Let’s start with a bold premise: if we’re serious about building the infrastructure of the future, one that can support the exponential demands of AI, digital transformation, and decarbonisation, then we need to stop tiptoeing around nuclear energy. The power needs of the next generation are staggering, and nowhere is this more evident than in the United States, where data centre energy consumption is projected to quadruple by 2030.

At Tamim, we’re constantly scanning for mispriced assets, misunderstood value, and global disconnects that others overlook. Right now, one of the most glaring opportunities lies in Japan, specifically, its fleet of dormant nuclear power plants, sitting ready to supply massive baseload energy to an AI-hungry world.

Let’s unpack why.

AI’s Insatiable Appetite for Power

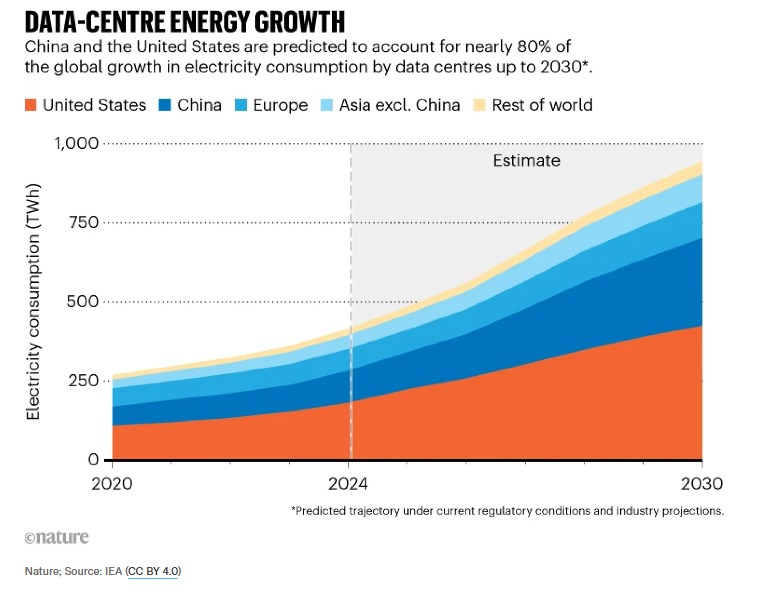

In the US Data Centre Energy Consumption chart, we see the trajectory of energy use by American data centres. From 147 TWh in 2023 to a forecasted 606 TWh by 2030, data centres will represent nearly 12% of total US power demand. That’s not incremental growth, that’s a structural reordering of the energy grid, driven by artificial intelligence, machine learning, cloud computing, and high-density enterprise storage. The biggest tech names: Meta, Amazon, Microsoft, Nvidia are all pushing the limits of data processing. The AI boom isn’t a cycle. It’s an epoch.

Meta recently tried to develop a 4GW power source for its data centres, only to be stopped by environmental objections involving bees.

With the U.S. facing both environmental and bureaucratic barriers, it’s time to look east.

Japan: A Sleeping Giant in the Nuclear World

The 2011 Fukushima disaster understandably pushed Japan to idle most of its nuclear reactors. But time, technology, and regulatory progress have shifted the picture dramatically. More importantly, the market has yet to catch up with this change in sentiment and potential.

Take Hokkaido Electric Power (TSE: 9509), for example. It owns the Tomari Nuclear Power Plant, a three-reactor PWR facility that’s been offline since 2011. The plant ran at near 100% capacity when operational and remains structurally sound and technically ready. It’s located in southwest Hokkaido – a cold, isolated area perfect for large-scale data centre co-location.

Why isn’t it online now? Bureaucracy. Specifically, a lack of staff at the Nuclear Regulation Authority to answer final technical questions. Not technical problems. Not infrastructure issues. Just a slow process.

Meanwhile, the Tomari plant’s 4GW capacity is sitting idle, nearly the same amount Meta was trying to build from scratch in the U.S. And unlike renewables, nuclear provides the consistent baseload power that data centres require 24/7. Japan’s existing infrastructure could be rebooted faster and more economically than new builds elsewhere.

Cement, Renewables, and Cost Illusions

Let’s address the elephant in the room: the debate between nuclear and renewables. Much of the opposition to nuclear power is not grounded in science, but in ideology.

Take wind turbines, for example. Anchoring just one turbine requires between 1,000 and 2,000 tonnes of cement. Cement production emits sulphur dioxide, nitrogen oxides, and carbon monoxide, pollutants that rarely make it into the glossy charts presented by renewable lobbyists. And then there’s the intermittency problem: wind and solar are variable; nuclear is not.

The bottom line? Nuclear energy, particularly from already-built plants, remains the most carbon-efficient and scalable solution for industrial power demand. And right now, Japan is sitting on a stockpile of it.

Valuation Disconnect: Hokkaido, Kansai, Shikoku

Let’s look at the numbers. Hokkaido Electric Power is trading on a P/E of 3.6x, a P/B of 0.45x, and an EV/EBITDA of just 11.5x. Compare that with the stretched valuations in global equities. As an infrastructure play with a nuclear asset that could be back online within 12–18 months, it’s one of the most asymmetric investment opportunities in global markets.

It’s not just Hokkaido. Kansai Electric (TSE: 9503) and Shikoku Electric (TSE: 9507) are also on the runway for nuclear restarts. Both have already received NRA clearance to resume operations.

Yet, these utilities still trade well below their long-term highs. The market continues to treat these companies like they’re operating in 2012, not 2025.

But the macro backdrop has shifted.

Macro Themes Colliding in 2025

Several powerful currents are now converging:

- AI growth is structurally increasing power demand; especially for constant, uninterrupted supply.

- The US and Europe are struggling to build new baseload power plants, due to cost, environmental regulation, and political inertia.

- Japan’s fiscal and energy policy has pivoted toward reindustrialisation and economic security. Nuclear reactivation fits squarely within that mandate.

- Valuations remain deeply discounted, reflecting a regulatory status quo that’s already shifting.

In short, this is a rare case where energy policy, AI infrastructure, and contrarian value investing collide.

Why We Like It at TAMIM

At TAMIM, we look for investments where the downside is well protected and the upside is driven by mispriced probabilities. Hokkaido, Kansai, and Shikoku all qualify.

These are not “hope and hype” stories. These are tangible assets with decades of operational history, efficient legacy infrastructure, and balance sheets that have weathered over a decade of idleness. The regulatory dominoes are falling into place and the AI data centre boom is creating a once-in-a-generation tailwind.

The TAMIM Takeaway

In a world where markets are obsessed with the next chip design or data analytics platform, we believe the real infrastructure play lies in powering that future.

Japan’s nuclear utilities are underappreciated, undervalued, and sitting on gigawatts of capacity that offer investors a unique opportunity to align with one of the most urgent megatrends of the decade: the energy demands of AI.

We expect these companies to re-rate significantly as restarts proceed and the global hunt for stable power intensifies.

______________________________________________________________________________________

Disclaimer: Hokkaido Electric Power (TSE: 9509) and Shikoku Electric (TSE: 9507) are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.