rhipe (RHP.ASX)

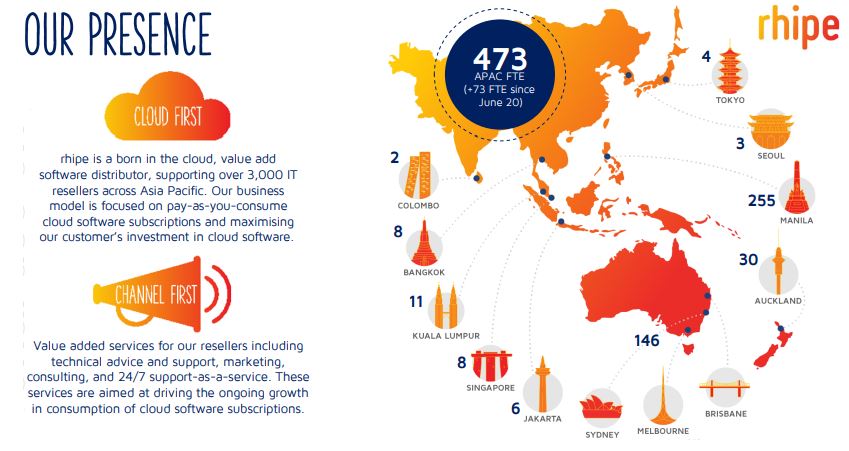

rhipe is a software reseller and is a strategic asset with 3,000+ resellers across ten countries in the APAC region. They predominantly sell Microsoft products (70% of sales) which provides other acquirers an opportunity to offer other vendor solutions – think Google, AWS, Symantec etc – to its product range.

rhipe is a software reseller and is a strategic asset with 3,000+ resellers across ten countries in the APAC region. They predominantly sell Microsoft products (70% of sales) which provides other acquirers an opportunity to offer other vendor solutions – think Google, AWS, Symantec etc – to its product range.

Authors: Ron Shamgar

Returning to the takeover offer, the bidder, a company called Crayon (CRAYN.OL) – is listed in Stockholm and has a very similar business model to RHP in Europe. CRAYN has already raised the funds for the deal through a bond offering so they are fully funded and ready to go. The due diligence and the Scheme Implementation agreement took only three days to complete once the offer was announced.

CRAYN has made this bid for RHP at a cyclical low given their exposure to South East Asia which has been heavily affected by Covid. This impacted their share price; RHP was trading at around $2.40 pre-Covid and has traded roughly in the $1.50 – $2 range since. As touched upon above, RHP has been investing significantly in Japan and Korea of late. Japan is the largest Microsoft market outside of the US and the upside of the 2019 transaction is yet to impact earnings for RHP.

We estimate significant synergies (approximately $10m p.a.) for CRAYN from the acquisition. RHP is cashed up with $54m on the balance sheet and no debt. Based on FY22 forecasts, the RHP bid values it at 15.5x EV/EBITDA but with synergies the multiple is closer to 11x. Other recent software deals have seen multiples range from 18x for Hansen (HSN.ASX) to 49x for Altium (ALU.ASX).

Given the timing of this acquisition and the strategic value RHP offers, we see a high likelihood of competing bids emerging from either an ASX listed company like Data3 (DTL.ASX) or another global player. The bid (with franking credit) is worth $2.56 but we think a price of $3.00+ is more reasonable.

Watch this space.

Capitol Health (CAJ.ASX)

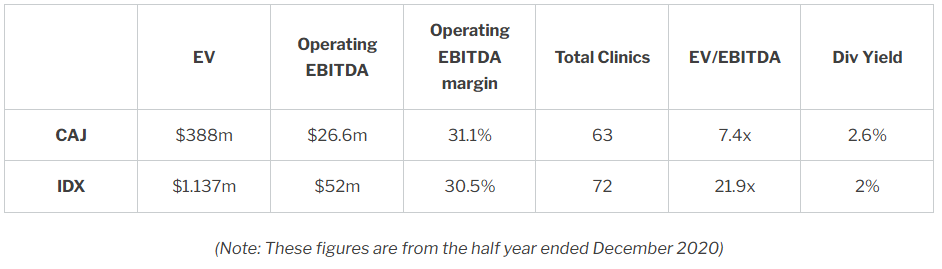

Capitol Health is one of the largest providers of diagnostic imaging and specialist radiology services in Victoria, they currently own and operate 63 radiology businesses around Australia. CAJ is a defensive business with their revenue coming from essential services such as X-rays, MRI’s and ultrasounds. The fact that 77% of their revenue mix is bulk billed is another great defensive indicator, meaning customers pay very little out of their own pocket for Capitol’s services. The newly appointed management team has turned the business around in the last eighteen months with improved margins, organic growth and a strong balance sheet. Their operating EBITDA was up 50% for HY21, improving their operating EBITDA margin from 22% to 31%. CAJ have grown their business by upgrading/expanding their clinics to maximise their revenue potential for each clinic, accretive acquisitions (most recently Direct Radiology) and a focus on customer referrals.

Capitol Health is one of the largest providers of diagnostic imaging and specialist radiology services in Victoria, they currently own and operate 63 radiology businesses around Australia. CAJ is a defensive business with their revenue coming from essential services such as X-rays, MRI’s and ultrasounds. The fact that 77% of their revenue mix is bulk billed is another great defensive indicator, meaning customers pay very little out of their own pocket for Capitol’s services. The newly appointed management team has turned the business around in the last eighteen months with improved margins, organic growth and a strong balance sheet. Their operating EBITDA was up 50% for HY21, improving their operating EBITDA margin from 22% to 31%. CAJ have grown their business by upgrading/expanding their clinics to maximise their revenue potential for each clinic, accretive acquisitions (most recently Direct Radiology) and a focus on customer referrals.The sector has been consolidating with several deals coming through recently. This includes the likes of Sonic Healthcare (SHL.ASX) buying Canberra Imaging Group at approximately 9x EBITDA and Quadrant selling Qscan to Infratil (IFT.ASX & .NZ). We believe that this corporate action in the sector not only makes Capitol Health look cheap but also makes them an attractive takeover target.

Listed peer Integral Diagnostic (IDX.ASX) is trading on 13.5x EBITDA while CAJ, currently sitting on a market cap of $390m, is trading on 7.5X EBITDA.

The metrics above show how compelling CAJ looks as a takeover target.

Looking at the corporate activity in the sector and the comparison with IDX, we think any takeover premium should see at least a multiple of 12-13x EBITDA and there is also the possibility of CAJ making further acquisitions this year.

Uniti Group (UWL.ASX)

Unita Group is a telco fibre provider to the residential sector and the only competitor of scale to the NBN. We estimate that UWL is currently winning a 25-30% share of all new greenfield developments against the NBN. UWL is currently annualising $130m of EBITDA and has a contracted pipeline of over 250,000 lots to connect fibre over the next 3-4 years.

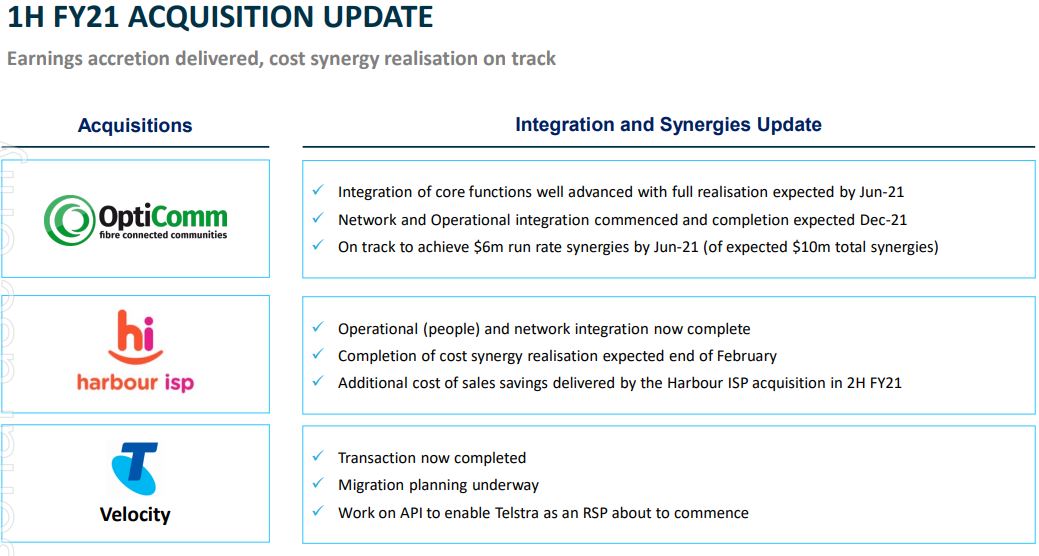

Unita Group is a telco fibre provider to the residential sector and the only competitor of scale to the NBN. We estimate that UWL is currently winning a 25-30% share of all new greenfield developments against the NBN. UWL is currently annualising $130m of EBITDA and has a contracted pipeline of over 250,000 lots to connect fibre over the next 3-4 years.At full rollout, we estimate that the group will have a run rate of $200m EBITDA. We like companies like Uniti as the majority of this EBITDA is recurring, long-life defensive core infrastructure earnings. Their sustainable cash flows also enable UWL to access cheap credit to expand the business through acquisitions, as we have seen through Opticomm and, more recently, Telstra Velocity, Telstra’s fibre business.

UWL are starting to see some structural tailwinds as demand for data consumption and connectivity rises. This has been accelerated by the pandemic and the general shift towards digitisation, something UWL are looking capitalise on through their Communications platform as a service (Cpaas) which is proving to be a very profitable business for UWL, accounting for 47% of their free cash flow. UWL will also benefit from a variety of emerging thematics such as 5G, IoT and data centres (a theme we spoke about the past fortnight). With a strengthened property market UWL will also have an opportunity to win market share from the NBN on the back of their acquisition of Opticomm who have a big presence in the residential market. Also of note is the fact that UWL recently got admitted to the ASX200 index. This usually provides a bit of momentum in the share price as UWL’s stock would be bought by rebalancing index funds.