As Artificial Intelligence (AI) reshapes industries globally, Australian companies like AI Media (ASX: AIM) are leveraging AI to transform their business models and drive growth. The Australian market is poised to benefit from AI’s projected $315 billion contribution to the economy by 2030, and local tech stocks are at the forefront of this revolution. In this two-part series, we highlight two ASX-listed companies that provide the best exposure to AI’s high-growth applications.

In Part 1, we covered Nuix (ASX: NXL), a leader in AI-driven data processing and investigation software. Nuix has shown significant growth through its proprietary Nuix Neo platform, which offers innovative solutions in legal, privacy, and forensic markets. Now, in Part 2, we explore AI Media (ASX: AIM), a company rapidly transitioning to an AI-powered technology business with global ambitions.

Part 2 – AI Media (AIM)

Company Overview and Business Model:

As highlighted by AI Media’s Chair in the 2024 Annual Report, the acquisition of New York-based EEG in 2021 played a critical role in the company’s evolution. This acquisition enabled AI Media to expand its suite of AI-driven technology solutions and diversify its customer base globally. In FY2024, approximately 50% of AI Media’s revenue came from technology sales, a significant increase from FY2022, when technology revenue accounted for just a portion of overall sales. The company achieved a compound annual growth rate (CAGR) of 35% in technology revenue from FY2022 to FY2024, significantly improving its gross profit margins from 55% to 64%.

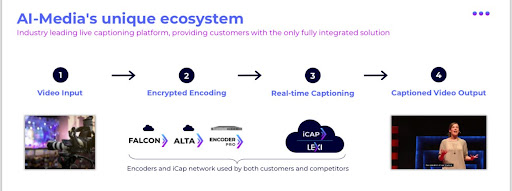

AI Media’s Lexi 3.0, launched in May 2023, represents the latest in AI-powered live captioning solutions. Lexi 3.0 rivals human captions in accuracy but at a fraction of the cost. It delivers captions for a wide range of content, including live TV, sports, government proceedings, and more, through AI Media’s integrated encoder and iCap Cloud Network, providing a competitive moat for the company.

AI Media’s success is also reflected in its customer diversification. The company has grown its reach to include sports rights holders, local and federal governments, large enterprises, and universities. In FY2024, the company expanded its global presence by building its sales team and forming strategic distribution partnerships, leading to major contract wins and a robust sales pipeline for FY2025.

FY2024 Financial Results:

AI Media’s FY2024 results reflect its successful transition to a technology-driven business. The company reported $66.2 million in revenue, a 7% year-over-year increase, despite a gradual decline in low-margin services revenue. This decline was offset by a rapid rise in the high-margin technology segment, which boasts gross margins of 85%.

Overall, the company’s gross margins improved to 64%, driven by a 37% increase in technology revenue and a 39% increase in technology gross profit. AI Media remains cash flow positive with $11 million in cash on hand. Its $8 million R&D investment highlights the company’s commitment to innovation, though only $500,000 of this was capitalised, demonstrating conservative accounting practices.

Outlook for FY2025:

Looking ahead, AI Media aims to have 80% of its revenue come from technology by December 2025, up from the current 50% level. The company’s five-year targets are ambitious, with management aiming for $150 million in revenue and $60 million in EBITDA by focusing on geographic expansion, sector diversification, and new AI-powered product launches.

A key part of the company’s strategy is growing its iCap network and introducing new AI products such as audio description and voice services. AI Media is also considering strategic acquisitions to accelerate growth, replicating its successful U.S. acquisition of EEG in other regions.

TAMIM Takeaway:

AI Media represents one of the most promising AI-focused companies on the ASX. With a strong foothold in global markets, AI Media’s business transformation, bolstered by its flagship Lexi platform, positions it well for long-term growth. The company boasts strong revenue and profit growth, a cash-rich balance sheet, and a highly committed leadership team. The Founder and Managing Director, holding a 16% stake, has continued to purchase shares, signalling confidence in AI Media’s future. Tony Abrahams is the kind of high energy and passionate founder we like to back here at TAMIM.

With technology revenue growing at 35% annually, we value the stock at around 90 cents in the medium term. As AI Media continues its rapid transition, the market is likely to price it according to its trajectory towards its five-year goal of $150 million in revenue and $60 million in EBITDA. At that point, a valuation of $5.00+ is achievable, making AI Media a potential ten-bagger over the next few years.

_______________________________________________________________________________

Disclaimer: AI Media (ASX: AIM) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.