Author: Ron Shamgar

The hottest thematic currently dominating headlines is centred around environmental change and decarbonisation. Investors are looking for companies that will facilitate or participate in an emission-free economy. However, it seems recycling has been overshadowed by the likes of battery metals and renewable energy. Yet it is arguably more vital to our fight for environmental preservation.

Our planet endures an ever-growing waste management problem, the major source of this harmful pollution is single-use plastic. Single-use plastics are responsible for many of our pollution problems both on land and in our oceans. In order to transform our use of single-use plastics, governments around the world have implemented a plethora of policies and incentives to help curb the problem. These incentives and policies are huge tailwinds for the recycling industry.

- Almost US $3tn (per year) of additional capital investment is required to meet increasing sustainability metrics

- Continued high landfill rates for plastic and print consumables

- Low adherence to recycling creates opportunities for companies to innovate and find solutions to increase overall recycling rates

- Packaging producers/customers are examining more effective and efficient recovery and take back/re-use of valuable product resources to increase their “social license to operate”

- Countries are beginning to ban exporting waste which creates a need to deal with it themselves rather than ship it to other countries that are likely not dealing with it in a environmentally safe manner

- Chinese National Sword ban on importing mixed recycled plastic waste – this has a huge impact on Australian waste and means we need to find domestic solutions to deal with waste

Close the Loop (CLG.ASX)

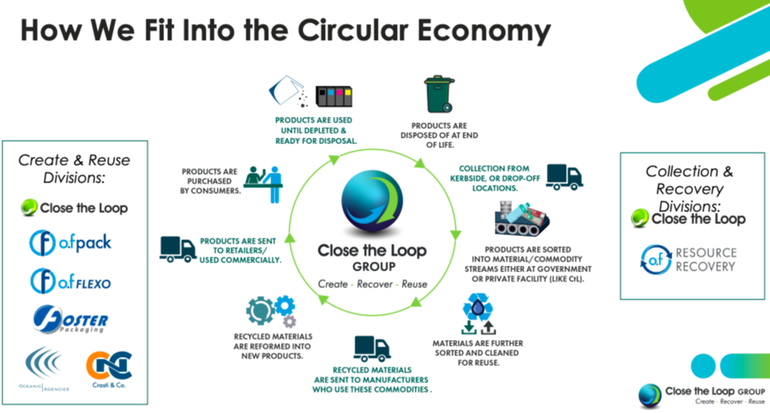

With locations across Australia, Europe, South Africa and the US, Close the Loop creates innovative products and packaging that includes recyclable and made-from recycled content, as well as collect, sort, reclaim and reuse resources that would otherwise go to landfill. From recovering print consumables, eyewear, cosmetics, and phone cases, through to the reusing of toner and post-consumer soft plastics for an asphalt additive, CLG is focused on the future, sustainability, and the circular economy.

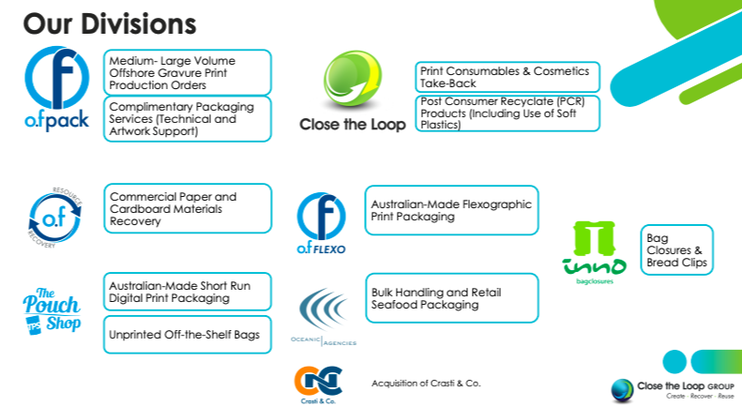

Close the Loop consists of the merging of two secondary business groups; Close the Loop and O F Packaging. The combining of these two entities allows for end-to-end solutions across packaging and consumables to a variety of markets, with advanced innovation in product development, as well as end of life take-back and recovery systems for complex waste streams to greatly reduce waste to landfill.

M&A

Close the Loop merged with O F packaging when listing late last year as part of their growth strategy. CLG are looking to acquire businesses that expand their business geographically, give them access to European markets, and provide cross selling synergies. Their recent acquisition of Oceanic Agencies strengthens Close the Loop’s bulk and commercial seafood packaging capability with strong cross-selling opportunities. CLG has a pipeline of M&A targets and they are sitting on a strong net cash position of over $6m, giving them room to lever up the balance sheet to accelerate their M&A strategy.

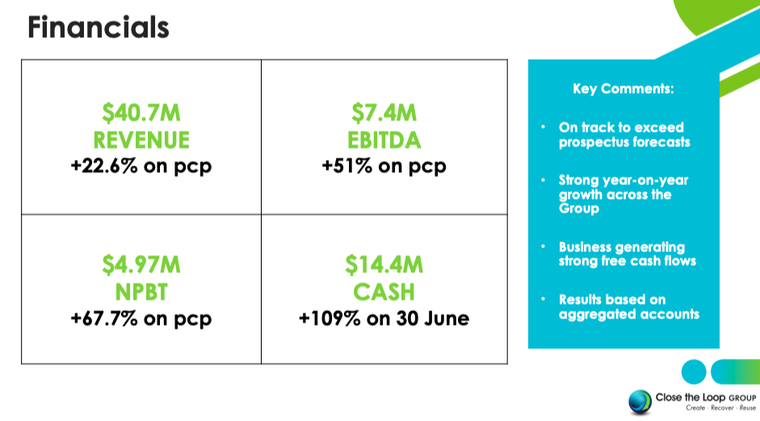

CLG grew its revenues by over 22.6% in the first half and is on track to exceed prospectus forecasts. It’s also key to note that only five months of their Crasti & Co acquisition (done earlier this year) revenue will be included in FY22 as well as only seven months from their Oceanic Agencies acquisition.

Outlook

We like CLG’s business model as it is hard to replicate and quite expensive to enter the recycling industry due to the huge startup costs. CLG has all the necessary infrastructure to operate, including over 60,000 collection sites in Australia. The business was slightly affected by covid as it is volume based and saw less volume throughout the pandemic. CLG has huge tailwinds that will further benefit their business from a macro and regulatory standpoint. On top of this, they are one of the only pure play recycling companies around. The business is profitable and trading at approximately 8x EV/EBITDA. Their future growth will be fueled by M&A and global expansion opportunities, particularly in the US and EU.