Written by Ron Shamgar The Ozempic moment for SaaS refers to a pivotal disruption scenario where a transformative technology threatens to erode or fundamentally reshape an established market leader's core business model, much like the hype around Ozempic (and other...

Australian Equities

The Reawakening of Small and Mid Caps

Written by Ron Shamgar After two years of relative underperformance, Australian small and mid caps are finally showing signs of life. With inflation easing, rate cuts now on the horizon, and investor sentiment gradually shifting back toward growth, we believe the next...

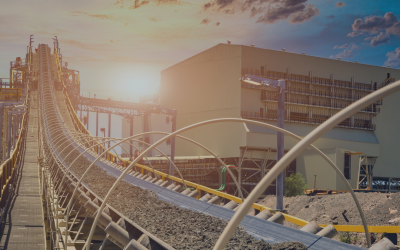

The Energy Reality Check: Tariffs, Transition Fatigue, and the Repricing of Industrial Giants

As the global energy puzzle grows more complex, investors are confronting a critical inflection point: the economic cost of the energy transition is rising, public patience is thinning, and traditional industrial titans are bearing the brunt of an increasingly...

Trust in Rust: Why Industrial Stocks Are Gearing Up for a Renaissance

There are moments in markets where the noise becomes so loud, it drowns out common sense. Tariffs, geopolitics, inflation, central banks, and a US Congress with a taste for budgetary excess. And yet, despite all the reasons to panic, a certain type of company is...

EROAD: From Grit to Growth – A Telematics Turnaround Worth Watching

In a market environment where capital is scarce and investors are hunting for profitable, cash-generative growth stories, EROAD Limited (ASX/NZX: ERD) has emerged from the shadows. The company's FY25 results mark a turning point, not just for its financials, but for...

The Rise of AI Tokens and Three ASX Small Caps Ready to Ride the Wave

AI Tokens, Data Demand, and the Small Cap Opportunity Artificial intelligence is no longer confined to research labs or theoretical discussions, it's already reshaping global industries. At the core of this revolution are AI tokens, units of data that fuel the...

Part 2 – Strategic Growth: TAMIM’s 2025 Picks in Infrastructure, Tech & Fintech

Continuing our thematic review of TAMIM’s high-conviction holdings, Part Two explores three businesses operating at the crossroads of technology, infrastructure, and financial services. These companies combine scalable platforms, robust balance sheets, and strategic...

ANZ vs. NAB: Which Bank Offers the Best Opportunity in 2025?

Australia’s Big Four Banks Under the Microscope Over the past fortnight, we’ve seen continued market skepticism toward the banking sector. With global recession fears, some dubbing it a potential "Trumpcession", we’ve witnessed a correction in bank share prices....

Coles vs. Woolworths: The Risks, Rewards, and Investment Outlook

The February 2025 earnings season has placed Coles (ASX: COL) and Woolworths (ASX: WOW) under the microscope, with both supermarket giants facing an evolving retail landscape. While Coles demonstrated strong execution and market share gains, Woolworths encountered...

ClearView (ASX: CVW) 1H FY25 Update: A Turning Point in Valuation & Growth

ClearView (ASX: CVW) has long been a business with strong fundamentals, yet its stock has remained undervalued in recent times. Now, with the worst of its claims experience behind it, earnings stabilising, and a bold share buyback program in place, the company is...

TAMIM Australian Equities – Could EML Payments Be the Next Big Takeover Target?

Is EML Payments staging a major comeback? With regulatory hurdles cleared and the EML 2.0 strategy gaining traction, EBITDA surged 50% to $33.4M, and revenue climbed 15% to $115.1M in 1H25. A $65M pipeline target by mid-2025 signals further growth. Will private equity...

TAMIM Australian Equities – Potential Takeover Targets to Watch

Portfolio Manager Ron Shamgar offers a glimpse into three under-the-radar companies with the hallmarks of strategic value, exceptional financials, industry leadership, and unique positioning. These businesses, quietly ticking all the right boxes, present compelling...