With June 30 now in the rear vision window, we suspect your attention has turned to digging up old receipts and preparing your tax returns. For the global fund, the date represents an important milestone to review our performance for the financial year; what went right, what didn’t go to plan and where we can improve in the months and years ahead.

Below we profile three top performers for the financial year end. If you would like to read more about our investment views on KLA and Emcor, please review our February and October monthly fund reports.

Sprouts Farmers Market Inc (NASDAQ.SFM)

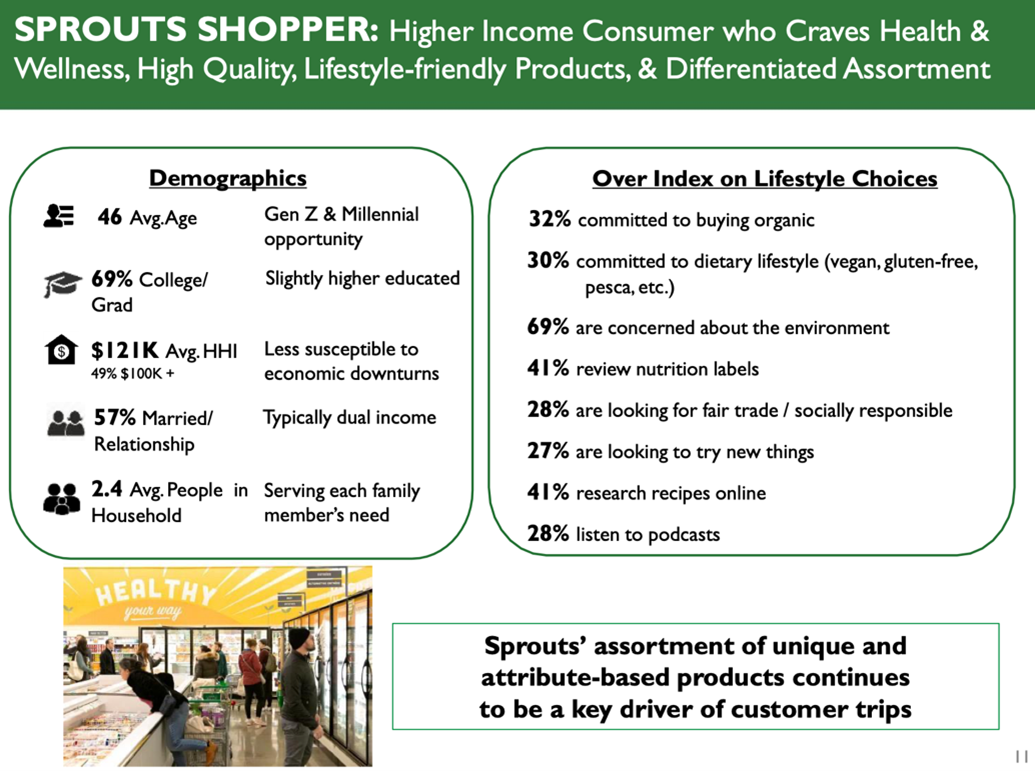

Sprouts Supermarkets is an American fresh-food supermarket retailer. The company offers a wide selection of fresh, organic, vegan, dairy-free, gluten-free and whole foods rarely available at mainstream supermarkets.

Source: Sprouts May 2024 Investor Deck

We first wrote about Sprouts in September 2023, highlighting that we believed the market had underappreciated the store rollout trajectory and the stickiness of its customer base. Since then, the company has continued to beat internal and analyst expectations regarding the pace of new stores, revenue and earnings. Despite the weakening economy, customers have continued to frequent Sprouts with same-store sales increasing by 4% and total sales rising by 9%.

The superior value proposition (Sprouts is regularly cited as being cheaper than close competitor Whole Foods) has shielded the business – and its consumers, from economic headwinds. The health-conscious shopper is also likely to be of middle or high-socioeconomic demographic and therefore relatively less immune to cost of living pressures. The average Sprouts shopper is 46 years old, has an income of US$121,000 per year and is likely to be college-educated.

Sprouts is a classic case of a market caught up in short-term macro headwinds rather than seeing the long-term fundamental growth story. The 122% increase in the share price means the earnings ratio now reflects a growth company rather than a nascent, low-margin retailer. While we would not expect the same share price gains to be repeated, the company remains well-positioned to capitalise on a growing and profitable grocery niche.

CNOOC Ltd (HK.0883)

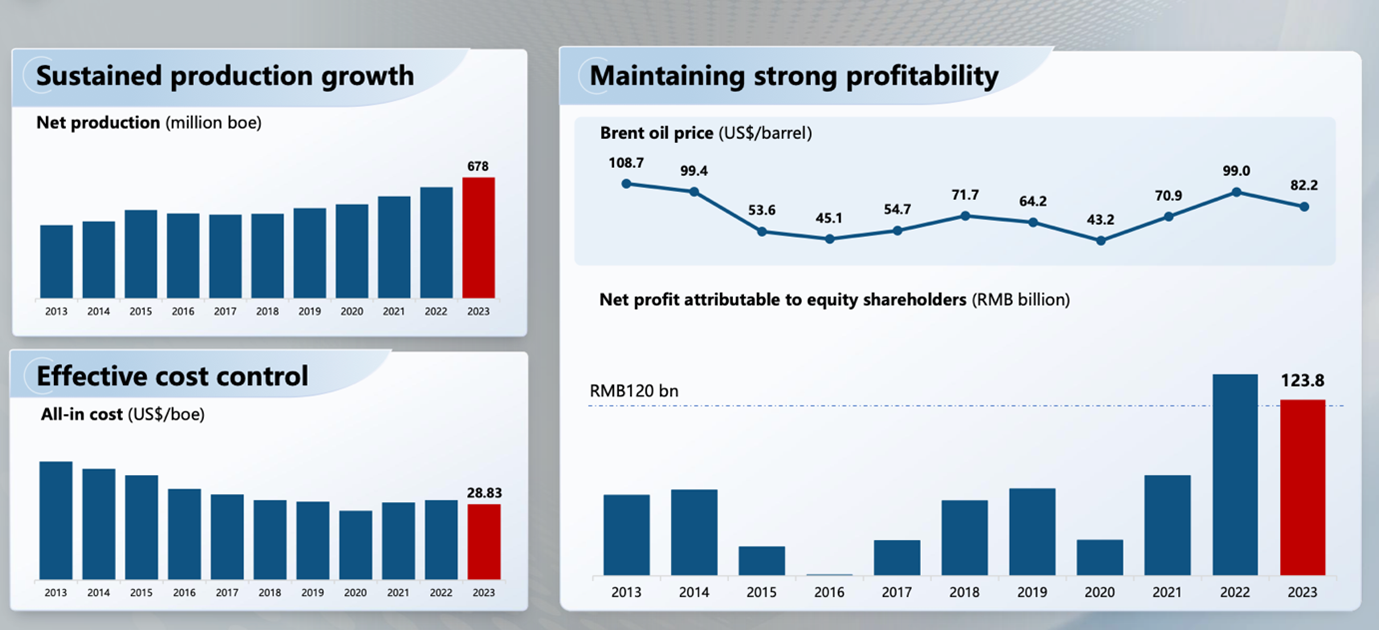

China National Offshore Oil Corporation (CNOOC) is one of the world’s largest oil and gas companies. The business derives around 70% of its production from China with the remainder sourced from assets in the Americas, Asia and Africa. CNOOC’s assets are competitive on the cost curve with an average cost of ~US$28/BOE (barrel of oil equivalent) compared to a current oil price of ~US$78.

Source: CNOOC 2023 Annual Results

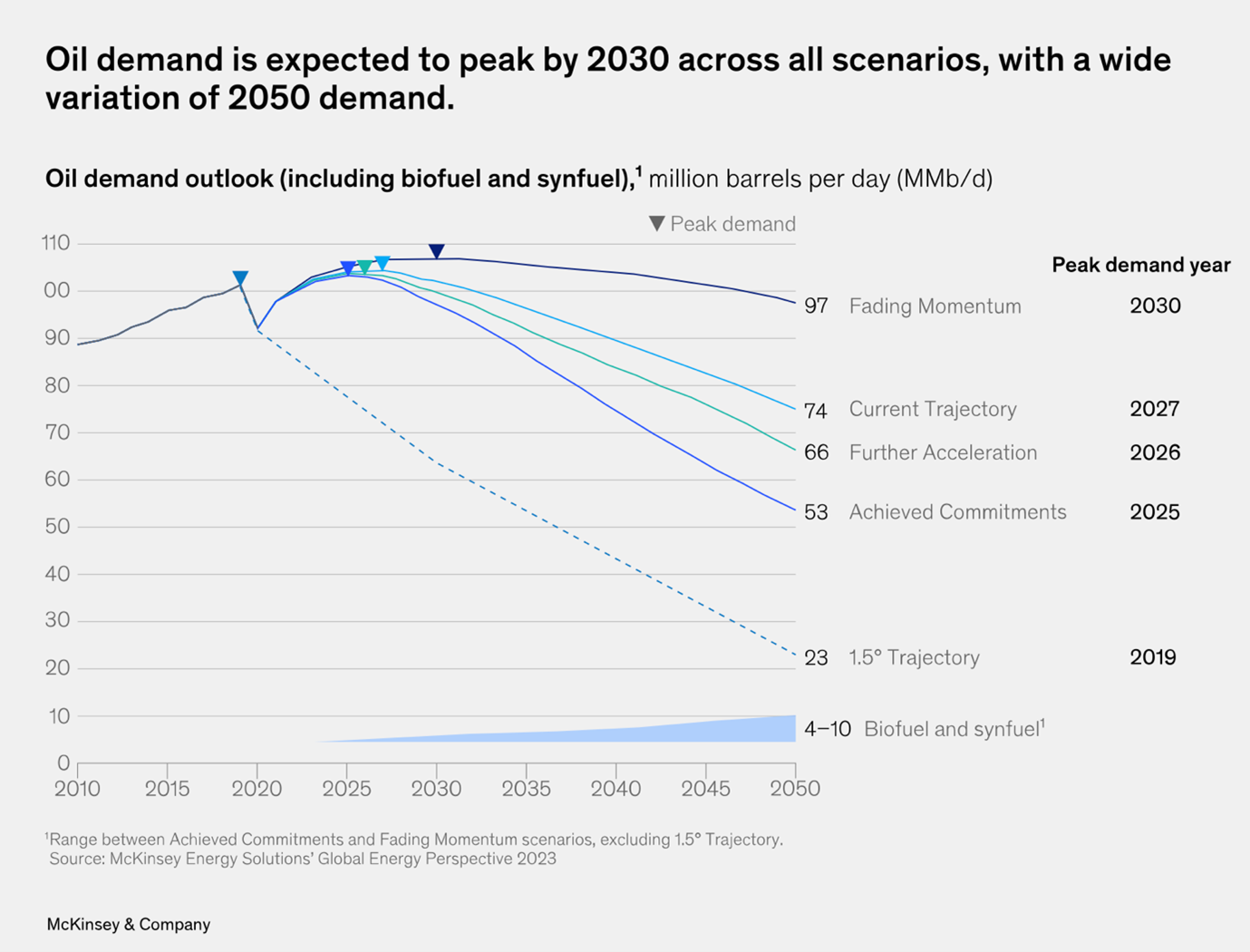

It’s well established that in the next five years, we will reach peak oil demand as electric vehicle adoption accelerates. However, the steepness of the decline is still uncertain, and given the lack of substitutes for fueling trucks, planes, and ships in addition to producing plastics, there is a fair chance that oil demand will remain resilient until commercial alternatives are developed and widely available. Moreover, new supply is becoming increasingly difficult to first gain approval, and then scale to be competitive, particularly in developed nations. This bodes well for CNOOC as a low-cost producer with a growing production profile. Management expects net production to reach 810-830 million BOE by 2026, up from 678 million in 2023.

Source: McKinsey

Traditional energy companies have faced significant valuation headwinds in recent years as the rise of sustainable (or ESG) prevented pension managers and institutions from deploying capital into the sector. Chinese companies such as CNOOC have also battled concerns over the domestic economy and ownership structures. While these headwinds remain to varying degrees, the underlying business performance of CNOOC has grabbed the market’s attention.

The company has diligently expanded production and reserves while also retaining tight control. Since 2018, earnings have increased 134% despite gyrations in the underlying oil price. There’s also been a broader trend in the energy market to “get big or get out”, with larger rivals taking over smaller peers to amalgamate resources and cash flows.

Recent transactions include Woodside’s US$19.6 billion purchase of BHP’s gas and oil assets and Chevron’s US$53 billion agreement to buy Hess. This has given the market a yardstick to value other public energy companies leading to multiple rerating. Even after the CNOOC share price has doubled, the business trades on a dividend yield above 5% and a mid-high single-digit earnings multiple.

Evercore Inc (NYSE.EVR)

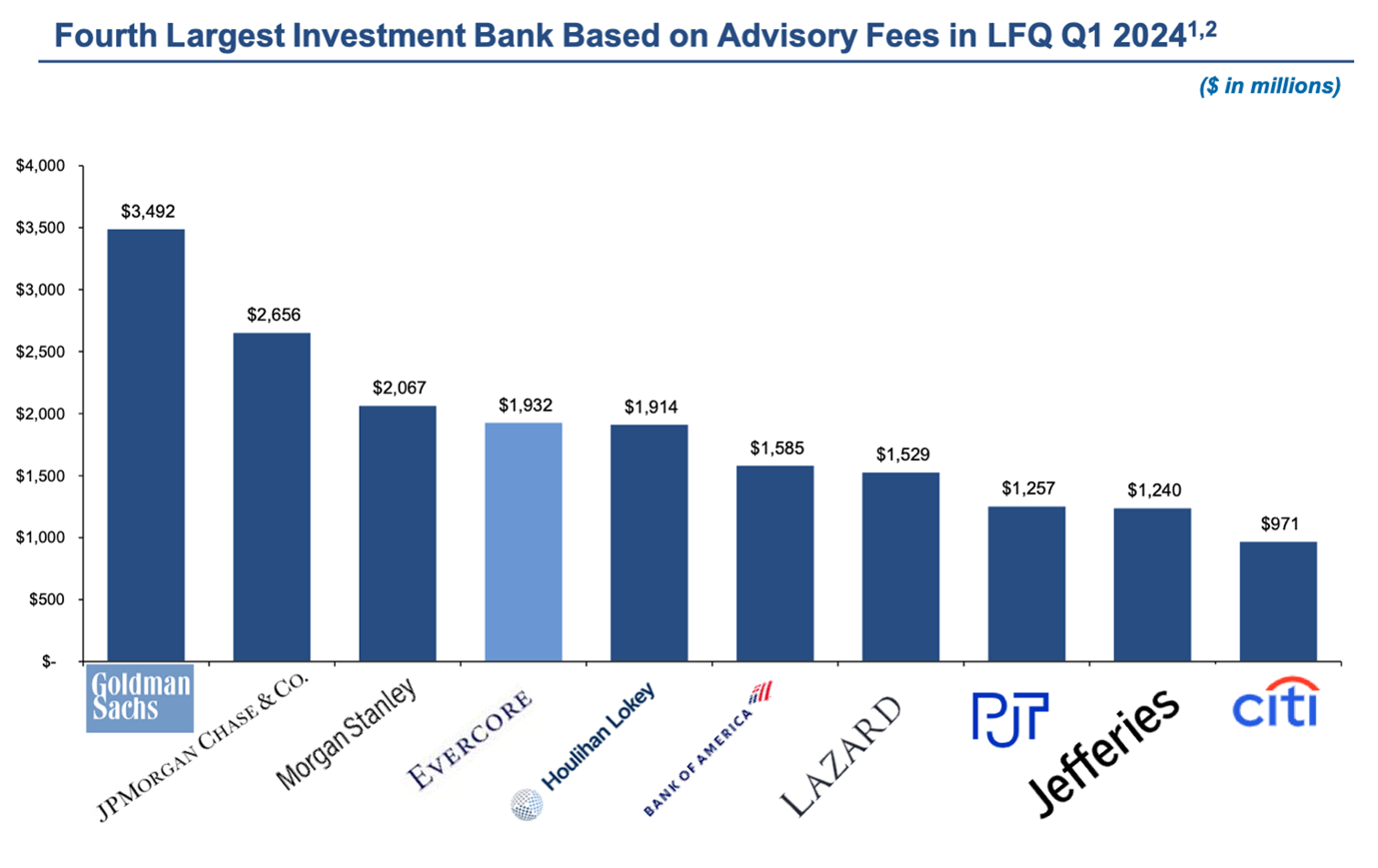

Evercore is the world’s largest independent investment bank. Unlike competitors who typically offer a universal banking platform that includes trading, lending and investing, Evercore focuses purely on advising organisations. This positions the company and its employees as trusted partners without the potential conflicts of interest that arise with larger peers. As a result, the business is frequently appointed to the largest corporate transactions including the spinoff of GE’s energy division Vernova and Global Infrastructure Partners sale to Blackrock.

Source: Evercore Q1 Results

Despite its size today, Evercore never intended to become a global company. It was founded three decades ago with the humble ambition of creating a small but high-quality advisory shop without the rough-and-tumble culture of Wall Street. The firm was deliberately not named after its founders, nor did they reserve any special ownership or legal structure. A uniform and transparent compensation system remunerated the whole firm rather than each department or business unit paying themselves from their respective P&L.

This instilled a culture of collaboration and comradery rather than an “eat what you kill” mindset. The unique culture has enabled Evercore to attract and retain high-quality talent that drives organic within the business. The company has 142 senior managing directors with a median productivity of US$18 million per year.

The 77% increase in Evercore’s share price over the past twelve months is primarily a result of the market recognising the company’s sizable growth runway. While investment banking remains a cyclical industry leveraged to corporate activity, Evercore has built earnings redundancy by expanding its advisory coverage across new sectors and geographies.

Over the past decade, revenue has increased 12% annually. Moreover, the business has an exceptional track record of rewarding shareholders, returning US$2.6 billion to equity holders since 2018 and increasing the dividend each year since 2008.

____________________________________________________________________________________________________

Disclosure: Sprouts Farmers Market Inc (NASDAQ.SFM), CCNOOC Ltd (HK.0883), and Evercore Inc (NYSE.EVR) are currently held in TAMIM Portfolios.