Powering the Global Shift to Renewables with Energy One

In Part 2 of our Small Cap Energy Transition Playbook, we continue identifying ASX-listed companies providing the critical infrastructure and technologies supporting the move to a net-zero economy. Following our focus on electrification and infrastructure in Part 1, we now turn to the brainpower behind energy trading: advanced software solutions.

One standout in this space is Energy One (ASX: EOL). This small-cap company is not only revolutionising energy trading but also positioning itself as a foundational pillar of the global renewable energy transition. With a unique integrated platform, significant European expansion, and a strong financial and operational track record, Energy One offers investors a compelling entry point into the evolution of energy markets.

Company Overview: Enabling the Future of Energy Trading

Founded 17 years ago, Energy One has evolved from a niche Australian software provider to a global leader in energy trading and risk management platforms. The company, led by CEO Shaun Ankers, has navigated the extreme volatility caused by global disruptions, notably the Russian invasion of Ukraine, and emerged stronger, solidifying its role as a mission-critical partner for energy market participants.

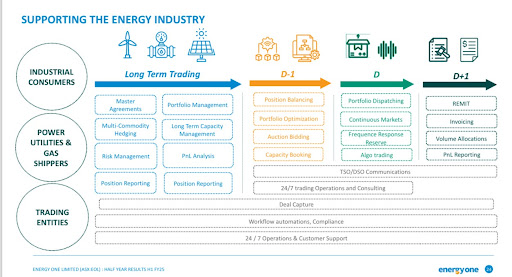

Energy One’s platform supports clients across Australia and Europe, delivering seamless integration across the entire energy trading lifecycle, from trade initiation to risk management, settlement, and regulatory reporting. This comprehensive capability increasingly differentiates it from competitors who specialise in narrower market segments.

Business Model: A Unique One-Stop-Shop Approach

Energy One’s integrated “one-stop-shop” software platform addresses the complexities of modern energy markets. Its end-to-end service model is particularly well-suited to the challenges posed by intermittent renewable energy sources, real-time pricing, and evolving regulatory frameworks.

By offering a full suite of energy trading solutions, Energy One enables utilities, energy retailers, and independent power producers to optimise trading, manage risks, automate settlements, and remain compliant. As energy markets grow more complex, the demand for holistic platforms like Energy One’s is set to expand significantly.

Source: Company

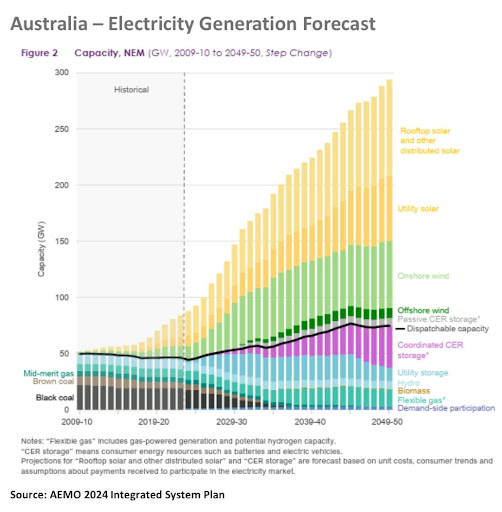

Market Dynamics: A Multi-Decade Tailwind

The energy transition is driving unparalleled growth opportunities. In Australia alone, over 300 new renewable energy assets are projected over the next five years, with wind generation expanding at 18% per annum and battery storage deployments growing at an astounding 40% annually.

Globally, particularly in Europe, the transition is even more profound. European energy markets are approximately 20 times the size of Australia’s, offering a substantial runway for growth.

As grids become more decentralised and complex, real-time trading, hedging, and settlement solutions become non-negotiable for financial stability. Energy One stands at the heart of this systemic transformation.

Financial Performance: A Record of Growth and Resilience

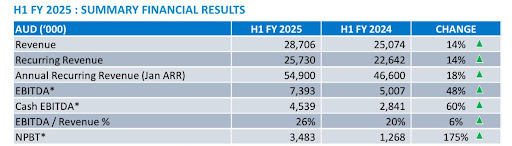

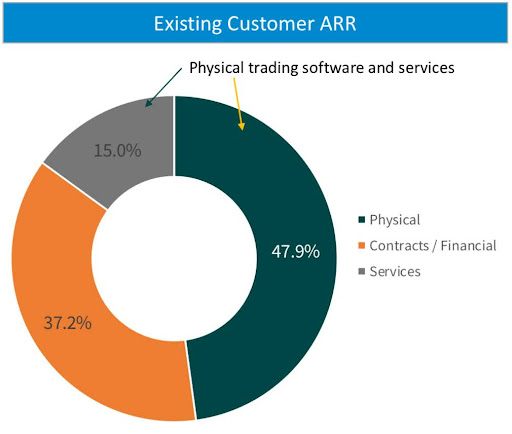

Energy One’s financial results for the first half of 2025 showcase robust operational strength:

- Annual Recurring Revenue (ARR) increased 18% year-on-year

- 53 new software installations completed

- Operational margins improved through strategic restructuring

- Consistent 15-20% revenue growth targeted

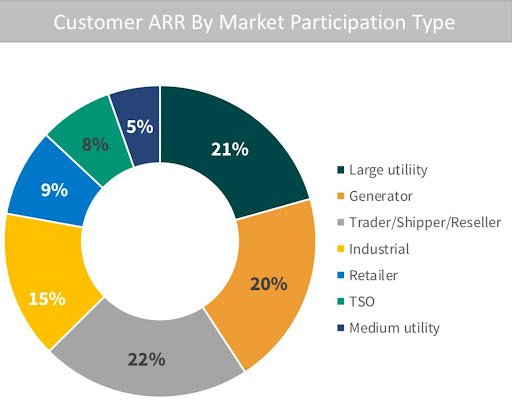

The company maintains an impressive customer profile, with average contracts ranging from $150,000 to $200,000, and enterprise clients capable of generating up to $1 million in initial-year revenues. Importantly, the company’s European revenue share has grown from zero to 56% over recent years, significantly de-risking its revenue base and enhancing scalability.

Source: Company

Technological Innovation: Building the Energy Market of Tomorrow

Energy One is not resting on its laurels. The company is investing heavily in future-proofing its platform through:

- Integration of Artificial Intelligence to enhance predictive analytics and automation

- Development of automated trading platforms to streamline operations

- Strengthening cybersecurity to protect critical infrastructure

- Offering 24/7 operational support to cater to the needs of global energy traders

This commitment to innovation positions Energy One as more than a software provider, it is a strategic partner for energy market participants navigating the renewable revolution.

Growth Strategy: Focused and Disciplined Expansion

Energy One’s strategic growth pillars include:

- Optimising pricing structures to enhance margins

- Improving sales effectiveness and customer acquisition

- Expanding market presence, particularly across European markets

- Developing tailored solutions for emerging independent power producers and market entrants

With low current European penetration (~10%), the addressable market opportunity remains vast.

Future Outlook: Ambitious but Achievable Targets

Management has articulated clear and measurable goals:

- Expand cash EBITDA margins from 16% to 30% by FY27

- Maintain consistent organic revenue growth of 15-20%

- Continue developing and deploying industry-leading technology

- Capitalise on the accelerating global shift to renewable energy

If the company achieves these milestones, we assess an intrinsic valuation of over $20.00 per share is realistic.

Source: Company

Investment Relevance: Why Energy One Stands Out

Energy One (ASX: EOL) ticks all the fundamental boxes sought by discerning investors:

- Founder-led leadership with strong alignment to shareholders

- Profitable and growing with high recurring revenue visibility

- Robust balance sheet and scalable business model

- Positioned at the nexus of the global energy transition

In a sector characterised by disruption and rapid change, Energy One offers a rare combination of technological edge, operational excellence, and strong secular tailwinds.

TAMIM Takeaway

Energy One exemplifies the type of high-quality small-cap business investors should seek when targeting exposure to the global energy transition. It is profitable, founder-led, growing its market share, innovating continuously, and addressing a critical need in the energy trading ecosystem.

For investors seeking technology-enabled leverage to renewable energy trends—without taking on the high risks associated with pre-revenue green tech startups—Energy One is a compelling proposition.

As a strategic enabler of the new energy economy, Energy One deserves close attention.

__________________________________________________________________________________

Disclosure: Energy One (ASX: EOL) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.