Identifying undervalued assets ripe for acquisition can provide significant opportunities for sophisticated investors. Could one such opportunity be Comms Group (ASX: CCG)? CCG is a small telecommunications company operating primarily in Australia and the Asia Pacific region. With its strong financial performance and strategic positioning in a consolidating market, Comms Group stands out as a potential takeover target.

The Australian telecommunications landscape is marked by intense competition and rapid consolidation. Major players like Telstra and Optus dominate the market, but smaller, nimble companies have been able to carve out niches by focusing on specialised services and underserved segments. Aussie Broadband (ASX: ABB) and Superloop (ASX: SLC) have emerged as formidable challengers, successfully gaining market share from larger incumbents through aggressive growth strategies, innovative product offerings, and strategic acquisitions. These companies are now in the consolidation phase, targeting smaller telcos to enhance their competitive positioning and expand their customer bases.

In this evolving landscape, smaller telcos like Comms Group present attractive opportunities for larger players looking to consolidate their market positions. Comms Group’s focus on cloud communications and secure modern workplace solutions, combined with its strong foothold in the mid-market corporate sector across the Asia Pacific, positions it uniquely for growth. It also makes Comms Group a prime candidate for acquisition by companies looking to diversify their service offerings and strengthen their regional presence.

Company Overview

Comms Group is a leading provider of innovative cloud communications solutions, secure modern workplace services, global unified communications, and wholesale telecommunications services. The company operates primarily in Australia and the Asia Pacific region, where it serves a diverse range of corporate clients, particularly in the mid-market segment.

Comms Group’s cloud communications services are designed to enable businesses to operate more efficiently and securely, offering solutions that include voice, data, and video communication capabilities integrated into a single, unified platform. This approach not only reduces costs but also enhances collaboration and productivity for its clients.

In addition to its core cloud communications offerings, Comms Group provides secure modern workplace solutions that cater to the growing demand for remote and flexible work environments. These solutions are particularly relevant in today’s business climate, where companies are increasingly adopting digital transformation strategies to stay competitive. By offering secure, scalable, and flexible workplace solutions, Comms Group helps businesses adapt to the evolving needs of the modern workforce.

The company’s wholesale services division offers telecommunications services to other carriers and service providers, generating additional revenue streams and enhancing its overall market position. This diverse range of offerings enables Comms Group to capture multiple market segments and provides a strong foundation for sustainable growth.

Strong Financial Performance in FY24

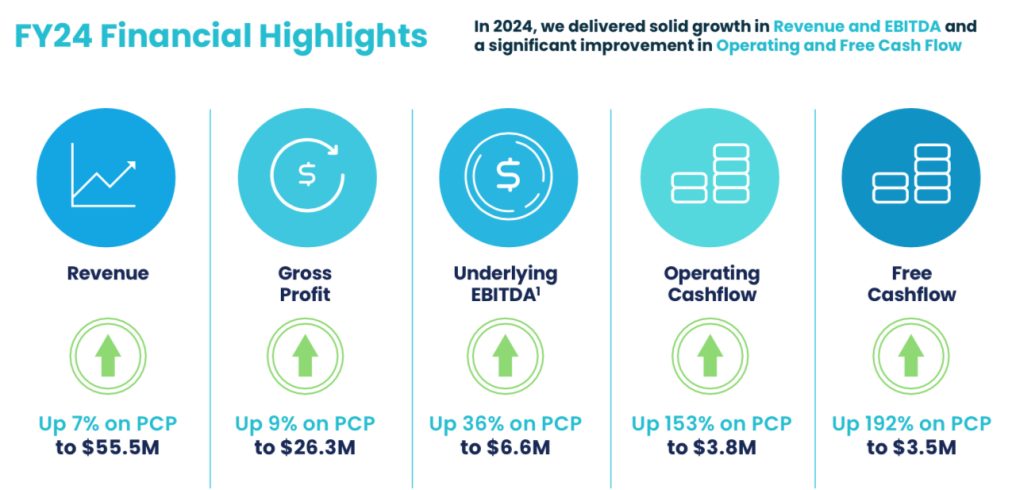

Comms Group’s FY24 results were exceptional, surpassing market expectations and setting the stage for a promising future. The company reported a record revenue of $55.5 million and an underlying EBITDA of $6.6 million, both exceeding guidance. A particularly notable aspect of Comms Group’s financial performance is that over 90% of its revenue is recurring, driven entirely by organic growth.

Additionally, Comms Group has shown significant improvements in its cash flow, with operating cash flow up by 150% and free cash flow increasing by 200%. These improvements highlight the company’s ability to generate substantial cash, which is crucial for funding future growth and potential acquisitions. The declaration of an inaugural dividend of 0.25 cents per share, potentially yielding 4-9% in FY25, further underscores Comms Group’s commitment to delivering shareholder value.

The company also expanded its relationships with strategic accounts, such as Vodafone (LON: VOD), and secured licenses to operate in more Asia Pacific countries. These achievements enhance Comms Group’s market presence and provide a solid foundation for continued growth and regional expansion, reinforcing its position as a leader in the telecommunications sector.

Positive Outlook and Strategic Growth Plans for 2025

Looking ahead, Comms Group has provided an optimistic outlook for FY25, targeting 5-10% organic revenue growth and over $7 million in underlying EBITDA. The company is focused on becoming a leading provider of cloud communications and secure modern workplace solutions across the Asia Pacific region. A key element of this strategy involves cross-selling secure modern workplace solutions to its existing telecommunications customers.

Furthermore, Comms Group is exploring strategic growth opportunities through selective acquisitions, aiming to expand its footprint and enhance its service offerings. The company also plans to transform its business by implementing common group-wide processes and systems over the next 12-18 months, which should drive operational efficiencies and further improve cash flow generation.

Importantly, Comms Group is targeting a net debt-neutral position by June 2025, reflecting its prudent financial management and commitment to maintaining a strong balance sheet.

Strong Board and Management Alignment

One of the standout features of Comms Group is the alignment between the board, management, and shareholders. At a recent Extraordinary General Meeting (EGM) in June 2024, the board was awarded 7 million shares that vest between 12.5 cents and 20 cents, compared to the current share price of 7 cents. The board collectively holds 23% of the company, with the Managing Director being the second-largest shareholder. This substantial insider ownership ensures that management’s interests are closely aligned with those of shareholders, a trait we value highly in potential investment opportunities.

The TAMIM Takeaway: A Potential Takeover Target

The telecommunications industry is inherently a consolidating one, where new challengers consistently emerge to take market share from larger incumbents. Over time, these challengers often become the consolidators, acquiring smaller players to expand their market presence. A decade ago, we witnessed this trend with M2 Telecom (ASX: MTU) and Vocus (ASX: VOC), who merged after acquiring several smaller listed players.

In recent years, Aussie Broadband (ASX: ABB) and Superloop (ASX: SLC) have emerged as successful challengers in the industry and are now in the consolidation phase, acquiring smaller peers to strengthen their market positions. We have benefited significantly from owning shares in Symbio (ASX: SYM), which was acquired by Aussie Broadband last year, and have also seen strong returns from our investment in Superloop.

Given the current market dynamics, we believe that Comms Group is a highly attractive target for both Aussie Broadband and Superloop. At a valuation of FY25 EV/EBITDA of just 3.5x, Comms Group presents a compelling opportunity that is too good to pass up. We anticipate a potential takeover within the next 6-12 months at a 6-8x multiple, representing a substantial upside of +71% to +128% from current levels.

Comms Group represents a unique opportunity to capitalise on the ongoing consolidation in the telecommunications sector. With its strong financial performance, strategic growth plans, and shareholder-aligned management team, Comms Group is well-positioned to deliver significant returns in the event of a takeover.

In conclusion, Comms Group is a small telco ripe for acquisition, offering substantial upside potential for investors willing to capitalise on the consolidation trends in the telecommunications industry. As always, we remain vigilant in monitoring market developments and positioning our portfolio to benefit from such opportunities.

______________________________________________________________________________________

Disclaimer: Comms Group (ASX: CCG) and Superloop (ASX: SLC) are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.