Crown Castle (CCI.NYSE)

|

Market Cap

|

Q1 Rev

|

Div yield

|

Q1 EBITDA

|

Q1 EBITDA Margin

|

Net Debt

|

|

|

Crown Castle

|

$84bn

|

$1.48bn

|

2.74%

|

900m

|

60.8%

|

$19bn

|

5G Rollout

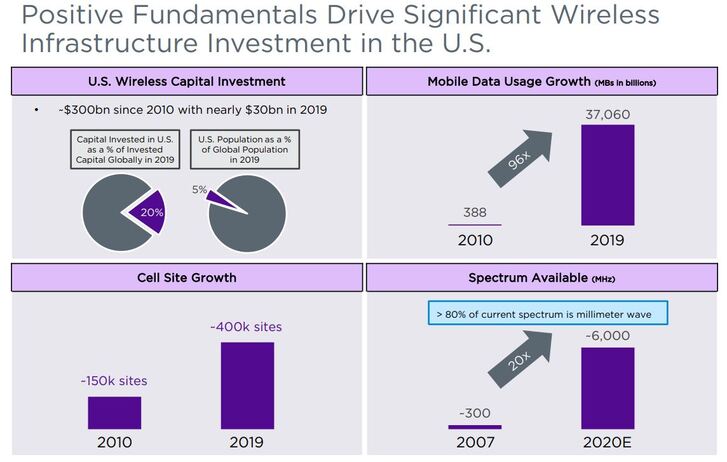

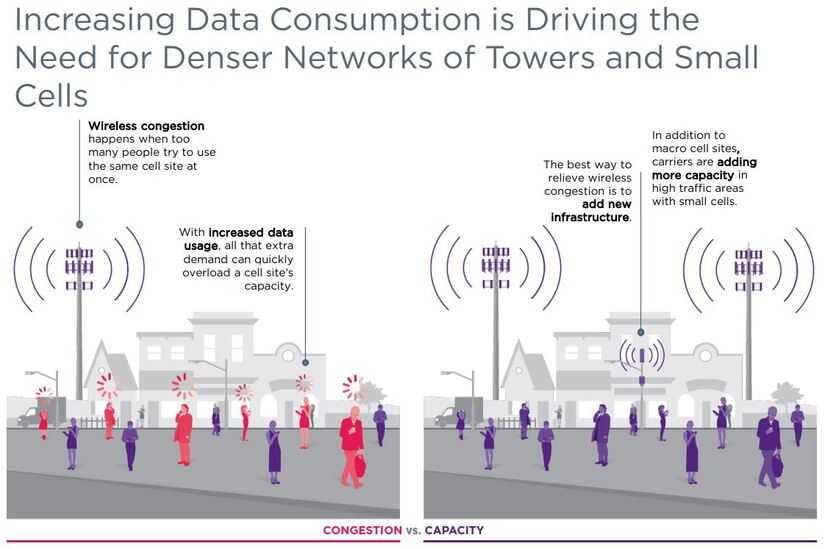

The rollout of the new generation of a mobile network requires significant investment in cell infrastructure and will need a denser web of transmitters as the demands of the new network are much higher. In simple terms, the biggest difference between 4G and 5G is the speed. 5G networks will be up to 100x faster than 4G. Whilst 5G doesn’t offer the same coverage capabilities, it offers far more channels for transmitting data which delivers higher bandwidth and lower latency. Each generational upgrade demands more data which is ultimately enabled by cell towers and small cells. Crown Castle’s customers are all looking to roll out 5G at scale and are investing heavily to improve and densify their networks. This is starting to drive demand in activity and leasing of Crown Castle assets. The shift from 3G to 4G was fairly stock standard as they were similar networks but the shift from 4G to 5G will be very different and a lot more complicated. It will require a lot more towers and small cells to provide this network. The biggest issue is that there currently isn’t enough infrastructure in place to do so.

How will Crown Castle perform in a high inflation environment?

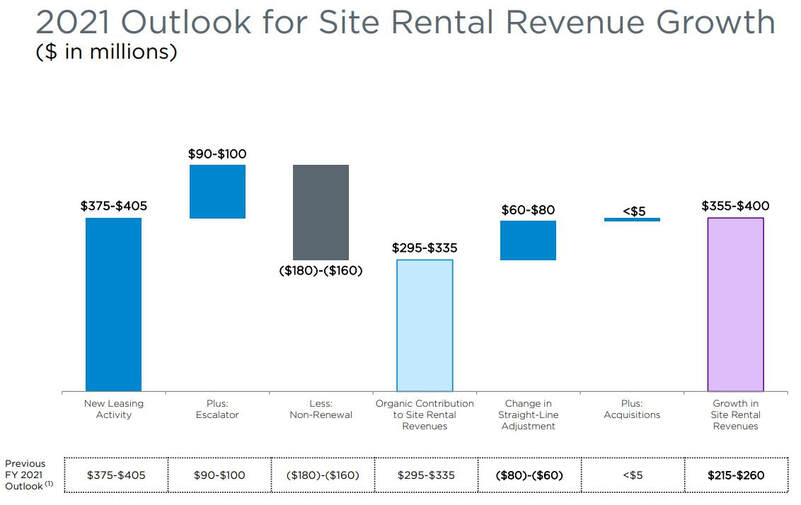

When looking for companies that will outperform in inflationary periods it is important to look for companies that have considerable pricing power and a favourable debt structure. Without pricing power, companies’ margins will suffer as their cost base increases. This is likely to happen to companies that are operating in crowded markets with no competitive advantage. Another factor to look out for is the company’s debt structure, whether it’s fixed or variable. This is important as the company’s cost of capital will rise and, if their debt is on a variable rate, their interest expenses will jump. With the rollout of 5G networks there simply won’t be enough towers to distribute 5G nationwide which not only provides Crown Castle an opportunity to develop more infrastructure but also provides them with significant pricing power in terms of the rates they charge their customers for leasing those towers. Crown Castle effectively operates in an oligopoly with few competitors and high barriers to entry. Management have been actively mitigating the risk of inflation and have embedded escalators in the majority of their contracted revenue. Crown Castle have an inflation-friendly debt structure with 91% being fixed. This will protect them from rising rates as well as benefit them if high inflation occurs as they will be paying their creditors back with money that is worth less, meaning their debt will get inflated away.

Growth Strategy

Crown Castle is at the forefront of a significant opportunity to capitalise on the rollout of 5G networks across the US. CCI’s plan to capture this market is through the development of small cells. Small cells boost coverage in a specific area and are attached to existing infrastructure such as traffic lights or street lamps through fibre optic cables. They also relieve congestion to networks, essential given the increased data usage we have seen in the US.

Thesis

Infrastructure companies like Crown Castle are considered by some as bond proxies, providing a steady yield supported by their real assets (towers, fibre and small cells). However, Crown Castle is offering a unique opportunity to investors, a bond proxy with equities-like upside. Crown Castle are aiming to grow their dividend by 7-8% annually and, given their opportunity to benefit from the incoming rollout of 5G, this is more than achievable. Crown Castle’s revenue is largely recurring and most of that revenue is from the top carriers in the US. Crown Castle’s contracts are typically between 5-15 years and currently have $27bn in contracted customer receivables. Given that their tenants include AT&T, Verizon, T-mobile and Sprint it makes for a resilient company with sustainable cash flow from creditworthy customers. This also allows Crown Castle to access cheap credit. They have $255m in cash and $4.4bn in undrawn debt facility on their balance sheet, giving them plenty of liquidity to execute their strategy of implementing more small cells and fibre assets to roll out 5G. Given the dynamics of the cell tower industry and the limited infrastructure available, Crown Castle is also well positioned in an inflationary environment as they have sufficient pricing power and a favourable debt structure. Crown Castle will also be a winner of the ongoing emergence of autonomous vehicles with the increased need for 5G and connectivity to ensure driverless cars operate efficiently. We will delve deeper into this next week with our discussion on, Ericsson (ERIC-B.STO).