Plastics Recycling

The poster children of current world issues are (arguably) the ongoing pandemic, Ukraine and climate change/pollution. Compared to even the very recent past, most people are far more conscious of their carbon footprint and make an active effort to minimise waste and recycle (there are obviously degrees to this). But what if I told you that right now the plastics you put in the recycling bin are as effective as eating carrots to improve your eyesight…

Today we are recycling over 50% of the world’s paper but, according to a study conducted by National Geographic, only 9% of the world’s plastic is being recycled.

Why is that though?

Of all the materials that end up in our recycling bins, plastic is the most difficult to recycle. This is because plastics are composed of several different polymer types. It’s currently almost impossible to recycle different plastics together as they melt at different temperatures. We also need to be able to sort food contaminated products from those that aren’t contaminated. Not all plastics are created equal, if we aren’t able to sort plastics the quality of the end product is very poor. Currently, when waste reaches a processing plant, it can be a challenge to identify what packaging is made of and what it was used for; which can be a barrier to more plastic being recycled into higher quality items. On top of this, plastic loses its quality as it’s being recycled. Without demand from companies to buy recycled plastic, this is all for nothing. We need to produce a recycled product that is worth using. If we were to be able to sort the different plastics on a mass scale then the whole recycling process would be far more efficient and valuable, creating a more sellable end product. Everyone is aware of our plastic pollution problem. Everyone is aware that it needs addressing. So we have a problem, what’s the solution?

Digimarc (DMRC.NADSAQ)

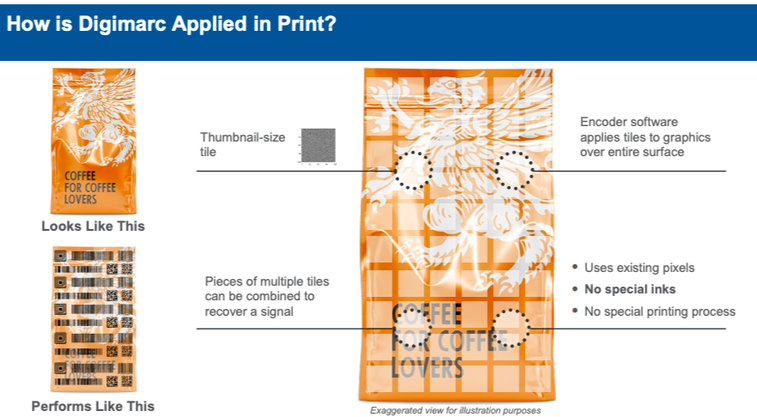

Digital watermarks are invisible codes, the size of a postage stamp, covering the surface of consumer goods packaging and carrying a wide range of attributes. Digital watermarks, functionally a barcode, allow for companies to maintain their packaging and branding without having to add visible barcodes.

The aim is that once the packaging has entered a waste sorting facility, the digital watermark can be detected and decoded by a high-resolution camera on the sorting line, which is then, based on the transferred attributes (e.g. food use vs. non-food, one plastic type vs. another), able to sort the packaging in corresponding streams. This would result in better and more accurate sorting streams. Consequently, this allows for production of higher quality recyclates, benefiting the complete packaging value chain. Due to the items being covered in these barcodes the machines can identify them at whatever position they are in, even if they are in pieces, and will know what they are made of and the right kinds of plastics can be reused.

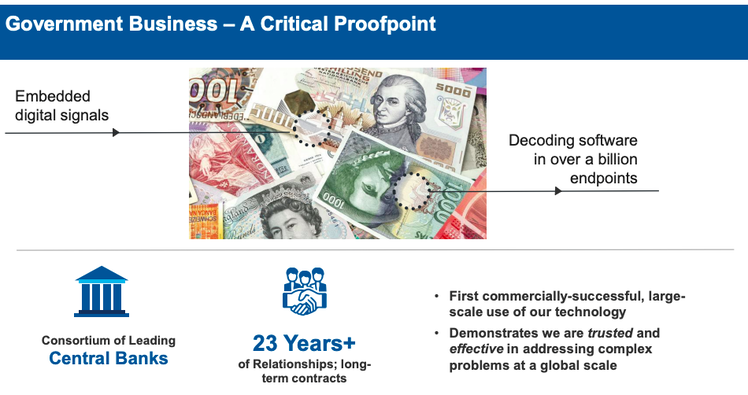

Additionally, Digimarc’s current customers include central banks. They use the watermark technology for banknotes. They are currently receiving around US $26.5m in revenue from this segment of the business. The revenue DMRC receives from central banks is sticky, recurring and provides the business with a solid base of cash flow with potential upside stemming from the counterfeit and recycling segments.

In terms of other uses for the technology, digital watermarks can also be used for basic packaging on top of the anti-counterfeit purposes above. Since the packaging is covered in what are effectively barcodes, it could significantly decrease checkout times at grocery stores; instead of having to find barcodes to scan, the whole product is simply covered in them. Another potential use on the packaging front is for the watermarks to also be embedded with information on how to correctly dispose of them, allowing people to sort their own recycling at home as they can scan the watermarks and see how to properly recycle them.

The use of the technology in counterfeiting extends beyond currency too. The counterfeit market is a $464bn market and is only expected to grow alongside e-commerce. It’s hard to prevent the trade of counterfeit items on a mass scale, especially if they are coming from countries that do very little about it. The application here, for example, is that designer brands like Gucci or Louis Vuitton use digital watermarks on their products to make them easily verifiable, preventing a lot of people from getting scammed through counterfeit products traded in online marketplaces.

Holy Grail 2.0

The objective of the Holy Grail 2.0 program is to prove the viability of Digimarc’s digital watermarking technology for accurate sorting and business use at large scale. The program is led by Procter and Gamble (PG.NYSE) and has 160 (and growing) participants across the circular economy. These include global CPG brands, retailers, trade organisations, recyclers, printers, plastic converters, plastic resin manufacturers and NGOs.

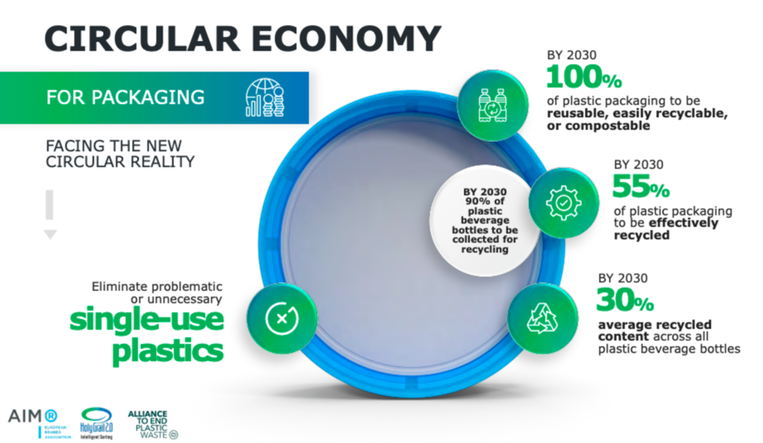

Among other companies, PepsiCo (PEP.NASDAQ) will trial these invisible watermarks on the surface of some of their product packaging, encoding them with information about the manufacturer, product, material type and whether the packaging is food safe. When scanned by a high resolution camera on a waste sorting line, this information helps to sort the packaging into the right stream. Thus more high quality material can be recycled, more efficiently. Digital watermarking has also been included in the European Commission’s Essential Requirements for Packaging and European Parliament’s Circular Economy Action Plan. The program is currently in the third and final phase of trials and the results have been promising, showing consistently strong results across all tested categories of plastic packaging material; 99% detection, 95% ejection and 95% purity rates. The Holy Grail 2.0 program can prove a commercially viable case for Digimarc’s technology to be implemented for some of the worlds largest brands.

Outlook

Barcodes were first patented in 1951 but took over twenty years to be implemented on a commercial scale. So, what will drive the adoption of Digimarc’s technology at scale today?

If we told you ten years ago that by 2030 you won’t be able to buy a new ICE vehicle and that you can hail a ride with no human driver in Phoenix, you’d probably have thought we were short a few marbles. The world’s shift on emissions over the last few years has been powerful, is accelerating and is rapidly transforming the way we live our lives. The EU are implementing aggressive regulations on emissions, legislating what kinds of cars can and can’t be sold going forward for example. Regardless of your stance on the issue, the Green Transition is being accelerated by some powerful regulatory tailwinds. In many cases, adoption of technology like electric vehicles or DMRC’s watermarks simply isn’t going to be a choice, it will be a requirement.

On that note, similar to EVs, the EU has put forward requirements to ensure that all packaging in the market is reusable or recyclable in an economically viable manner by 2030 and introduced a regulatory framework for biodegradable and bio based plastics. Most of the world’s largest plastic producers, like Pepsi and Coca-Cola (KO.NYSE), are being targeted by activists to do more about their waste. According to Greenpeace, PepsiCo uses 2.3m metric tonnes of plastic every year, while Coca-Cola is responsible for over 100bn bottles of single-use plastic. Additionally, countries like China are no longer accepting waste export from other countries; the problem can no longer be outsourced and ignored and we need a solution to deal with it. Regulation and a generational transformation are driving companies to change their ways and fast, Digimarc has the technology to benefit. Humanity’s current plastic recycling regime is ineffective and simply not sustainable, DMRC can help address this.