While these ASX small caps are a drop in the ocean compared to the earnings anticipation of global behemoth NVIDIA Corporation (NASDAQ: NVDA) the below-mentioned companies continue to produce exceptional results in the face of challenging environments.

This report examines three notable companies within the TAMIM Australia Small Cap Income portfolio that have recently reported strong results.

Retail Food Group is a global food and beverage company headquartered in Queensland, Australia. Retail Food Group is Australia’s largest multi-brand retail food and beverage franchise owner boasting a diverse portfolio, including renowned brands such as Gloria Jeans, Donut King, and Brumby’s.

We discussed Retail Food Group and what we like about the company in greater detail here.

Amidst prevailing economic uncertainties, Retail Food Group’s first-half results showcased a resilient performance, with underlying revenue rising 2.2% compared to the prior period and 7.8% from the second half of 2023. Gross margins remained steadfast at 71.9%, demonstrating stability despite an increased mix of lower-margin corporate stores. Controlled costs and stable overheads resulted in a 3.5% increase in underlying Earnings Before Interest, Tax, Depreciation & Amortisation (EBITDA) to $15.4 million compared to the prior period, marking a substantial 45.7% improvement from the second half of 2023.

The company’s strategic expansion was evident, with the addition of 70 new outlets in the first half of 2024, signaling growth across all core brands excluding Brumby’s. Café, Coffee, Bakery (‘CCB’) contributed significantly to the group’s network sales, counteracting challenges faced in the Quick Service Restaurants (‘QSR’) segment. Looking ahead, Retail Food Group projects underlying revenue to be between $110 million and $118 million, an increase of between 8% to 16% above FY23 with a corresponding EBITDA guidance of $28 million to $32 million.

In a challenging market, Retail Food Group showcases resilience and potential growth, particularly in the CCB business, offering optimism to shareholders.

SRG Global Ltd (ASX: SRG)

SRG Global Logo

SRG Global (ASX: SRG) is an ASX-listed diversified industrial services company, standing at the forefront of innovation with a mission to simplify the complex in the asset lifecycle. We shone a spotlight on the company back in October.

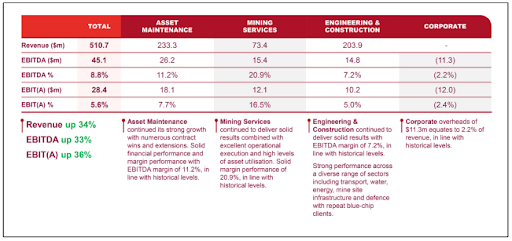

SRG Global delivered strong results with revenue growing 34% to $510 million. This impressive result flowed through to EBITDA of $45.1 million, an increase of 33%.

As at 31 December the company has work in hand of $1.9 billion with a further $6.5 billion in the pipeline and significant exposure to government-backed infrastructure investment, high quality commodities, diverse industries and a blue-chip client base. Maintaining a strong balance sheet, SRG Global increased its cash balance by 44% to $68 million compared to June 2023. The health of the balance sheet allowed the company to return cash to shareholders with an interim dividend declared of 2 cents per share in line with the prior year. Yielding over 5% at the time of writing, SRG Global has found an impressive balance between funding its growth phase of the business while also increasing its dividend to shareholders.

Management’s upgraded FY24 EBITDA guidance to a range of $95 million to $100 million underscores SRG Global’s commitment to sustained growth and financial stability.

Bravura Solutions Ltd (ASX: BVS)

Bravura Solutions Ltd (ASX: BVS) specialises in the development, licensing, and maintenance of advanced software applications, Bravura caters predominantly to the Wealth Management and Funds Administration sectors within the financial services industry.

We discussed Bravura in greater detail and the potential for its turnaround here. The company released its first half results on Tuesday with the market responding ecstatically, initially jumping over 45 cents to a 52 week high of $1.40 before closing the day up 30% at $1.25. Revenue increased by a modest 7.35% to $127 million compared to the prior period. Impressively, the company posted EBITDA of $7.9 million, up $11.5 million.

Commenting on the group performance, Mr Russell, Group Chief Executive Officer and Managing Director said:

“We are making good progress on resetting the business and right sizing our cost base, with the business returning to profitability in 1H24 on a Cash EBITDA performance basis, ahead of forecast.”

The positive results reflect the impact of the new management team.

CEO Andrew Russell and Non-Executive Chairman Matthew Quinn were appointed in FY23 with the task of driving profitability via the company’s transformation programme. Shareholders are clearly thrilled with the results so far.

Looking forward, the company has forecasted annualised FY24 cost cuts of $40 million. Including $27 million already delivered in the first half. Furthermore Bravura management announced that they would be upgrading FY24 EBITDA guidance to $18 million to $22 million from $10 million to $15 million.

Bravura Solutions’ turnaround story presents a promising trajectory for long-suffering shareholders, highlighting the efficacy of strategic leadership in reshaping the company’s performance.