EML Payments (EML.ASX)

Authors: Ron Shamgar

Author: Ron Shamgar

The fire: EML Payments has been heavily oversold because of a dispute with the Central Bank of Ireland that could impact their European operations.

EML Payments Limited (formerly EMerchants) are the provider of payment solutions, offering payment technology for payouts, gifts, incentives and rewards, and supplier payments. EML issues mobile, virtual and physical card solutions to a number of corporate brands around the world and manages more than 3500 programs across 26 countries in North America, Europe and Australia.

Central Bank of Ireland Correspondence

In March 2020 EML completed the acquisition of Prepaid Financial Services (Ireland) Limited (PFS), a multi award winning European provider of white label payments and banking-as-a-service technology which gave them a presence in Ireland. In May this year EML announced that there had been correspondence with the regulator in Ireland, the Central Bank of Ireland (CBI). The Central Bank of Ireland deems all e-money institutions to be high risk, and they require firms in such sectors to have very strong AML/CTF frameworks in place to mitigate that inherent risk consistent with their expectations. The Boards of PCSIL (the Irish regulated entity) and EML have endorsed a Remediation Plan that has been in progress for some months. EML is hoping to resolve the regulatory issues at the end of this year. The silver lining to this situation is that under the acquisition terms EML will save $110m (AUD) contingent on PFS achieving agreed rebased annual EBITDA targets for the three financial years ending 30 June 2021 to 2023, reflecting growth of approx. 20% CAGR.

EML has completed 45% of Level 1 tasks as at the end of October and we are expecting another update before the half year results. So far, the CBI has found zero breaches of AML or CTF. Our view is that the CBI is reluctant to regulate a high growth fintech like EML and is making life difficult in the hopes that EML moves on to another regulator in Europe.

While this undoubtedly has a material impact on the business, we saw the share price fall 50%, from $5.76 to today’s price of ~$2.75. This fall wiped $1bn worth of market cap off EML; we think this is too much. EML’s management team has proven that they are good at managing issues over the years as they have done with both Covid-19 and Brexit. We are extremely confident that not only will the CBI issue get resolved but that EML will transition away from the CBI and into another regulated jurisdiction like Spain or France (where they already operate). We estimate a 4-6 month time frame. Their recent AGM update tell us a different story than the one painted by the market.

AGM Update

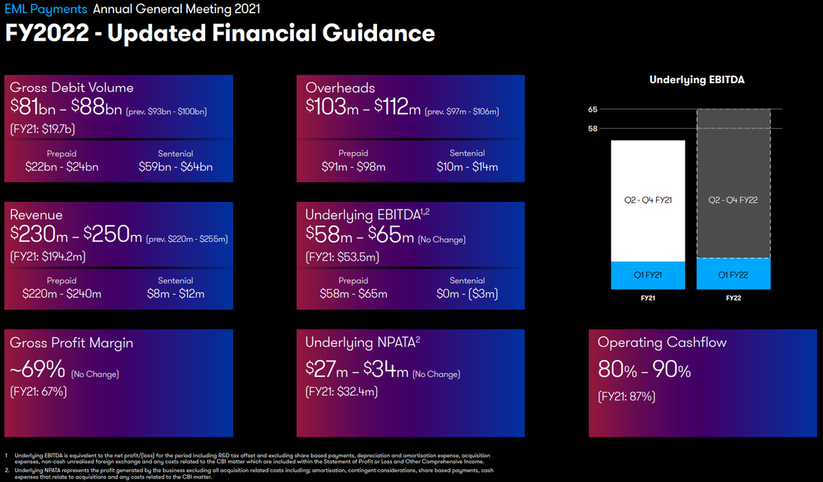

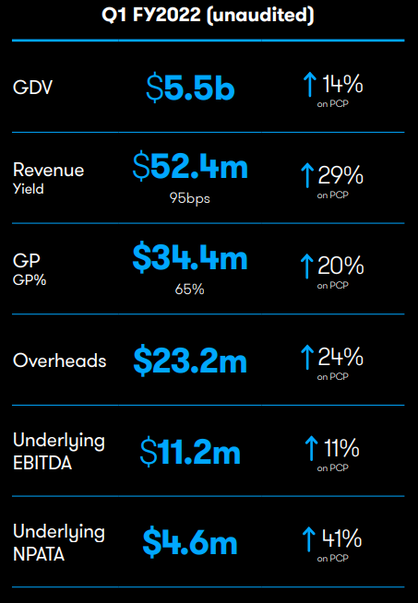

Last week, at their AGM, EML provided an operational update for Q122. EML were able to affirm guidance for FY22, the market was clearly expecting that this would not be the case. The company noted that in Q122 it signed 23 contracts and launched 64 programs, ending the quarter with 114 programs in implementation globally (including 36 on hold due to the CBI issue). The business has still been able to grow and maintain guidance despite the issues with the CBI.

For example, management has replaced high volume-low margin programs with the CBI in order to make room for the 36 on hold high margins programs. This should be approved shortly. They also announced a new deal with Banco Sabadell, one of the largest banks in Spain, operating in twenty countries including the United Kingdom and Mexico. We expect to see more deals like this in Europe which should more than compensate for the delayed CBI contracts. Given the huge pipeline and growth in the business, the CBI issue is now potentially a significant upside scenario if successfully resolved.

EML reported gross debit volume (GDV) growth of 14% Y-o-Y in Q122, with increases across all three divisions. An increase in the group yield (Q122: 95bp, Q121: 84bp) resulted in Y-o-Y revenue growth of 29%. Their EBITDA guidance for FY22 (including acquisition costs and costs related to CBI) is $42.2m, $10m or 30% above FY21.

From a business development perspective, EML ended the financial year with 313 deals in their pipeline which we believe represent potential GDV in Years 3-4 post-launch of approximately $10.5bn. Their historical win rate for new business is approximately 40%. Using their historical GPR yield, this would generate an incremental $40-50m in revenue in 3-4 years.

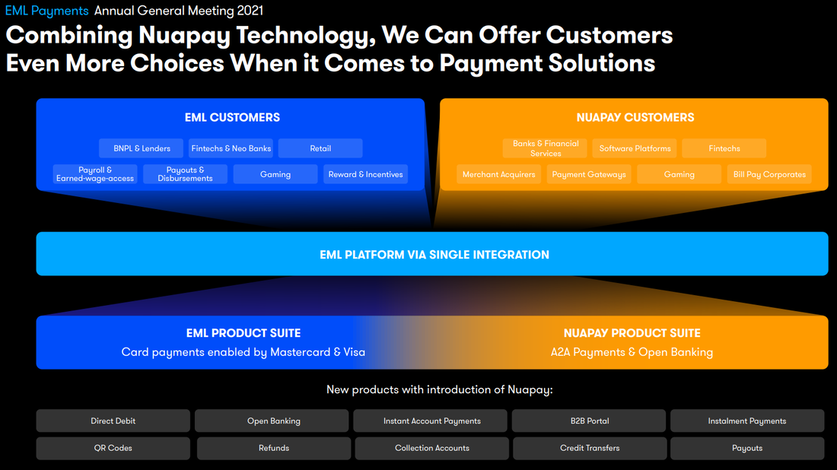

Sentential Acquisition

EML recently acquired Sentenial. Sentenial own Nuapay, a market leading open banking platform processing Account-2-Account payments. This broadens EML’s payment offerings to include alternate (non-card, non-scheme) payment products on their platform to address customer demand, complementing card scheme based payments. Sentenial is currently connected to 1,750 banks across Europe and growing. Open banking is not well understood by Australian investors, but it is the future of payments and it will bypass the rails of Visa and Mastercard. This is why both giants are scrambling to acquire any open banking data provider at ridiculous valuations.

EML currently have around €2bn from cash received from stored value account holders. Whilst this comes with a corresponding liability, the cash is invested in high quality bonds and all the interest earned from this cash goes straight to the bottom line. For those that are predicting inflation and a rise in rates, EML should be a beneficiary. For example, for every 1% rise in interest rates we estimate that it will add €20m to EML’s bottom line.

Outlook

EML’s recent update was far more positive than the market was pricing in, yet the share price has only gone down. EML is now trading at lower multiple to its peers and sitting on half the market cap it was before the CBI issues, even though their FY22 guidance has been reaffirmed which should see a 30% increase in EBITDA. Their pipeline is huge at $10.5bn and their recent acquisition of Sentenial and their contract with Banco Sabadell gives them a huge presence in Europe. Heading out of lockdown and into Christmas they should also see an increase in their gifts and incentives segment. As a result of the huge sell down, any downside in resolving the CBI issues has more than been accounted for. At this point, there isn’t much risk if these issues can’t be resolved and any positive news out of the CBI is all upside. EML is sitting on an EV of around $900m, we think EML will do at least $80m of EBITDA in FY23 which will put them at a forward EV/EBITDA of around 11.5x. It may take time but the market will get it right. Our valuation is $4.50

UPDATE SINCE TIME OF WRITING:

Today, 25 November 2021, EML updated the market on the CBI issue. The CBI will permit PCSIL to sign new customers and launch new programs while staying within the material growth restrictions. PCSIL is confident that it can meet these obligations. Broad based reductions in limit controls on programs will not be imposed.

As mentioned throughout this article, this was a unique situation where the downside was fully priced in at this point. The announcement today should see these issues appearing in the rear view mirror.