In Part 2 of our series on trends within the Australian and global gambling industry, we explore two standout small-cap ASX stocks – BlueBet Holdings Limited and PointsBet – that have demonstrated significant potential in a consolidating market. Their impressive growth trajectories, strategic moves, and commitment to technology innovation position them well for future gains. In Part 3, we’ll conclude with another ASX small-cap pick that offers unique value.

BlueBet Holdings Limited: A Powerhouse in Australian Wagering

In its first quarter since completing the merger, BlueBet has demonstrated its ability to execute at a breakneck pace, seamlessly integrating the Betr business and unlocking significant synergies. The successful migration of the Betr customer base onto BlueBet’s platform in just 59 days is a testament to the company’s operational excellence and the strength of its technology.

The financial results for Q1 FY25 paint a promising picture for the company’s future. The combined business was operating cash flow positive in the quarter, a remarkable achievement that reflects BlueBet’s disciplined approach to reactivating the Betr customers and swiftly unlocking the efficiencies of its leading technology platform.

Source: BlueBet Holdings

The standout performance came in September, the first full month post-migration, where the business saw a step change in scale. All key metrics were up over 100% compared to BlueBet’s performance in the prior corresponding period, with net win surging more than 150%. This momentum has continued into Q2, with October turnover and net win up 120% and 140%, respectively, compared to the prior corresponding period.

BlueBet’s strategic and disciplined approach to reactivating the Betr customer base has been a key driver of this impressive performance. By aligning the reactivation efforts with key sporting and racing events, the company has been able to engage customers in an efficient and profitable manner, protecting the combined business’ strong net win margin.

The company has also made significant progress on the cost synergy front, upgrading its annualised synergy target by 20% to $16.9 million. This, combined with the favourable terms secured for the exit of the US market, has bolstered BlueBet’s cash position and put it on a clear path to profitability.

Looking ahead, the company remains confident in its ability to deliver positive monthly EBITDA by the end of the calendar year and full-year EBITDA positivity in FY25. This optimism is underpinned by the company’s focus on strategically reactivating the dormant Betr customer base, leveraging key sporting and racing events as catalysts.

Moreover, the company’s scalable platform, repeatable integration model, and experienced team position it well to execute on its organic growth plans and aggressively pursue further inorganic opportunities to grow its share of the Australian wagering market. CEO Andrew Mance has made no secret of the company’s ambition to achieve a 10% plus market share, and the successful integration of Betr has brought it one step closer to realising this goal.

Overall, BlueBet’s strong Q1 performance and promising outlook suggest the company has navigated the integration process seamlessly, setting the stage for continued profitable growth in the quarters and years ahead. As the company continues to innovate, drive operational efficiencies, and capitalise on the significant reactivation opportunity presented by the Betr customer base, it is poised to cement its position as a true powerhouse in the Australian wagering industry. We estimate BBT will generate $15-20 million of Ebitda in FY26.

PointsBet Delivers Impressive FY24 Results, Sees Path to Sustained Profitability

The company’s Australian business was a standout performer, with statutory segment EBITDA surging to $26.8 million, up from just $0.1 million in the prior year. This marked the fifth consecutive year of positive full-year EBITDA for PointsBet’s Australian operations, underscoring the strength and resilience of the business.

Revenue in Australia grew by 10% during the year, outpacing the broader market, driven by solid performances in both racing and sports betting. PointsBet also made significant investments in consumer protection measures, integrating a national self-exclusion register and banning credit card deposits, demonstrating its commitment to responsible gambling.

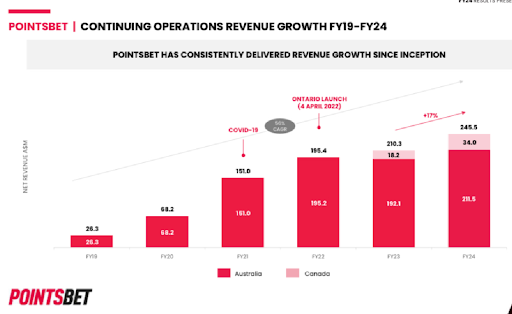

Across the group, PointsBet reported a 17% increase in revenue to $245.5 million, while reducing its EBITDA loss to $1.8 million – a $47.2 million improvement from the prior year. The company ended the fiscal year with a strong financial position, holding $28.1 million in corporate cash and $19.3 million in net assets.

While the Australian business continues to be a reliable performer, PointsBet is particularly excited about the growth prospects in Canada, where the company has been steadily building its presence. In the 2024 fiscal year, the Canadian business saw revenue increase by 87%, with the EBITDA loss narrowing to $19.7 million from $35.8 million in the prior period.

The Ontario market has been a key driver of PointsBet’s Canadian success, with the company successfully increasing its market share in the fast-growing province. Looking ahead, the company sees significant further potential, with the addressable market expected to expand as Alberta and British Columbia regulate their online sports betting and iGaming sectors in the coming years.

PointsBet’s proprietary “Odds Factory” technology has been a key competitive advantage, powering its sports betting offerings in both Australia and Canada. The company’s investments in data science, product development, and customer relationship management have also paid dividends, driving improved revenue retention and customer acquisition.

For the 2025 fiscal year, PointsBet has provided guidance of revenue between $280-$290 million, representing growth of 14-18%, and normalised positive EBITDA of $11-$16 million. Importantly, the company expects to reach cash flow breakeven in FY25 as it continues to scale its business and benefit from operating leverage.

Looking further ahead, PointsBet has outlined an illustrative path to EBITDA margins of around 20% and EBIT margins of 15% in the future, underpinned by its stable cost base and the significant operating leverage it expects to achieve. This equates to a potential $60 million of Ebitda next few years.

Source: PointsBet

Pointsbet Delivers Strong Q1 Results, Reaffirms FY25 Guidance:

Pointsbet reported a strong start to the 2025 fiscal year, with impressive growth across its key markets.

In the September quarter, the company delivered a net win of $65.3 million, up 12% from the prior corresponding period. This was driven by improved sports betting net win margins of 9.7% and a 50% increase in iGaming net win.

The Australian trading business continued its growth trajectory, with a 7% increase in net win compared to the prior year. Active client numbers grew 5% to 238,238, as the company saw double-digit growth in the mass market segment and marginal growth from VIPs.

In Canada, the company delivered stellar results, with net win growing 62% to $8.7 million. This outpaced the overall Ontario market, which grew by around 37%. The strong performance was driven by growth in both the sportsbook and iGaming verticals.

Overall, PointsBet’s impressive FY24 results and clear roadmap to sustained profitability demonstrate the company’s strong positioning in the rapidly evolving online sports betting and iGaming landscape. With a focus on regulated markets, proprietary technology, and a commitment to responsible gambling, PointsBet appears well-equipped to deliver long-term value for its shareholders.

This week media reports indicated PBH to be in the crosshairs of overseas parties looking to acquire the company at a valuation north of $300 million. With the stock doubling to $1.00 since we first bought in, we still see upside if a bid does emerge in the near term. We also view a potential merger between PBH and BBT as highly accretive with estimates of $25-$30 million of synergies alone. A merged group could deliver in excess of $80 million of Ebitda pro forma.

The TAMIM Takeaway

Both BlueBet Holdings and PointsBet have delivered impressive performances in FY24, demonstrating the strength of their respective strategies and positioning them as key players in the Australian wagering and iGaming industry. BlueBet’s successful integration of Betr and PointsBet’s growing presence in Canada reflect the opportunities for growth and consolidation within the industry.

For investors, these companies represent compelling opportunities to gain exposure to a highly competitive, rapidly evolving market. BlueBet’s focus on operational efficiencies, cost synergies, and strategic customer reactivation through high-profile events positions it for sustainable growth in Australia. PointsBet’s expansion in Canada and the strength of its Australian operations showcase its capability to scale effectively, with a clear roadmap to profitability and market expansion.

The Australian and global gambling landscape is increasingly competitive, with regulatory challenges and evolving consumer preferences shaping the industry. However, the growth strategies of companies like BlueBet and PointsBet demonstrate the potential to navigate these challenges and capitalise on emerging opportunities. I

n Part 3, we will conclude our series by introducing a final small-cap ASX stock that stands out in this dynamic market. This pick offers unique value with a specialised focus that complements the growth trajectories of BlueBet and PointsBet. Stay tuned as we unveil our final insight for investors looking to capture upside in the Australian gambling sector.

_____________________________________________________________________

Disclaimer: BlueBet Holdings Limited (ASX: BBT) and PointsBet (ASX: PBH) are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.