We first invested in ZNT when it was known as BGD Corporation in December 2015, when it was undertaking a small raising to fund the acquisition of a group of profitable GP clinics (Modern Medical) and had a market capitalisation of under $5m.

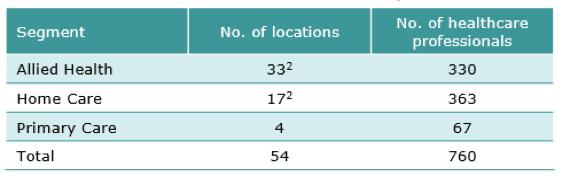

In December 2016, we increased our investment in ZNT by participating in a larger capital raising ($30m) to fund various acquisitions, which was well supported by Australian institutional investors and an Asian healthcare investor. ZNT now operates from 54 locations throughout Australia, employing 700+ health professionals, providing services across allied health, home care and primary care (GPs). ZNT now owns Australia’s largest allied health/physiotherapy business, and the first ASX listed home-care business.

|

Source: ZNT Prospectus (October 2016)

|

Note: ZNT’s Allied Health division provides home care services in WA

|

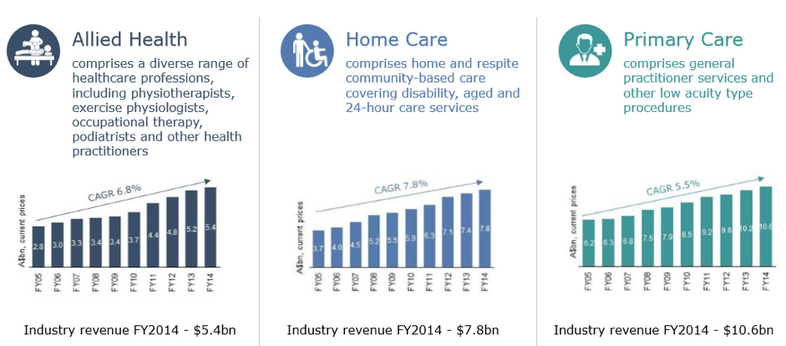

ZNT’s offering is unique, in that it is focused on having its three divisions (allied, home care and primary care) complement each other, through:

- Offering an integrated patient care approach utilizing services from across its divisions;

- Cross referrals (particularly from GP to allied health, i.e. chronic disease management);

- Co-locating facilities; and

- Centralised management and administration.

Since relisting in January, two brokers have commenced research coverage on ZNT:

- Wilsons (current price target $1.25) noted “Zenitas Healthcare offers an exposure to the emerging Australian community-based healthcare market. We expect Zenitas will deliver solid network growth as it expands and integrates three service verticals in allied health, general practice medicine and homecare.”

- Bell Potter (current price target $1.27) noted “Zenitas Healthcare is a fresh take on corporate healthcare in Australia. The business incorporates General Healthcare, Allied Healthcare and Home Care Services in an integrated model that aims to service high needs patients and the growing home care industry”.

In recent months ZNT’s Management has been focused on developing the cross referral network of the current businesses and building out practitioner numbers/utilization rates in those facilities that have excess capacity. Given the relatively fixed cost base, these initiatives offer meaningful earnings upside.

ZNT also has an extensive pipeline of acquisition opportunities currently under review that have the potential to add significant scale to each of the three ZNT verticals. ZNT currently has debt and equity funding available of up to $20m to pursue these acquisitions (equating to a possible contribution of ~$4m to $5m in EBITDA earnings).

Bell Potter have assumed FY18 earnings incorporates an additional $3m of acquired EBITDA (resulting in total EBITDA of $9.7m forecast for FY18), which flows through to their forecast EPS for FY18 of 10.5cents. On current prices, this places ZNT on an FY18 PE of under 10x and a 5% dividend yield. Wilsons are forecasting more modest acquired EBITDA ($1.4m) in FY18 in their assumptions (forecast FY18 EBITDA of $8.0m), therefore ZNT has the balance sheet capacity to comfortably exceed broker forecasts (i.e. the potential to acquire up to $5m EBITDA to add to their FY17 forecast EBITDA of $6.6m – reaffirmed by ZNT on 28 April 2017) without incurring dilution.

We like ZNT as it is in a sector supported by strong tailwinds and encouraging thematics, it is priced on an undemanding multiple, has multiple and credible pathways to grow, and is run by an experienced management team. While it is early days, (ZNT currently has a market cap of $45m), ZNT has the platform in place to become a leading national community healthcare player and respected brand, with the potential to have multiple clinics providing integrated services offerings in major cities throughout Australia.

Recent ASX announcements indicate that larger institutional investors that supported the December 2016 capital raise have been buying more stock on market. We have also been adding to our position into recent weakness, and ZNT now represents one of our larger holdings.