What goes up, must come down

The pandemic created an almost perfect storm for the consumer discretionary sector, particularly retailers. No dining out. Those who could worked from home. Travel was off the table. And that’s before including government stimulus payments and record low-interest rates. Subsequently, the savings rate topped a historic high of 20%.

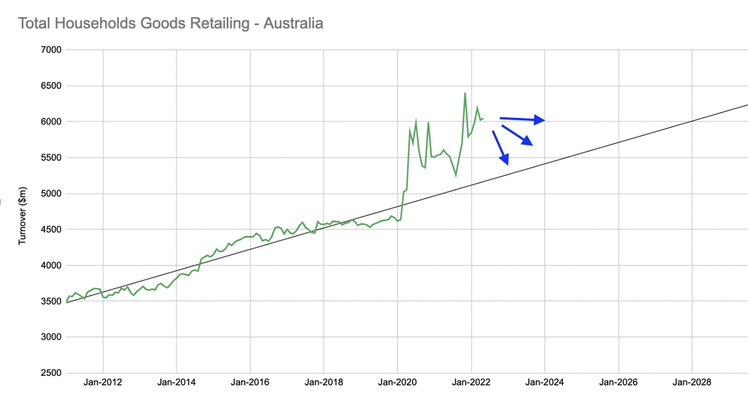

The one thing consumers could spend on was household goods such as couches, electronics and homewares. As a result, total goods spending reached levels not expected until 2028 resulting in a boom for Australian retailers.

Retailers generally have a lot of fixed expenses. Therefore when sales increase, profits increase by a relatively higher amount. To illustrate, just a 13% increase in sales at JB Hi-Fi (JBH.ASX) led to a 67% jump in FY21 profits.

But what goes up, must come down. The market has already begun to price in falls, with the S&P/ASX 200 Consumer Discretionary index down -20% this year. Households simply aren’t going to buy a second lounge couch or another monitor screen. The latest Westpac-MI Consumer survey confirmed consumers are 26% less likely to purchase big-ticket items than one year ago. Goods spending growth will normalise, possibly even decline.

The operating leverage retailers benefitted from will also unwind. Third quarter sales at Kogan.com (KGN.ASX) fell -8%, however gross profit sunk -20% and net profit -164% (it went from positive to negative).

It’s not however all bad news. The resulting impact on individual retailers will vary. On Tuesday, JB Hi-Fi reported a 7.7% profit increase for FY22. Cumulatively, that’s an 80% earnings jump since 2020. Given how far consumer discretionary share prices have fallen, it could prove an opportune time to pick high-quality retailers. Investors should remain cautious as elevated pandemic numbers and economic conditions normalise though.

Inflation to hit earnings estimates

In the most recent McDonald’s (MCD.NYSE) earnings call, inflation was mentioned on 25 occasions. On the same call a year ago, it was mentioned just once. With hindsight, an inflationary spike was inevitable. Factories and offices were literally shut down. Supply chains were choked. Poor weather conditions contributed to a global food shortage. And that’s all before Russia invaded Ukraine and threw Europe into chaos. Subsequently, commodity and input prices soared.

The RBA predicts inflation will reach 7% by year-end while in the United States it’s already hit 9.1%. Put simply, inflation eats away at purchasing power. Consumers trade-down to less expensive items, while prioritising needs over wants. Corporates are forced to either raise prices and risk losing market share or absorb the cost increase and take a hit to margins.

Exemplifying the pressure on margins, quarterly input costs increased 4.8 per cent compared to just a 2.3 per cent increase in final product prices.

Even wages, after years of languishing, are starting to see growth. It remains negative in real terms, but the need for skilled labour is a key concern for Australian companies. Around 62% of large businesses are having difficulty finding suitable staff, while 40% of firms reported wage growth exceeding 3%.

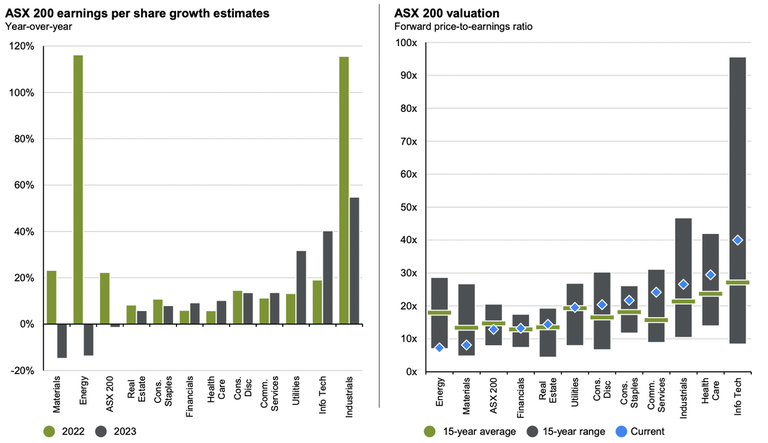

It’s not unrealistic to suggest the average Australian company is facing an annual increase of 5-10% in operating costs going into FY23. Unless businesses have pricing power, margins will be squeezed. With the ASX 200 expecting earnings estimates to remain flat on FY21, this implies more downside than upside to analyst expectations. Judging by the implied sector growth rates, those most at risk are Industrials, Utilities, Communications and the aforementioned Consumer Discretionary.

One sector well positioned in a rising inflation environment is healthcare. Typically medical companies pass through increased costs given the essential nature of their products. CSL (CSL.ASX) has already banked 80% of its earnings in the first half of FY22, leaving potential upside in its August result. Elective providers Cochlear (COH.ASX) and ResMed (RMD.ASX) will benefit from economies reopening and patients returning to clinicians.

Despite having the lowest estimates, Materials and Energy are not immune to cost headwinds. Rio Tinto (RIO.ASX) recently flagged US$400 million in inflation impacts. Whitehaven Coal’s cost of production increased 13.5 per cent compared to FY21. The reason this isn’t making more headlines is that commodity prices have risen exponentially over FY22, which should lead to another solid year for the sector.

In recent weeks signs of weakness have appeared as prices begin to roll over. As we have written previously (See: Commodities: An Abundance of Policy Missteps) the supply crunch is likely to persist for the time being. But with costs on the up and prices falling, FY23 will be a more difficult period for producers.

Interest rates a double-edged sword for banks

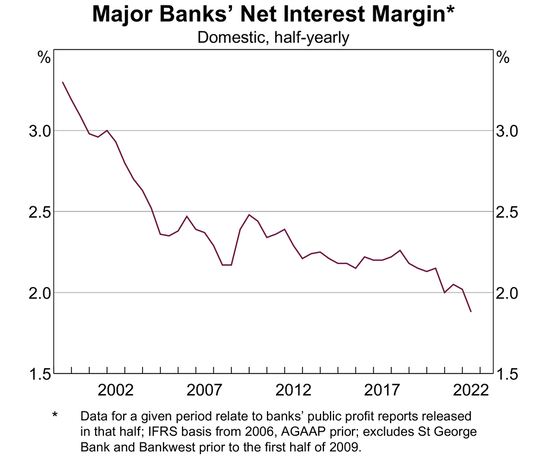

For decades Australian banks have complained about deteriorating net interest margins (NIM) due to the impact of falling interest rates.

In simple terms, banks earn revenue from the difference between the interest rate charged to borrowers (mortgages, business loans) and the cost of funding loans (deposits, hybrids, bonds). The spread between the two rates is referred to as the NIM. As rates have fallen, competition has become more fierce and NIMs subsequently contracted.

For the first time since 2009, interest rates are on the way up. Typically banks will pass through the full cash rate increase to borrowers, but retain some of the rate rises for depositors. Subsequently, the NIM expands and earnings are boosted.

While this might sound rosy, it fails to account for the impact on the economy. The RBA is raising the cash rate rapidly to slow demand and bring inflation back to more acceptable levels.

The flow on impact is that the serviceability of existing loans becomes more difficult as the interest component increases. Per the RBA, a 3% increase in interest rates would result in at least a 30% increase in borrowing costs for two in five households. It’s likely that the cash rate is at 1.85% by the start of August, potentially leading over-leveraged borrowers to fall into arrears.

Additionally, households and businesses become less optimistic about the economy. Home prices are falling (See: House Prices: How Far Will They Fall?). And the higher cost of debt reduces the incentive to invest. Credit activity subsequently slows and banks compete more fiercely for a shrinking pie.

Ultimately it will depend on how high the RBA needs to push to quell inflation. The economy is in a strong position with unemployment at 3.5%. Moreover, corporates have never been more profitable. It’s going to take some serious demand destruction to reign in inflation.

Due to the uncertain economic environment, banks will likely adopt a more conservative outlook. Credit provisions could increase, which will weigh on earnings and subsequently dividends.