Over the last several years, Joyce has been slowly building out a business of considerable scale, with the group’s total network revenue in the home improvement and furniture space now in excess of $125 million. The recent sale of a non-core property asset and the purchase of another property, together with the purchase of an interest in (and subsequent accounting consolidation of) a new business unit, has meant Joyce’s recent financial reporting is messy, and the Joyce story (and its potential) is perhaps poorly understood by the market. We expect the story to become clearer over the coming reporting periods – below we provide our thoughts on where the business currently sits, and it’s potential.

Balance sheet and operations

Joyce currently has $13m cash and a property with a market value likely to be in excess of $5m on its balance sheet. Joyce’s strong balance sheet, in the words of its Chairman, puts “the company in a relatively impregnable position with little downside”.

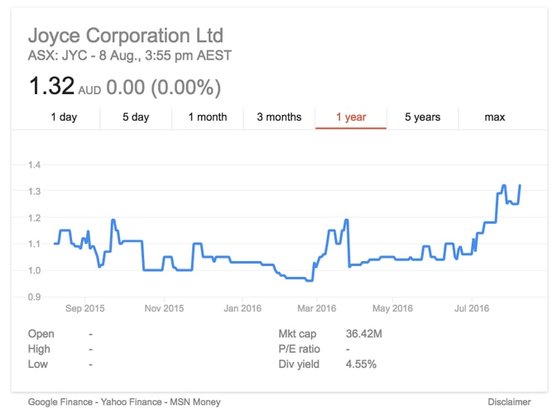

With a market capitalisation of $30m, given the value of its cash and property assets, (simplistically) the market is applying a value of approximately $12m to the Joyce operating business that could generate close to $2m (normalised) NPAT for the full year. Joyce reported $900k NPAT after non-recurring items and minority interests (& paying full tax) for the first half of 2015. While traditional value investors would be attracted to the strong cash backing and low implied earnings multiple on offer, we are equally excited by the opportunities associated with the operating model Joyce has quietly been developing over the past few years.

Essentially, Joyce acts as a business partner, providing capital and management expertise to good profitable businesses that currently lack the capital and management to reach the next level. The key in this business partnership is to ensure that the risks and rewards are appropriately shared (between Joyce and the incoming owner/manager partner), and incentives are aligned. Joyce’s two businesses are discussed in detail below.

Bedshed www.bedshed.com.au

Joyce owns 100% of the Bedshed (franchise) business. The first Bedshed store was opened in Perth in 1980 (as a waterbed expert!). Today, it is one of Australia’s largest specialist mattress, bedding and bedroom furniture retailers with a network of 30 stores (the bulk of which are franchised). Bedshed has been able to consistently grow like for like sales through offering a compelling customer proposition – personalised service from highly trained bedding specialists, with the benefits (and value) of being part of a substantial buying and marketing group.

The benefits of the ‘partner’ model is evident through the success of the franchised stores which consistently record superior profit metrics to the small number of company (Joyce) owned Bedshed stores – reflecting the drive and commitment that a passionate business owner/manager can bring to a retail business. Joyce is committed to expanding the retail footprint of Bedshed through recruiting high calibre new franchisees. As well as the alignment of interests, this franchise model serves Joyce well as it means the store fitout, leasing costs and working capital investment required to roll out a new store is funded by the franchisee, not from the balance sheet of Joyce. In return, Joyce can offer franchisees support, specialised advice, training, a proven structure and 35 years of franchising experience that significantly reduces the risks relating to starting a new business, in many cases facilitating a positive change of lifestyle for a new franchisee The Bedshed operations currently contribute approximately $2m+ in annual EBIT to Joyce. As the footprint expands (together with ongoing same store growth) this has the potential to deliver Joyce solid ongoing returns with low capital requirements.

Kitchen Connection www.kitchenconnection.com.au

In 2013 Joyce acquired an interest in KWB Group Pty Limited, Australia’s largest specialist retailer and installer of kitchens, laundries and wardrobes, and currently owns 51% of the company, having made an investment of approximately $1m. KWB targets the lucrative renovation market, providing a unique (for a national provider) “do-it-for-me” (rather than DIY) one stop, premium, full service consultation-to-design-to-installation kitchen, laundry and wardrobe offering, with competitive pricing.

When Joyce acquired its interest in 2013, annual sales were approximately $22m. For the six months to 31 December 2015 sales were at $19m (+28% on the corresponding period) with EBIT of $2.3m (+90%). Joyce reported KWB’s normalised earnings grew in FY15 over 300% on the corresponding period, driven by the strategic investment in the retail kitchen showrooms, the additional depth in back end customer service management and the expansion of the core product range. Joyce noted they expect that further significant improvements can be obtained. The founding KWB management team remain as 49% shareholders and continue to lead KWB. Together with Joyce they are focused on driving further growth, and sharing in the rewards of the growth as meaningful shareholders in the business. On the numbers reported, Joyce is certainly succeeding in its initial aim to grow the KWB business to reach its potential. The business would appear to have good momentum, with significant opportunity to expand both its products, and geographically into other regions/states. KWB could potentially achieve EBIT of up to $5m for the full year – applying a 5x multiple generates an enterprise value close to $25m (versus the $1m JYC investment for 51%).

Following the settlement of the non-core industrial property in late 2015, Joyce now has the balance sheet strength to deploy capital into new opportunities. Such an opportunity may be a high performing business centered in a particular region, which has the potential for expansion into other regions, but the current owners/managers lack the capital and know-how to go about this. Joyce can bring its capital, its contacts, its experience, its back office systems and its leadership to do just that. It is not difficult to see Joyce in the not too distant future with say four or five solid, profitable, scalable and growing national businesses that they have partnered with, and with a national network of sales far in excess of the current $125m. In the meantime, for the current $30m market cap, one gets:

- a substantial cash balance

- a substantial unencumbered property asset with significant development potential

- around $2m of after tax, after minorities, earnings for FY16

- 9%+ fully franked dividend

- potential upside from earnings growth of 2 national businesses – one of which is very fast growing

- potential upside from new acquisitions

- an experienced management team, with a proven ability to execute.

The TAMIM Australian Equity Small Cap Portfolio is an investor in Joyce. This is a strong example of the types of investment we look for in our portfolio. Strong cash balances, earnings, real assets and strong growth potential – not to mention a dividend yield that would make the bank envious. If you would like more information on this portfolio and the services we offer to clients please contact us for a conversation with one of our Directors.

Happy Investing,