from BGH Capital at $7.10 a share in December last year. The latest offer, from CapVest, was $7.70 a share. VRT operates in Australia, UK, Denmark and Singapore. We believe that VRT’s stronger international presence is what saw them receive takeover bids over the likes of MVF. MVF is the smaller of the two and has half the market share in Australia, nonetheless, MVF is working on their international expansion and we think they could be heading down a similar path.

The latest takeover bid for VRT values them at approximately 12.4x EV/EBITDA, making MVF look cheap given that they are currently trading around 8x EV/EBITDA. If MVF were to trade at the same multiple as VRT they would be sitting at a share price of $1.68 (based on FY22 EBITDA of $52.7m), a ~30% premium from the current share price.

Outlook

When looking at companies we also like to try to examine them through the lens of a potential acquirer. That is, what would someone else pay for this company? The recent bids for VRT show that there is interest in the IVF industry from private equity players. It also tells us that the multiple they are willing to pay is far above what MVF is trading at. MVF has a strong foothold in Australia (20% market share is nothing to sneeze at) and are building out their international presence so we wouldn’t be surprised to see MVF receive a takeover offer at some stage. Looking into the second half, MVF has seen an +11% increase in new patient sign ups domestically and has a strong pipeline of returning patients. The industry has also seen increased government support and they anticipate further government funding which improves affordability for patients, one of the biggest constraints of IVF treatment.