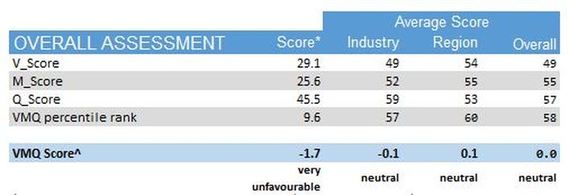

The TAMIM Global Equity High Conviction IMA works on a quantitative scoring system which ranks each company in our universe on its Value, Momentum and Quality rankings.(see the

VMQ Ranking article)The current and persistent low economic growth environment globally has recently seen a reassessment of credit risk all around the world. Many of you reading this would be feeling the pain of the reassessment through your holdings in any of the big 4 Australian banks, or the harsher losses seen in the sharp price declines in European bank stocks. We’ve seen this many times before and therefore believe that the best business to hold in the current market climate are those that are financially sound, that is, those who screen strongly on our quality metric amongst the other factors we look for. Financially weak companies are being punished by the market, including the business we investigate in this weeks’ article.

Recently we ran the VMQ screen over Rolls Royce Holding PLC, a UK based aerospace company making jet engines, not to be confused with the car company that is owned by BMW. Rolls Royce was popular with analysts for a number of years because of its order book growth and steady progression in declared EPS. Our VMQ scores in recent years gave us doubts. Quite simply, the EPS growth wasn’t reflected in free cash flow and upon further investigation we decided that the VMQ rank was correct. This assessment and strict adherence to our processes meant that we haven’t been worried about not owning this market darling.

The above workings will show that our quantitative VMQ process has resulted in a very unfavourable rating for Rolls Royce. The lower the VMQ score the worse the ranking. This alone does not tell us to avoid the stock completely, so we dug a bit further and produced the following important qualitative findings:

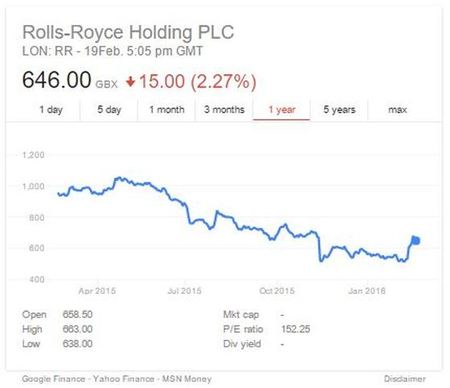

- Rolls Royce (RR) announced on 12 November 2015 an earnings revision based on a negative outlook for 2016. This was the fifth downgrade in 2015. The share price fell by 20% overnight and was down 48% for the calendar year 2015.

- RR order book is very reliant on demand for aircraft from fleets operating in emerging market countries which are economically challenged as commodity prices fall.

- Many of the planes powered by RR engines are being retired by airlines that are seeking more fuel-efficient models

- RR is also challenged by the accounting treatment of revenue and earnings.

- The accounting treatment for “risk and revenue sharing partnerships” has long dogged the company. This was first flagged in 2002 and has always been at the back of our minds. Effectively component suppliers contributed to the cost of new engine development in exchange for a share of the profits. Rolls Royce considered these as revenues as opposed to loans or R&D to be amortised.

- In 2013 the Financial Reporting Council, the UK accounting regulator, forced the company to restate this practice.

- Additionally the maintenance contract revenue is booked on a smoothed basis in advance of the actual work being done over the life of the engine.

- It’s transparently done for all analysts to see but it is aggressive recognition of revenue – something we don’t like.

- There is still a fair size pension fund deficit with defined benefit obligations exceeding value by about GBP1.1bn (A$2.3bn)

The company had never changed its aggressive accounting treatment of revenue and the use of off balance sheet R&D (partners) to reduce engine development costs. The company was making a lot of money from service contracts on older generation aeroplanes and was alienating customers with the terms of those contracts. All this came to a head and the CEO was replaced late last year and the share price fell back to where it was 5 years ago. The company’s new CEO, Warren East, has decided to reset the guidance of the business and reduce costs. This is a standard procedure for a new CEO and we expect a few more nasty ‘surprises’. Interestingly an activist investor has now appeared on the share register. We continue to watch this through the lens of the VMQ scores. We currently hold Northrop Grumman from the USA instead which has performed better than Rolls Royce and has far fewer issues with respect to its balance sheet and strategic position. We will take some time to explain our investment in this great business in a later edition of our weekly investment newsletter.

Summary

Our quantitative analysis indicates very poor earnings yield and earnings quality (both bottom decile), arising from accounting restatements. The bottom decile momentum score arises from the short term market reaction to the earnings downgrades. Earnings guidance restatement tends to be serially correlated (both good and bad news), which the momentum factor picks up.

The outcome demonstrates the importance of evaluating multiple factors and avoiding reliance solely on one dimension. Value factors are liable to have exposure to value traps (superficial analysis suggests stock is cheap, but to get better stock selection results you need to understand why and if it will change). Analysis still indicates a poor outlook, even after the share price declined significantly in 2015.

The point of this story is not that we will always avoid these kinds of stocks; we won’t.

Nor that other investors are stupid; they aren’t.

It is more about the conviction we have in our investment process and the fact that applying a well constructed quantitative stock selection model with some knowledge of a company’s “fundamentals”, is a powerful and rewarding combination. This can be seen in the stellar performance of the underlying fund which has grown by 144.5% since inception compared to the All Ordinaries which is only up by 10% in that time-frame.