|

In what has been a mixed earnings season these three ASX small caps have stood out over the last week showing strong results and resilience in a challenging market.

Aussie Broadband Aussie Broadband (ASX: ABB) is an Australian telecommunications and technology company focused on providing a broad range of solutions to residential, business, enterprise and government customers. The company provides wholesale services to other telecommunications companies and managed service providers. Aussie Broadband (ASX: ABB) is an Australian telecommunications and technology company focused on providing a broad range of solutions to residential, business, enterprise and government customers. The company provides wholesale services to other telecommunications companies and managed service providers.Aussie released its FY23 results last Friday and has risen close to 20% at the time of writing. The company’s revenues grew by 23.1% to $788 million with EBITDA increasing 52.1% to $89.6 million. In good news for shareholders these increases showed great cash conversion with net cash in flow of $27 million compared to an outflow of $9 million in the prior year. Co-founder & Managing Director Phillip Britt proudly stated:

Aussie’s Residential segment defied market competition, achieving a robust 23.3% revenue growth to $511.8 million. The company added 57,256 new residential connections and expanded their NBN market share to 7.6%. The Business segment added 8,314 new broadband connections increasing by 21.3%, resulting in $89.4 million in revenue. Enterprise & Government was boosted by 800+ deals, leading to an 8.5% increase in revenue to $86.4 million, and a notable 51.4% gross margin. Wholesale was the jewel in the crown growing 61.7% for the year and hitting $100+ million in revenue. With a strong FY24 EBITDA guide of between 12%-23% and Aussie’s diverse segments performing strongly there is a promising and dynamic outlook for investors.

Helloworld Travel

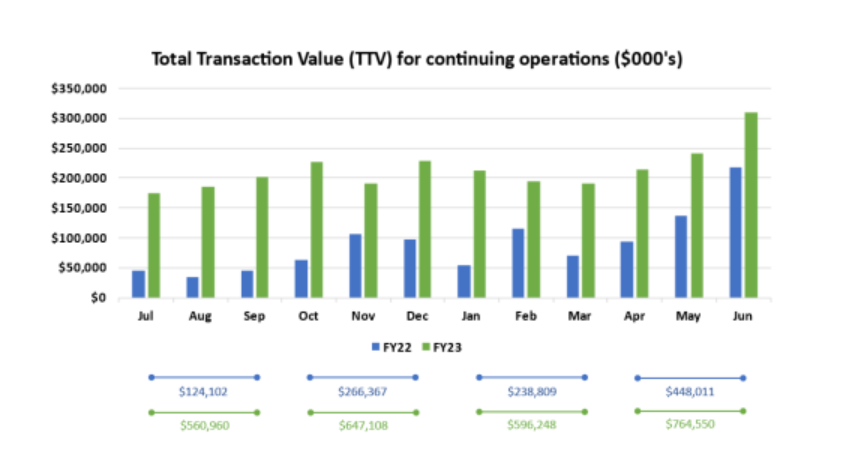

The company came in at the higher end of guidance with underlying EBITDA of $44.1 million having previously guided for between $42-$45 million. Total Transaction Value (TTV) accelerated to $2.57 billion ahead of the $2.56 billion on the previous guide. Revenues grew to $165.9 million up a whopping 139.5% which converted to a profit of $19.2 million compared to a loss of $28.8 million in the prior period highlighting the strong post pandemic recovery. The retail travel sector is experiencing a resurgence of optimism and growth. Demand for agent and broker network services consistently outpaces supply. Ticket volumes are on the rise as carriers reestablish operations in Australia and New Zealand. Total Transaction Value (TTV) for flights approaches pre-pandemic levels, benefiting from higher ticket pricing that offsets lower volumes. Further growth is anticipated into FY24, fueled by the reopening of Asian markets. From a wholesale and destination management perspective there was exceptional growth with international visitors returning for their first summer in the southern hemisphere since before the pandemic.This growth is expected to continue across Australia and New Zealand with FY24 the first full year without border restrictions. Helloworld has demonstrated an impressive post-pandemic recovery, exceeding market expectations with strong financial results.

EML Payments EML Payments (ASX: EML) is a global payments company that operates in Australia, the UK, Europe, and the US. It services a range of customers including major banks in Europe, EML Payments (ASX: EML) is a global payments company that operates in Australia, the UK, Europe, and the US. It services a range of customers including major banks in Europe,government, retail brands and financial services companies.The company released its FY2023 results on Tuesday and has seen the share price rocket 45% in two trading sessions. Operating revenue for the year came in ahead of guidance, growing 9% over the year to $254.2 million. Underlying EBITDA was down 28% to $37.1 million although this did also come in ahead of the previous guide. Unfortunately for shareholders EML recorded significant impairments on its PFS and Sentenial acquisitions which generated a statutory loss after tax of $284 million.The new management team is looking to simplify the businesses operating model and has four key priorities moving forward. This includes:

Furthermore the strategic review continues with Barrenjoey playing a key role in assessing potential strategic interest in EML. Structurally, the review identified the need to separate the UK domiciled business PFSL, from the Irish domiciled European business. The PFSL business is a profitable venture characterised by diversification, serving both high-quality government and private clients. Notably, the majority of its book comprises corporate and government-funded projects, ensuring a low-risk profile. The PCSIL business is currently unprofitable and faces challenges such as a high level of client concentration. Additionally, the business is heavily reliant on retail consumer-loaded cards, potentially exposing it to market fluctuations. Management expects separating the two will lead to improved performance and unlock value. EML shareholders have been on a rough ride of late. With positive news around strategic plans perhaps this turnaround story is coming to fruition. Disclosure: ASX: ABB, ASX: HLO, ASX: EML are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.

|

Helloworld Travel (ASX: HLO) is a leading Australian & New Zealand travel distribution company, comprising retail leisure travel and business travel networks, travel broker networks, destination management services (inbound), air ticket consolidation, tourism transport operations, wholesale travel services, online operations and event-based freight operations. We wrote about Helloworld’s market update earlier in the month

Helloworld Travel (ASX: HLO) is a leading Australian & New Zealand travel distribution company, comprising retail leisure travel and business travel networks, travel broker networks, destination management services (inbound), air ticket consolidation, tourism transport operations, wholesale travel services, online operations and event-based freight operations. We wrote about Helloworld’s market update earlier in the month