FAANG – an Opportunity in Plain Sight?

Large technology names have dominated the investment headlines in recent years, and with good reason. Facebook, Apple, Amazon, Netflix and Google are widely regarded as some of the best businesses in the post-industrial era, with enormous network effects and economies of scale, impressive revenue growth, and fortress balance sheets. While it’s tempting to look for complex, out-of-the-way situations to generate outsized investment returns, sometimes keeping it simple is the right approach and the best investment ideas are in fact right in front of you – as the saying goes, in investing you don’t get paid for complexity.

Alphabet (NASDAQ: GOOG), named as a pun about investment returns above a benchmark (‘alpha-bet’) was founded in 2015, and is best known as the holding company that houses the Google search engine. As you likely know, Google dominates the online search market. As at March 2023, it captured approximately 85% market share, compared to 9% and 3% for Bing and Yahoo! respectively (according to Statista). Online search is also a hugely profitable business. It is getting more mature though, and Google’s extremely high market share does mean that the company’s growth rate is likely to slow in coming years. This is where Alphabet’s other businesses come in. YouTube is riding the wave of people consuming an ever-greater amount of video content, both professional- and creator-produced. Google Cloud offers infrastructure, platform and other services to businesses, along with cloud-based collaboration tools such as Gmail and Google Docs. It’s the third-largest cloud services provider behind Microsoft Azure and Amazon Web Services, but it’s growing at a rapid pace. Let’s not forget the Company’s device business, which includes the likes of the Pixel, Fitbit (acquired in 2021) and the associated Play application store. Finally, there is ‘Other Bets’ – Alphabet’s venture capital and private equity operations, home to emerging companies at various stages of development including Waymo, X and GV. While currently unprofitable, Other Bets is targeting big innovative areas of the economy including health, autonomous driving, and technology.

On 2 February, Alphabet reported its financial results for both the full-year and fourth quarter of 2022. Revenue for the full year came in at US$282 billion, a 10% increase over the prior year 2021 [or 14% excluding the effects of foreign currency, as the increase in the U.S. Dollar (USD) decreased the value of international revenue translated back to its USD financials]. The currency effect was even greater in Q4, where revenue increased only 1% to US$76 billion but 7% on a constant currency basis. Inside this 1% number, Google Advertising (the biggest division that includes both Search and YouTube) declined 3.6%, an unusual but unsurprising result after a couple of blockbuster years during the pandemic. Google Cloud revenue increased 32% to $7.3 billion for the quarter, a growth rate that shows great momentum in the business and outpaced both its major competitors. Other Bets revenue also grew from US$181 million to US$226 million, although this still remains a drop in the ocean compared to US$76 billion in quarterly sales.

Expenses have been a hot topic over the past 12 months, and Alphabet’s total operating expenses expanded 8.2% to US$57.8 billion, due to higher cost of revenues and higher research and development (R&D) expenses in the quarter. R&D increased due to the Company’s artificial intelligence (AI) efforts, which are a ‘strategic priority’ for Alphabet and have been consistently called out by Alphabet CEO Sundar Pichai over the last several years (and even more recently with the launch of Bard to combat the highly-publicised ChatGPT developed by OpenAI). This meant that operating profit decreased to US$18.1 billion, from US$21.8 billion and net income fell to US$13.6 billion compared to US$20.6 billion in the prior year’s Q4. With a weakening macroeconomy and revenue growth slowing after a strong period during the pandemic, Alphabet (like many other large tech companies) is looking to reduce expenses and announced 12,000 layoffs. This has been welcomed by most investors given the increase in expenses in recent years and should provide an opportunity to significantly increase profitability going forward, as the company continues to deliver new advertising solutions, YouTube and Cloud achieve standalone profitability, and Other Bets either achieve scale or are sold/closed down.

Quiet Industry Champion Churning Higher Returns

Chubb reported its fourth quarter and full year 2022 financial results on February 1. Net premiums written increased 10.3% to $41.8 billion for 2022, or 13.0% excluding the impact of the strong U.S. Dollar, which reached a 20-year high in September (net premiums written are the total insurance policies written during the period, after deducting those that are ‘ceded’ to a reinsurer, meaning the risk is transferred). Q4 results were even stronger, with net written premiums up 11.9% to $10.2 billion, or 16.0% excluding currency effects. This was boosted by the acquisition of the Cigna Asian business during Q3, which led to a 92.0% increase (100.8% in constant dollars) in life insurance premiums in Q4.

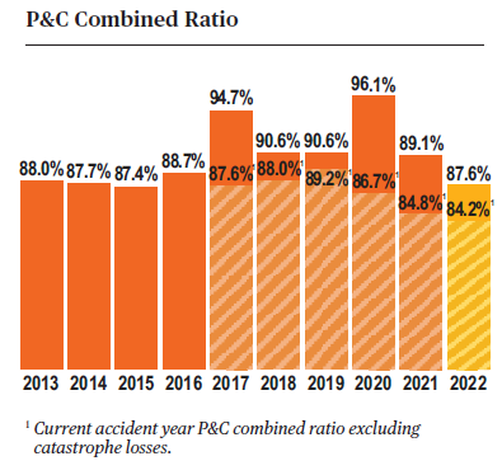

Profitability was again a highlight for Chubb, with the combined ratio coming in at 87.6% for 2022 versus 89.1% in 2021, and 88.0% for Q4. Chubb, like most insurers, also provides certain adjusted (or ‘but for’) numbers that exclude the effects of various ‘one-off’ events such as natural catastrophes, but which are arguably part of the cost of doing business as an insurance company. One of the few beneficiaries of higher interest rates, net investment income was a record in both Q4 (rising 23.6% to $1.12 billion) and the 2022 full year (up 8.2% to $4.02 billion). One of the few minor blemishes was a $107 million underwriting loss in the North American Agriculture division. This is unlikely to be the cause of the share price fall on the day, though, which is more likely the result of commentary on the earnings call regarding a moderating in insurance pricing. Insurance has been in a hard market for several years (meaning that prices have been rising), and this a key focus for investors. Given higher inflation and increased catastrophe losses though, most insurers seem intent on higher prices at least in the short term, which should bode well for insurance companies such as Chubb.