This week we take a look at three stocks that are both defensive in nature but still in their high growth emerging phase of their business evolution. All stocks are high conviction holdings in the TAMIM Fund: Australia All Cap portfolio.

Authors: Ron Shamgar

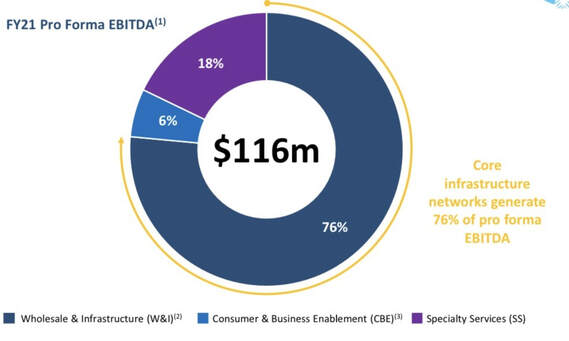

Unity group (UWL.ASX) is our top pick for 2021 and not so coincidentally one of our largest holdings. In our mind, owning UWL is like owning a mini version of the NBN but with better growth prospects. 75% of group revenues come from fibre services to residential Greenfield developments. We believe fibre should be viewed as a core infrastructure service by investors, one that is defensive and has a very long use life.

Since UWL has 18% market share versus NBN in its sector, we think the stock should be valued more like a core infrastructure asset rather than a telco. UWL recently acquired the Telstra Velocity fibre asset for $180m. This will add Telstra as an internet service provider on the network and will increase group EBITDA to $120m. UWL is currently trading on a one-year forward EBITDA multiple of 12x but we believe it should be closer to 15x. Our valuation is approximately $2.50, so we see another 30% of potential upside.

Smartpay (SMP.ASX) is a high growth payments and terminal provider. By now we all know that Covid-19 further accelerated the take up of electronic payments and, like its bigger competitor Tyro (TYR.ASX), SMP has benefited accordingly. The merchant terminal market in Australia is around one million terminals and growing at 3% p.a.. About 30,000 new terminals are added each year and the banks dominate 90% of the market, followed by TYR (approximately 5%) and then SMP with about 5000 terminals of their own.

There is a pool of about 300 000 small merchants that SMP is targeting. On their current run rate SMP is adding over 5,000 terminals p.a.. Every 5000 terminals equates to approximately $20m of annual recurring revenue. Recently TYR has been having a serious connectivity issue with its terminals and this provides SMP with a unique opportunity to grab market share. At the moment SMP’s market cap is ~$200m and, based on current growth rates, we believe that SMP can add up to $150m of value to shareholders each year. With the sector consolidating, SMP is a takeover target and we think the stock will double over the course of 2021.

Healthia (HLA.ASX) is an allied health rollup of podiatry, physiotherapy and optometry clinics around Australia. The business plays into thematic focused on the aging demographic around the country with 650 Australians turning 60+ every day. Accordingly, we see further increased demand for HLA services. We estimate that HLA is on track for $180m revenue and $40m of EBITDA in Financial Year 2022.

So why do we like HLA:

- Management are ex-Greencross (GXL, now privately held), which was a very successful vet clinics roll up that eventually got acquired and delivered significant value to shareholders.

- HLA has now hit scale financially and has delivered a track record of execution since listing over two years ago.

- The sector is consolidating. We see HLA as interesting because they could be both an acquirer and/or a potential takeover target in future.

- Lastly but most importantly, HLA is cheap. Trading on 11.5x PE multiple, 6x EV/EBITDA multiple, and offering a 5% gross dividend yield. We value HLA at approximately $2.50