ClearView (CVW.ASX)

Authors: Ron Shamgar & Adam Wolf

FY21 Results

FY21 saw ClearView report a strong result to the market with operating earnings up +83% to $23.9m and underlying NPAT up +54% to $22.7m. Considering the challenges presented by low interest rates and Covid-19, this was an exceptional result for ClearView. They saw their gross premium income rise +7%; this growth will follow through to FY22 as they raise their pricing policies. Even though funds management represents a very small piece of the business, the core focus is firmly on insurance, ClearView also increased their funds under management by +22%.

Capital Management

It is important to assess a company’s ability to allocate capital, what capital management strategies they are using to return value for shareholders and whether they are making the most of opportunities. ClearView has been buying back shares aggressively and, while we typically prefer dividends (it makes more sense with franking credits as opposed to US companies that prefer buybacks), they have executed these buy backs at an opportune time (around 50 cents per a share). They have also extended the program, indicating that management still think the share price is too cheap. ClearView has also reinstated their fully franked dividends and intends to payout 40-60% of operating earnings.

ClearChoice Transformation

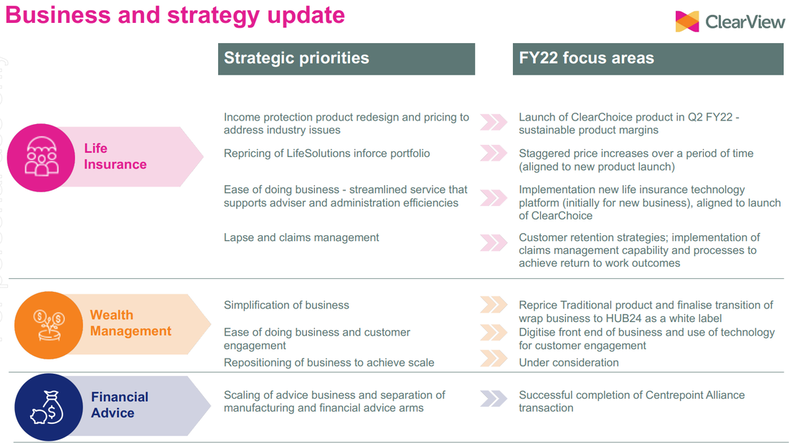

As part of ClearView’s multiyear transformation they have been developing and investing in their new insurance platform ClearChoice, which will be replacing their existing life insurance platform. The new platform will deliver an enhanced user experience, drive efficiencies, and become a single source of truth for all customer data. Improved access to accurate customer information and the ability to generate data-driven insights to capture timely opportunities and aid strategic and tactical decision-making is one of many benefits to come from ClearView’s new ClearChoice platform. The platform is launching in Q2 FY22 and will also implement new policy pricing increases which will increase operating earnings.

In August ClearView announced the sale of their financial advice business to Centrepoint Alliance (CAF.ASX), another holding in our Australia Small Cap Income portfolio. The total consideration for the sale was $15.2m to be paid in cash and shares, Clearview receiving 48m CAF shares and $3.2m in cash. The deal with Centrepoint Alliance provides the combined entity with immediate scale, a strong and effective management team, best of breed technology/processes and the capability to take a market leading position in the financial advice industry to build a strategically successful and profitable financial advice business. The deal allows ClearView, through their interest in Centrepoint Alliance, to continue participating in the growth of the financial advice sector while effectively removing any perceived conflict of interest.HUB24 Partnership

Last year ClearView announced a partnership with HUB24 which will see over $1bn in funds under administration migrated from the current ClearView WealthSolutions wrap platform to HUB24. The partnership is set to deliver on ClearView’s previously advised project seeking a modern replacement solution for its wrap technology. It is expected to substantially address the tax credit issue for the ClearView Retirement Plan and foster business simplification as they continue growing their life insurance and wealth management businesses.Manulife Partnership

ClearView has entered a strategic partnership with Canadian wealth firm Manulife Investment Management, the global wealth and asset management segment of Manulife Financial Corporation (MFC.TSE), to launch a range of products with an immediate focus on retirement income solutions. It is important to note that it is a non-binding memorandum of understanding (MOU) (we typically don’t like to pay too much attention to non-binding agreements). The partnership will leverage ClearView’s local product development and distribution capabilities with Manulife’s global expertise across public and private asset classes as well as ESG integration. Given Australia’s rapidly ageing population, this is a thematic worth targeting.

Outlook

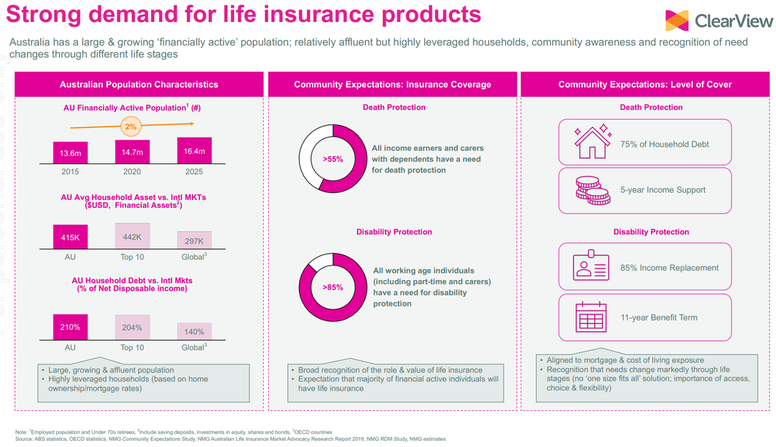

As mentioned, the life insurance industry has been through a particularly turbulent period due to pandemics, Royal Commissions, and broad poor pricing policies. With all this now in the rearview mirror, the industry has returned to profitability and is growing. Yet Clearview is still trading at a substantial discount to its asset base. This is despite the fact that it is a profitable business with sustainable recurring revenue that has made a number of strategic adjustments to turn the company around. APRA’s new regulations on pricing policy will boost profitability and, given how high household debt is in Australia, insurance policies are always going to be in high demand. Additionally, Clearview’s new ClearChoice platform will help them create more efficiencies in the business and begin to leverage the data they collect to produce insights that will further help them grow the business.

But none of this is why we bought this stock as a takeover target.

Strategic Review

In early September of this year [2021] CVW announced that:

|

“following an evaluation of the Company’s future capital structure and discussions with CVW’s largest shareholder, Crescent Capital Partners, the Board has commenced a strategic review process. Its objective is to maximise shareholder value, determine the optimal future direction of the Company to protect and enhance customer and policyholder outcomes, and achieve a long term shareholding base. This review will assess strategic options to unlock and enhance value for shareholders, including potential change of control transactions. … Crescent Capital Partners has advised the CVW Board that it supports the strategic review.” |

Why do we believe a takeover is imminent?

Very similar wording to the above was used by Crescent holdings Cardno (CDD.ASX) and Intega (ITG.ASX) when strategic reviews were announced for them in June, both stocks were held in TAMIM funds. Approximately four months later both companies had received significant takeover proposals from strategic acquirers.

CVW represents the last remaining meaningful life insurance asset up for grabs in Australia with approximately 7% market share. We believe this share is significant enough for someone looking to enter the domestic market and grow but also not large enough to cause competition concerns for an existing player to acquire.

In addition, we believe Crescent’s investment in CVW must wind up and realise its investment into cash by June 2022. This means that they are a motivated seller which in turn makes a favourable outcome (for other shareholders) highly likely by February 2022, as signalled by the board.

The value of an insurance business lies in the embedded value (EV) of its policies and their future cash flows discounted to today. This embedded value can change over time based on new business growth rates, franking credits). Historically, life insurance companies have been acquired in the range of anywhere between 0.8x to 1.6x EV. In the case of CVW, this suggests a figure in the range of 77 cents to $1.54. Usually, when an insurance business is growing like CVW, it is trading or acquired at a premium to EV.

CVW has previously seen two takeover attempts; the first in 2012 by Crescent and the second in 2016 by Sony Life. Due to several reasons at the time, neither eventuated but the offer then was $1.50. While it is unlikely that shareholders will see $1.50 again, we cannot rule it out. Most likely, and based on the current environment, we believe that our base case scenario would be a takeover at a premium to EV of +10%. With some luck, we may end up seeing a bidding war which may then see a much higher offer, i.e. toward $1.50 mark.

We believe that the most likely acquirers would be either a Japanese life insurer, private equity or a new domestic entrant looking to diversify into the life insurance industry. As discussed above, the conditions for the industry are finally positive again.