|

Buying bargains or check out traps? Is it time to consider retail stocks? There have been plenty of reasons to avoid the consumer discretionary space over the last 12 to 18 months. Does this provide an opportunity? We’ve previously discussed second-level-thinking when it came to US homebuilders. As a refresher, iconic investor Howard Marks explains the concept of second-level thinking in his book ‘The Most Important Thing”. Marks explains it best:

First-level thinking is the fast, reactive option. Consumer confidence and spending power is down, therefore retail stocks will go down. It’s hardly irrational, but only considers the immediate problem. Second-level thinking takes it a step further and asks “and then what?”. Zooming out and viewing the situation and considering the consequences. If everyone is dumping their retail stocks, perhaps this is an opportunity on a long term horizon when sentiment improves.

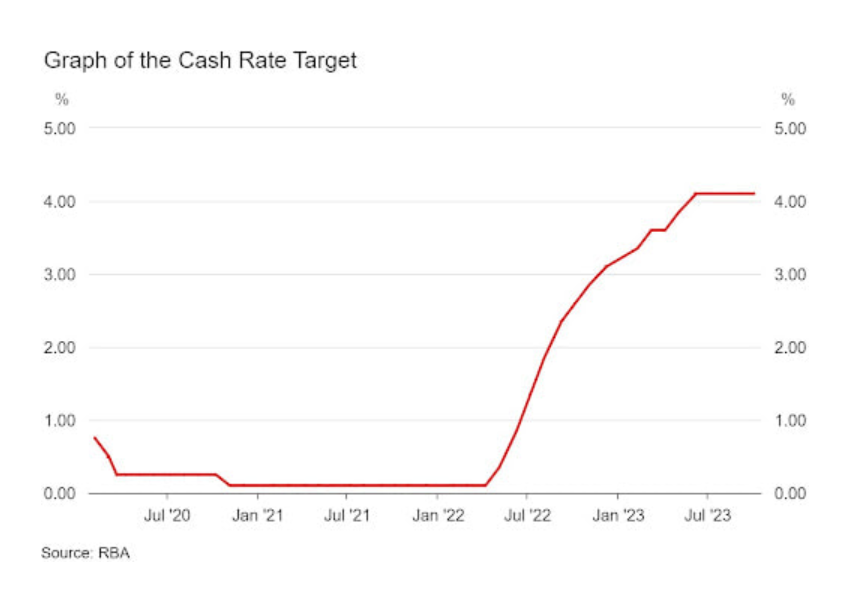

What has driven the decline in sentiment?Cost of living pressures are front of mind with the RBA hiking rates 12 times since May 2022 as stubbornly high inflation refuses to go away. But are we beginning to see interest rate stability?

While the prospect of stabilising interest rates offers a potential reprieve, its impact on the economy has been multifaceted Per the RBA:

The rich get richer? Is this an opportunity for a company in the luxury space to continue to grow? Or is the pool of customers declining as those who could afford products in a low interest rate environment begin to look elsewhere? A company in this space is Cettire (ASX: CTT). Cettire is a global online retailer, offering a large range of personal luxury goods via its website, cettire.com. Cettire boasts more than 2,500 luxury brands and 500,000 products of clothing, shoes, bags, and accessories. Cettire’s 2023 financial year report was strong. The company experienced a 98% increase in sales revenue to $416.2 million with active customers soaring 62%. Notably, 58% of gross revenue was attributed to repeat customers. Clearly showing very little signs of cost of living impacts. In a recent presentation the company noted that early FY24 trading was strong. Unaudited numbers showing July 2023 sales revenue increasing 120% compared to the prior corresponding period with positive adjusted earnings before interest tax depreciation and amortisation (EBITDA). A move away from luxury brands and to a niche operator feeling the impact of cost of living pressures is retailer Beacon Lighting (ASX: BLX). The company specialises in the retail of lighting, ceiling fans, and light globes, providing customers an extensive selection of products coupled with expertise, service, and guidance. Its product offerings include both stylish and design-oriented elements, along with cutting-edge technology to enhance energy efficiency. While it did record revenue for FY23 its profits saw a decline of 17% to 33.6 million as well as decline in its dividend for the full year of over 10% to $0.083. The founder-led business is transitioning to a greater trade customer focus which has seen strong growth in trade members despite the decline in building activity as consumers pull back on renovations. Despite the softer results perhaps Beacon is a candidate for the second-level thinking approach for when building and renovations are back in vogue. The final company we’re taking a look at is Temple & Webster Group (ASX: TPW). Temple & Webster is an online furniture and homewares retailer. Operating on a drop-shipping model, the company dispatches products directly from suppliers to customers. In addition to the drop ship range, Temple & Webster offers a private label range sourced directly from overseas suppliers. The once market darling has seen its share price nosedive from the dizzying heights of almost $14 per share back in September 2021 to at one stage trading at just above $3. The FY23 results perhaps a sign things are turning around with business back to growth in the fourth quarter of the financial year and August 2023 revenue at the reporting date up 16% compared to the prior period. Managing director Mark Coulter noted at the time:

With its online presence providing lower cost options for consumers, are we seeing a turnaround story for Temple & Webster? In the ever-shifting retail landscape, Cettire’s luxury growth, Beacon Lighting’s resilience, and Temple & Webster’s potential turnaround beckon investors. Second-level thinking reveals opportunities amid challenges. Disclaimer: TAMIM Asset Management does not own any of these companies at the time of publishing.

|