As the reporting season draws to a close, it’s understandable if you’re holding your breath as some companies delay releasing potentially lacklustre results.’

While not every report can be a winner, we believe the last few weeks had two further standout performers in ClearView Wealth (ASX: CVW) and Austco Healthcare Limited (ASX: AHC). Both companies continue to see the benefits of strategic focus while growing organically.

Let’s take a deeper look at both earnings results below.

ClearView Wealth’s Success Driven by Strategic Precision

ClearView Wealth (ASX: CVW) has delivered strong performance for FY24, reinforcing its strong market position in the Australian life insurance sector.

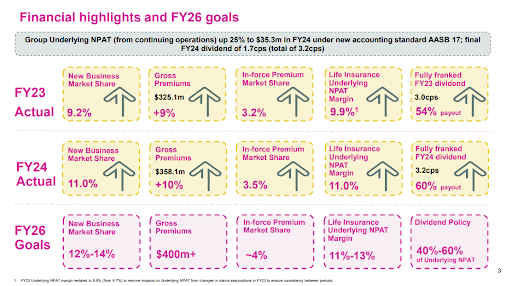

The company’s strategic shift towards focusing solely on its core life insurance business has continued to yield positive results. This year, the company’s underlying net profit after tax (NPAT) rose by 25% to $35.3 million.

ClearView’s new business market share increased to 11%, up from 9% in the previous year, indicating an expanding presence in the market. Gross premiums rose by 10% to $358.1 million, driven by strong customer acquisition and retention efforts. Life insurance underlying NPAT improved by 23% to $39.5 million, reflecting effective management and favourable market conditions.

Underscoring the success of ClearView’s strategies in attracting new customers, new business growth expanded by 34% to $33.7 million, up from $25.2 million in FY23.

In line with its strong financial performance, ClearView declared an interim dividend of 1.5 cents per share in March 2024 and a final dividend of 1.7 cents per share in September 2024, bringing the total FY24 dividend to 3.2 cents per share. ClearView’s net assets stand at $353.2 million, with an embedded value of $591.1 million (including franking credits), equivalent to 91.4 cents per share.

Strategic Focus and Business Simplification

ClearView has maintained a clear strategic focus on its life insurance business, simplifying its operations to become a dedicated life insurer.

A cornerstone of this strategy is ClearView’s technology transformation, aimed at providing greater flexibility and enabling customised solutions tailored to the evolving needs of customers and distribution partners.

Leveraging its expanding distribution network and enhanced data insights, ClearView aims to make life insurance more accessible and improve customer experiences. This strategic direction is supported by the company’s exit from wealth management and the sale of its advice business to Centerpoint Alliance (CAF). This divestiture enables ClearView to concentrate fully on life insurance, driving growth in its most profitable segments. We estimate the wealth division exit to complete in March 2025.

Outlook

Looking forward, ClearView remains optimistic about sustaining its growth trajectory, targeting an FY26 underlying margin of 11-13%. This expected margin expansion will be driven by scale efficiencies, increased underwriting risk exposure, and cost savings from the company’s technology initiatives. This will also yield higher dividend payments.

The company’s key strategic priorities include continued business simplification and significant technology investments. The planned migration of existing portfolios onto a new functional platform is set to deliver substantial scale and efficiency benefits starting in the first half of FY26.

ClearView appears well-positioned to seize future market opportunities, and we anticipate the stock will re-rate to its fair value of 90+ cents as it proves these targets during FY26 (next 12-15 months).

Austco Healthcare: Record-Breaking Results Fueled by Strategic Acquisitions

Austco Healthcare Limited (ASX: AHC) delivered an outstanding performance in FY24, marked by record-breaking revenue and profit figures.

The company reported a 39% increase in revenue, reaching $58.2 million, and an impressive 213% growth in net profit after tax (NPAT) to $7.1 million. Growth in unfilled contracted orders continued with $50.3 million (as of 15 August 2024) representing confirmed contracted orders from customers that have not yet been fulfilled and, as such, no revenue recognised.

These results display Austco’s successful execution of its growth strategy, which combines organic expansion with strategic acquisitions.

A significant portion of the revenue growth was driven by the acquisitions of Teknocorp and Amentco, which contributed $6.5 million and $2.7 million, respectively. Organic growth also played a crucial role, particularly in the North American and Asian markets. The gross margin for FY24 was AUD 30.7 million, an increase of 37% from the previous year, although the gross margin percentage slightly declined due to the integration of the lower-margin acquired businesses. The company anticipates that as integration progresses, margins will improve in the medium term.

Strategic Initiatives and Market Tailwinds

Austco’s strategic focus on expanding its software and subscription-based revenue streams was evident, with Software and SMA revenues growing by 9% to $9.3 million.

This growth represents a key opportunity for Austco to further integrate and expand these revenue streams within the newly acquired businesses. The company also made significant strides in reducing its cost base, with overhead expenses increasing only slightly relative to revenue growth. This cost discipline, combined with strong operating leverage, enabled Austco to more than double its operating earnings, which exceeded the top end of the company’s guidance.

Outlook

Austco’s outlook for FY25 appears promising, bolstered by its record-high unfilled contracted orders.

The company plans to continue leveraging its recent acquisitions to drive further revenue growth, particularly in the high-growth markets of North America and Asia. Austco’s strategic roadmap includes launching innovative products, forming strategic partnerships, and exploring potential mergers and acquisitions, all of which are expected to strengthen its market position and contribute to long-term profitability.

Overall, Austco Healthcare’s record-breaking performance in FY24 reflects its strong operational execution and strategic focus, positioning the company for continued success in the healthcare technology space.

The TAMIM Takeaway

Both ClearView Wealth and Austco Healthcare are examples of the type of innovative, growth-oriented companies that align with TAMIM’s investment strategy.

These businesses strike a balance between organic growth, business simplification and strategic acquisitions, delivering impressive financial performance despite their competitive markets. These companies are not just responding to market demands but proactively transforming the way they operate.

As they continue to leverage their unique strengths, both ClearView and Austco are well-positioned to deliver long-term value and attractive returns for patient investors.

___________________________________________________________________________________________________

Disclaimer: Austco Healthcare Limited (ASX: AHC) and ClearView Wealth (ASX: CVW) are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.